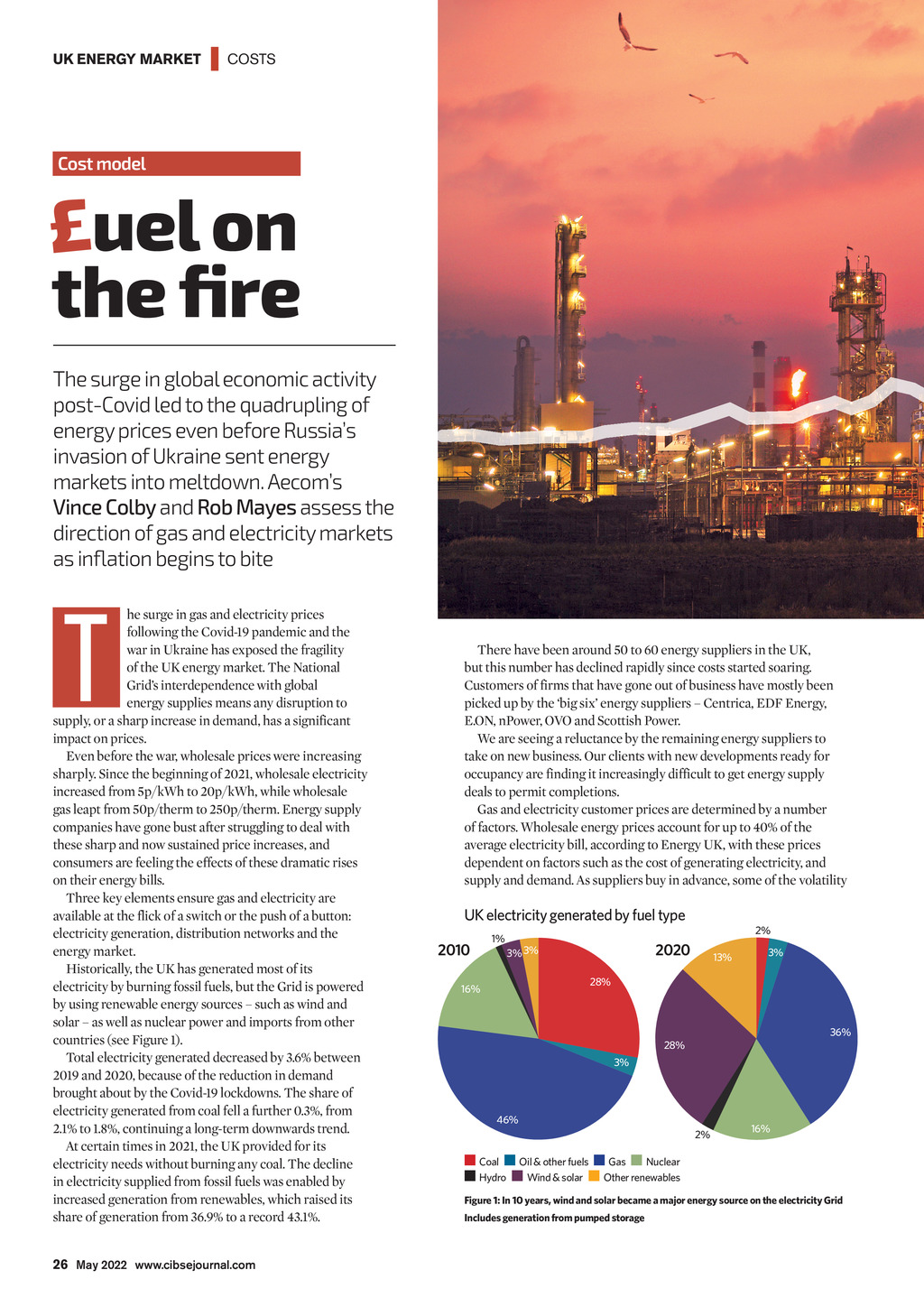

UK ENERGY MARKET | COSTS Cost model uel on the fire The surge in global economic activity post-Covid led to the quadrupling of energy prices even before Russias invasion of Ukraine sent energy markets into meltdown. Aecoms Vince Colby and Rob Mayes assess the direction of gas and electricity markets as inflation begins to bite T he surge in gas and electricity prices following the Covid-19 pandemic and the war in Ukraine has exposed the fragility of the UK energy market. The National Grids interdependence with global energy supplies means any disruption to supply, or a sharp increase in demand, has a significant impact on prices. Even before the war, wholesale prices were increasing sharply. Since the beginning of 2021, wholesale electricity increased from 5p/kWh to 20p/kWh, while wholesale gas leapt from 50p/therm to 250p/therm. Energy supply companies have gone bust after struggling to deal with these sharp and now sustained price increases, and consumers are feeling the effects of these dramatic rises on their energy bills. Three key elements ensure gas and electricity are available at the flick of a switch or the push of a button: electricity generation, distribution networks and the energy market. Historically, the UK has generated most of its electricity by burning fossil fuels, but the Grid is powered by using renewable energy sources such as wind and solar as well as nuclear power and imports from other countries (see Figure 1). Total electricity generated decreased by 3.6% between 2019 and 2020, because of the reduction in demand brought about by the Covid-19 lockdowns. The share of electricity generated from coal fell a further 0.3%, from 2.1% to 1.8%, continuing a long-term downwards trend. At certain times in 2021, the UK provided for its electricity needs without burning any coal. The decline in electricity supplied from fossil fuels was enabled by increased generation from renewables, which raised its share of generation from 36.9% to a record 43.1%. There have been around 50 to 60 energy suppliers in the UK, but this number has declined rapidly since costs started soaring. Customers of firms that have gone out of business have mostly been picked up by the big six energy suppliers Centrica, EDF Energy, E.ON, nPower, OVO and Scottish Power. We are seeing a reluctance by the remaining energy suppliers to take on new business. Our clients with new developments ready for occupancy are finding it increasingly difficult to get energy supply deals to permit completions. Gas and electricity customer prices are determined by a number of factors. Wholesale energy prices account for up to 40% of the average electricity bill, according to Energy UK, with these prices dependent on factors such as the cost of generating electricity, and supply and demand. As suppliers buy in advance, some of the volatility UK electricity generated by fuel type 2010 1% 2% 2020 3% 3% 13% 3% 28% 16% 36% 28% 3% 46% 2% 16% Coal Oil & other fuels Gas Nuclear Hydro Wind & solar Other renewables Figure 1: In 10 years, wind and solar became a major energy source on the electricity Grid Includes generation from pumped storage 26 May 2022 www.cibsejournal.com CIBSE May 22 pp26-27 Cost Model.indd 26 22/04/2022 15:15