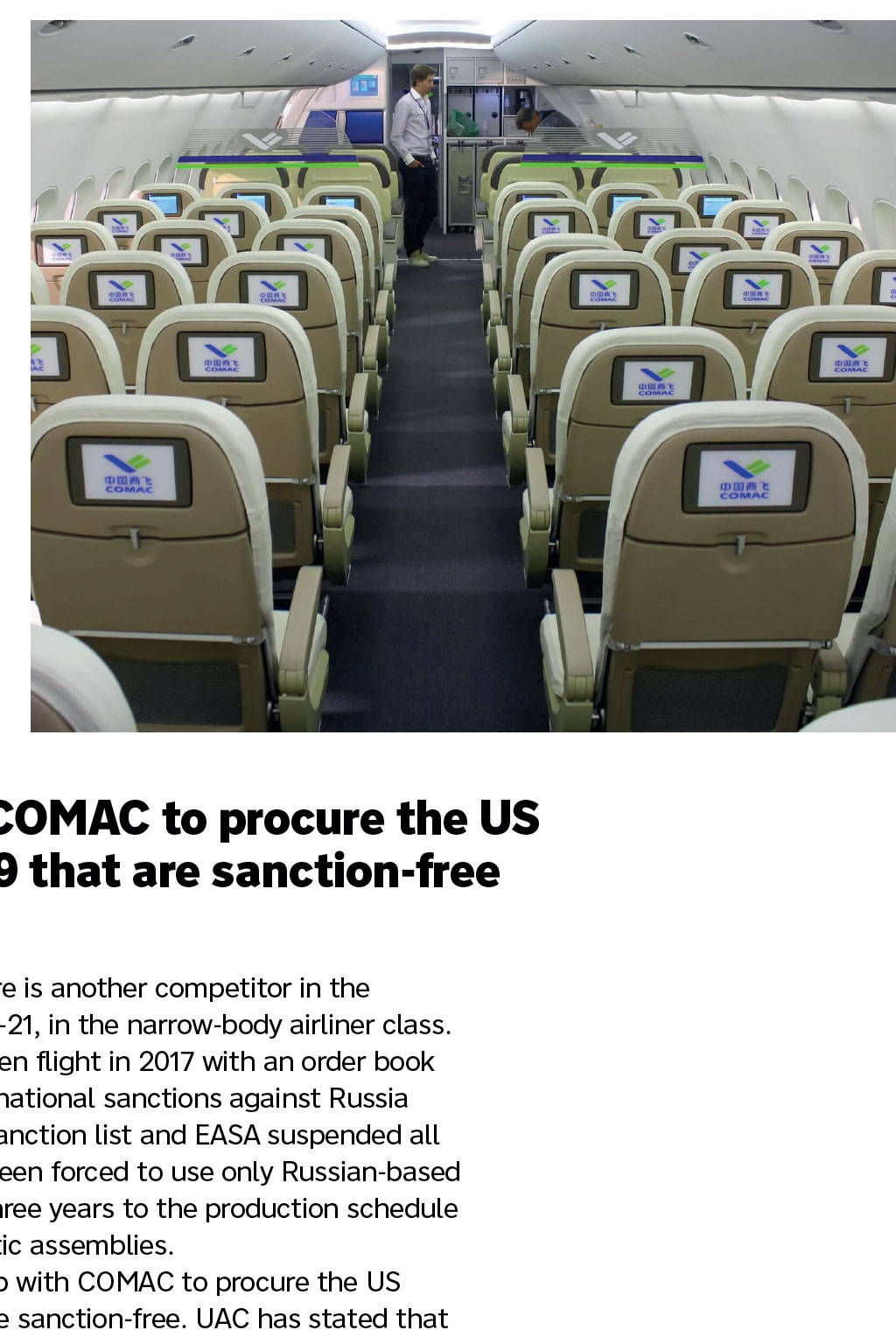

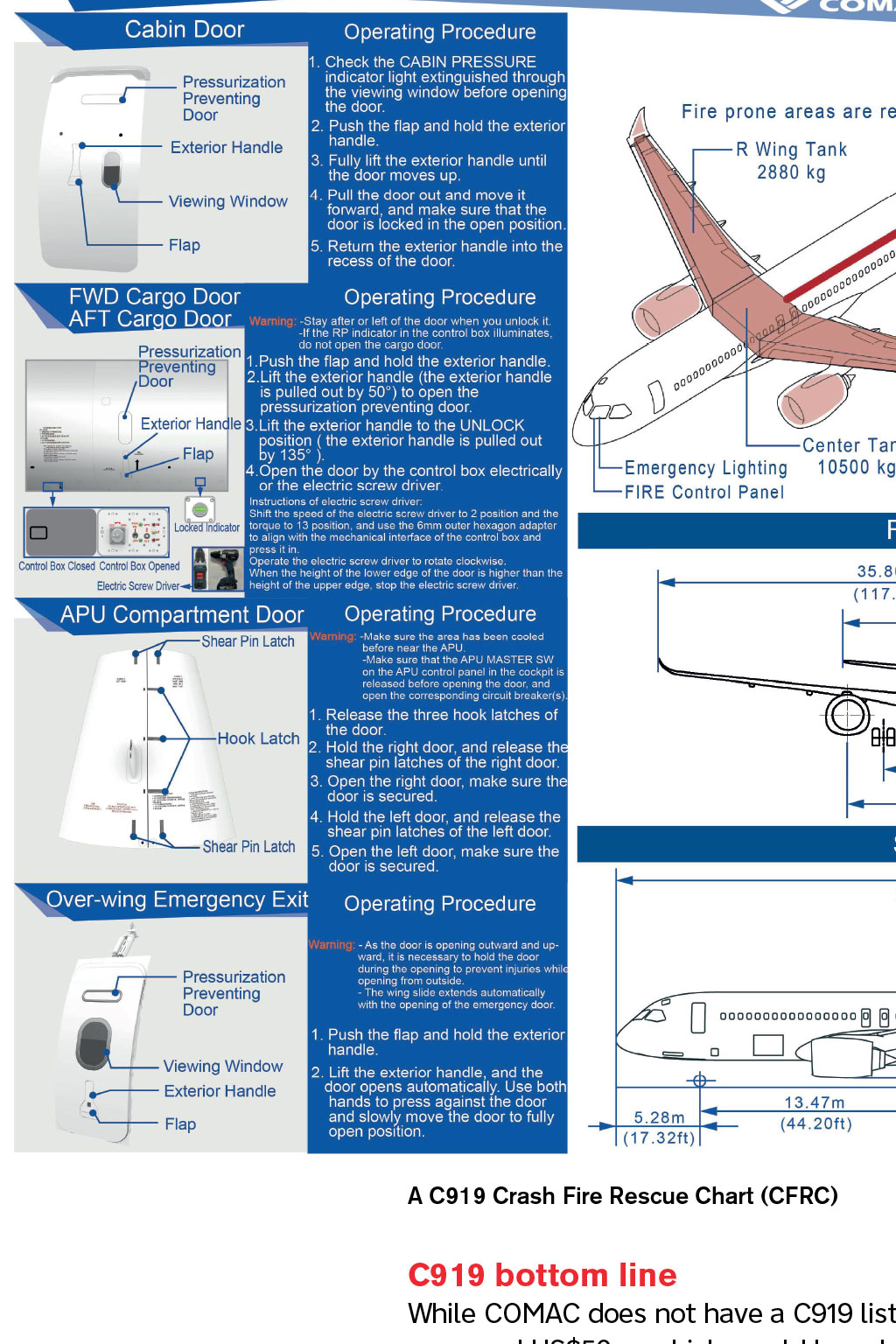

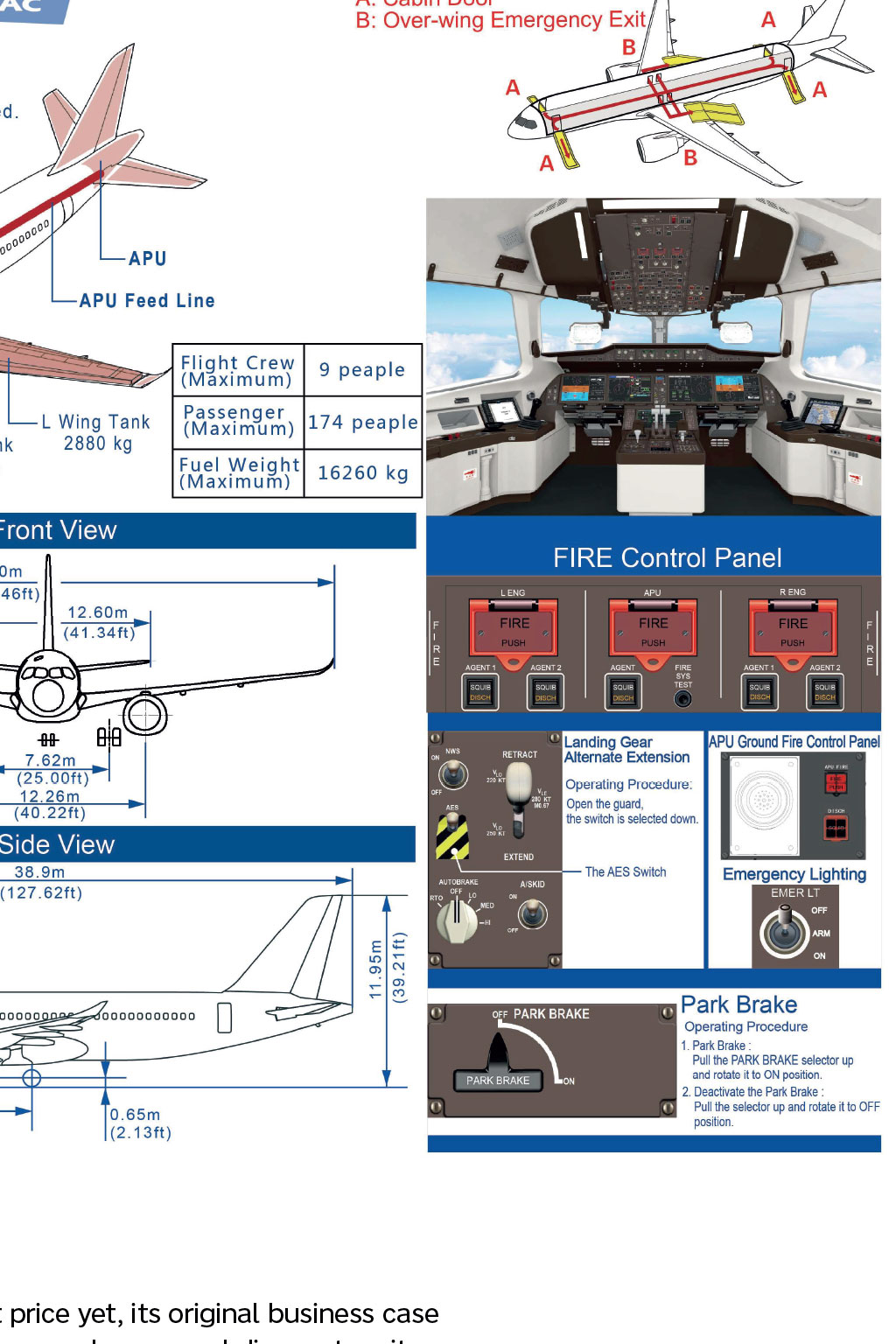

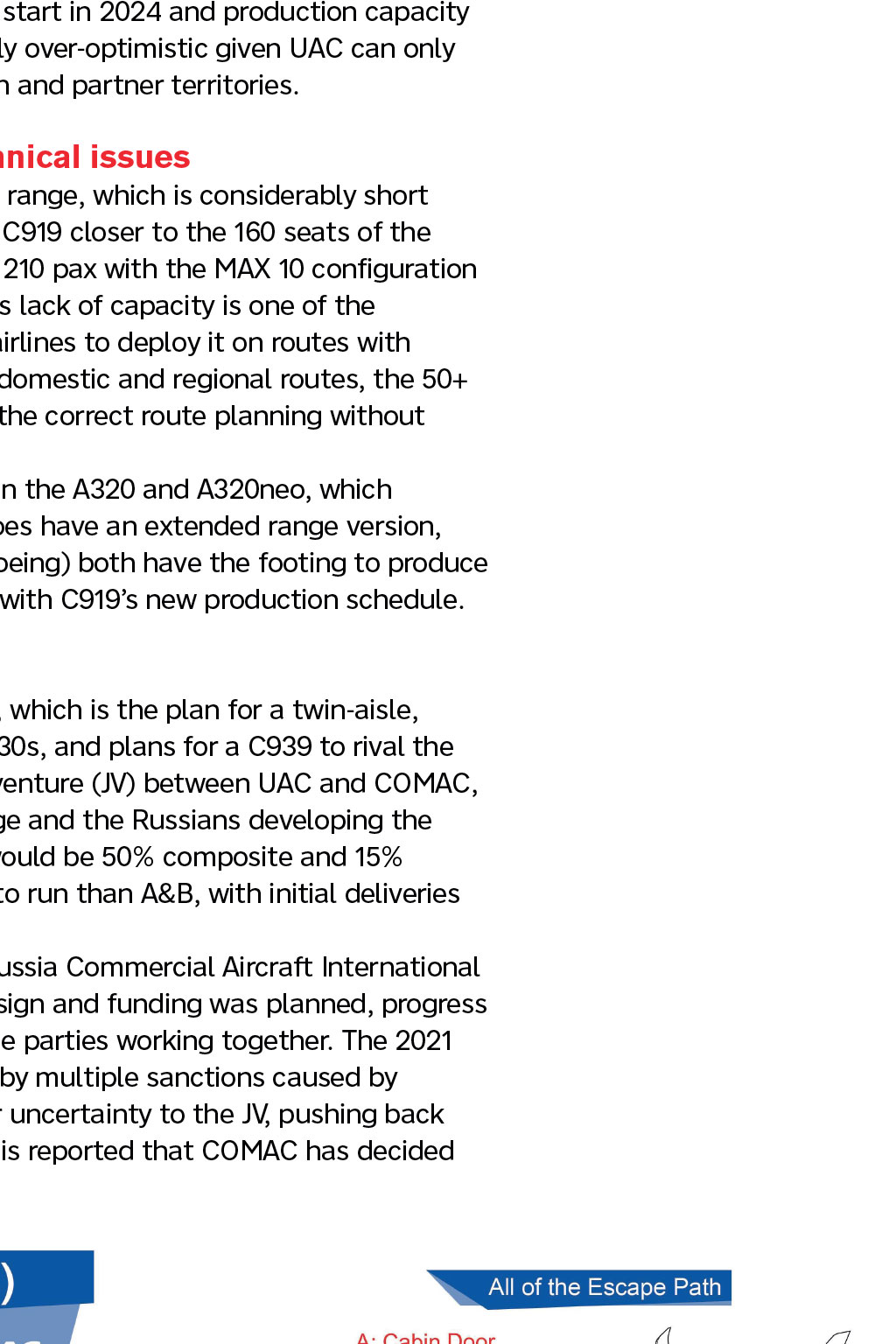

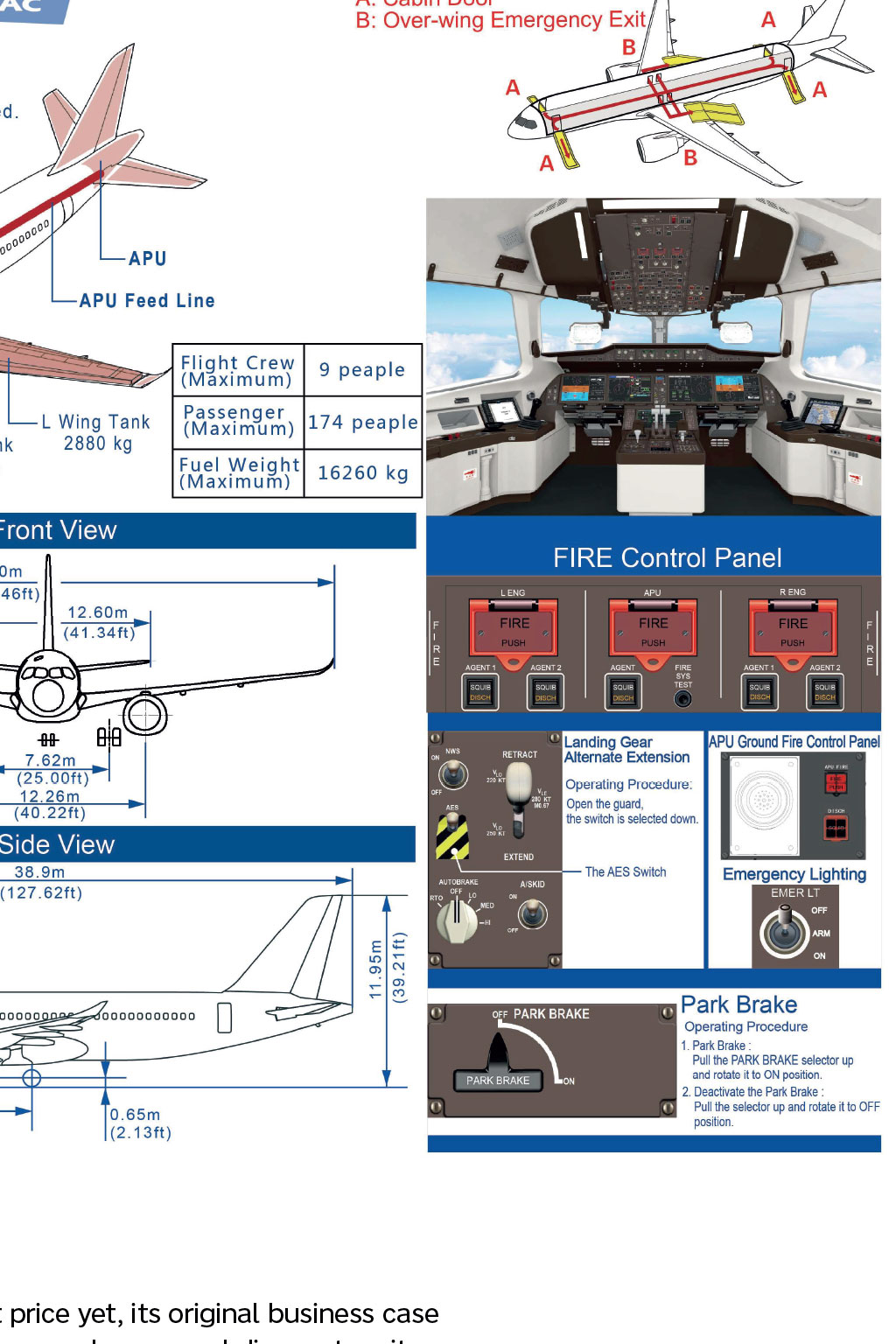

COMAC C919 The next chapter wrote about the rather unknown C919 in the Spring 2019 edition of The Log; it has been a busy few years in the development and production schedule for the Chinese Commercial Aircraft Corporation (COMAC). COMAC had hoped to make its first deliveries in 2021 but development slowed during cold weather-testing in Chinas Inner Mongolia, followed