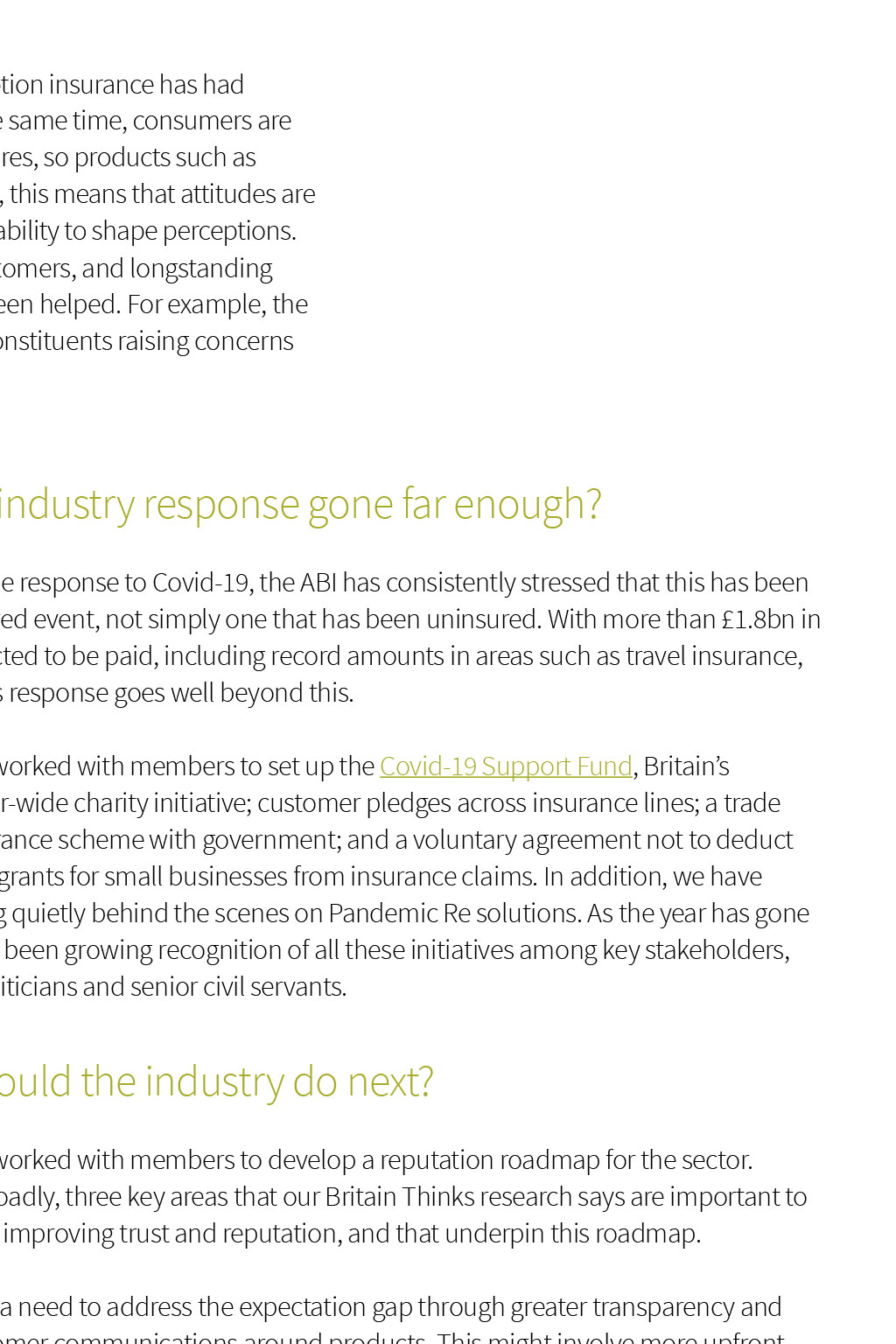

Customers and stakeholders are increasingly savvy and cynical about PR. Deeds not just words are needed to build the industrys reputation post-Covid-19, says Director of Advocacy Ben Wilson. How bad has the reputational impact on the industry been in 2020? It has, undoubtedly, been a difficult year for the industry, but it is important to understand the nuance. Our research shows that the dispute around business interruption insurance has had limited visibility and impact with consumers as a whole. At the same time, consumers are more concerned and engaged in their long-term financial futures, so products such as pensions and insurance have more salience than ever. Overall, this means that attitudes are quite fluid, and it is a pivotal time for the sector in terms of its ability to shape perceptions. But, clearly, no industry likes to be in dispute with valued customers, and longstanding challenges around low levels of trust will certainly not have been helped. For example, the ABI has seen its MP caseload rise steeply as a result of local constituents raising concerns about business and travel insurance cases. Six survey findings on industry reputation espite media coverage, stories about insurance 1 Dhave had a limited cut-through with consumers during Covid-19 only 8% had heard (mainly negative) things about the industry, with 50% not hearing anything, and 27% hearing a mix of positive and negative 2 A significant minority of consumers (23%) feel pensions will become more important to them in the next year, with 54% saying they would have the same level of importance 3 82% say they would feel vulnerable without insurance 4 Only 29% agree that they understand how their premiums are calculated 1% of SMEs say the sector is important for the UK 5 8economy, and 73% say insurance helps them run their business with confidence 6 reater transparency about product coverage G (insurance and pensions) is the No 1 thing that would make people feel more positive about the industry (60%), followed by solutions for future uninsured events (39%). (research by Britain Thinks, November 2020) Has the industry response gone far enough? In terms of the response to Covid-19, the ABI has consistently stressed that this has been a major insured event, not simply one that has been uninsured. With more than 1.8bn in claims predicted to be paid, including record amounts in areas such as travel insurance, the industrys response goes well beyond this. The ABI has worked with members to set up the Covid-19 Support Fund, Britains biggest sector-wide charity initiative; customer pledges across insurance lines; a trade credit reinsurance scheme with government; and a voluntary agreement not to deduct government grants for small businesses from insurance claims. In addition, we have been working quietly behind the scenes on Pandemic Re solutions. As the year has gone on, there has been growing recognition of all these initiatives among key stakeholders, including politicians and senior civil servants. What should the industry do next? The ABI has worked with members to develop a reputation roadmap for the sector. There are, broadly, three key areas that our Britain Thinks research says are important to customers in improving trust and reputation, and that underpin this roadmap. First, there is a need to address the expectation gap through greater transparency and simpler customer communications around products. This might involve more upfront conversations about the trade-off between price and product coverage in insurance, or making pension products easier to understand and access. Second, while a clear majority of customers believe that insurance is worth paying for, even if you cant always be covered for everything, they do expect the industry to strive for solutions to providing future pandemic cover. Finally, the sector has an important role to play in building back better, whether that be by using our financial muscle as an investor in infrastructure and jobs, tackling climate change, or helping creating a more fair and inclusive sector and society. While consumers will always care most about whether the products they buy work for them, these are all areas in which, our research shows, action can shift the dial on how the industry is perceived. What role has the ABI in improving trust and reputation, and what can firms do? Improving trust and reputation has to be dealt with at firm and industry level. Through our political, media and regulatory networks, the ABI is uniquely placed to act as the voice of the industry, and to tell a complete story of how the industry acts as a force for good through the products it provides and the economic contribution it makes to the UK during a time of recovery. In 2020 alone, the ABI gave more than 145 media interviews and more than 40 briefings on Covid-19 to ministers and politicians. It can also galvanise action across the industry as we have seen throughout 2020 and act as a convener in dealing with some of the most knotty challenges. The sector has an important role to play in building back better, whether that be by using our financial muscle as an investor in infrastructure and jobs, tackling climate change, or helping create a more fair and inclusive sector and society Firms own the customer relationships. Because pensions and insurance are low-engagement sectors compared with some such as broadcasting or newspapers, which are in your home every day, or supermarkets and banks, with which you might engage on a weekly basis customer experience and engagement is even more critical to reputation. Thats why issues such as customer transparency and managing the millions of touchpoints with consumers are, rightly so, high up on the agenda of our general insurance committees. Supporting diversity and inclusion In a year when there has been intense public dialogue about diversity and inclusion in society as a whole, it is more important than ever that the sector be modern, diverse and reflective of our customers. To this end, the ABI has retained a strong focus on a range of initiatives: In response to the global Black Lives Matter movement, our sector has put black, Asian and minority ethnic (BAME) inclusion front and centre. The ABI and 32 of its members are among the first wave of insurance and long-term savings firms to have signed up to Business in the Communitys Race at Work Charter. We also held our inaugural Diversity Summit, focused on improving BAME diversity in our sector and supported the 10,000 Black Interns campaign. How important are issues such as climate change? One of the surprises for polling companies during the Covid-19 pandemic has been that movements such as Black Lives Matter and action on climate change have risen in prominence and public concern, rather than being crowded out by the pandemic. Our data shows a variation by age of customer. Among 18 to 34-year-olds, 29% are likely to identify taking action on climate change or sustainability in driving positivity towards the industry, compared with 21% of over-55s. It is also worth noting that our member survey reflects a notable rise in firms identifying climate change as a priority issue for the years ahead. What lessons should the industry learn from 2020? Our Britain Thinks research highlights how it is a challenging time for brands, across sectors, when it comes to connecting with customers and finding the right tone can be elusive. e promoted job sharing and the work of our W members to improve flexible working, highlighting the benefits of job sharing, in particular to help reduce the gender seniority gap, increase diversity, and strengthen our sectors reputation. The main lesson I would draw is that customers and stakeholders are increasingly savvy and cynical of PR. Reputations are built on a foundation not only of communications, but also of deeds: stakeholders can see through PR that isnt supported by real and consistent business activity. e continued to lead the way in increased W transparency around parental leave and pay, with more than 75% of the market committing to this first-of-its-kind, sector-wide pledge. It will be those industries and firms that go through a full process of introspection and change that will come out stronger. Read more here Virtue signalling, and short-term or defensive strategies, will not work over the long term. As our research shows, actions speak louder than words. To quote Socrates: Endeavour to be what you desire to appear.