by natural icing conditions in Ontario, then further delays caused by COVID restrictions. Despite setbacks, on 28th May 2023 the C919 successfully completed its first commercial flight with its launch customer, China Eastern Airlines (CEA) from Shanghai to Beijing, with 128 passengers. The C919, Chinas self-developed passenger aircraft programme, started in 2007 with the first aircraft built in 2015 and its maiden flight in 2017. This followed several years of extensive flight-testing, with a three-month delay this year because of a malfunction in the CFM International LEAP-1C engine reverse thruster (handy for wet runways). C919 future order book To date, there have only been two deliveries to CEA; its not clear exactly what the production operations are, but a look at its order book shows a large ramp-up under way. COMAC reported in January 2023 that it now has more than 1,200 orders and it will increase annual production to 150 units by 2028. Interestingly, many future orders are from financial institutions and leasing companies, not just airlines; clearly state support is higher than other countries would normally expect for an aircraft development programme. Rise of the Asian airlines Chinas Big Three state-owned carriers Air China, CEA, and China Southern Airlines and their subsidiary airlines, have been a bright spot in the airline industry globally, averaging triple the industry average return. In 2019, 660m passengers flew within China, double the total in 2012. The Chinese international market is experiencing rapid growth, driven by aggressive expansion from Chinese airlines, although almost 90% of air traffic is internal. Foreign airlines have been steadily losing market share in China and Asia with the profitability of their Chinese routes on the decline. There are now more than 50 Chinese, including Hong Kong, Macau and Taiwanese airlines. Luxury business travel increases The McKinsey Global Institute foresees threefold growth in the number of people in Asia able to afford airline travel in the next decade. The upper strata of Chinas fast-growing middle class is poised to become the principal engine of consumer spending, including air travel. Many Asian airlines are creating more luxury business and premium-class experiences, compared with traditional carriers such as BA that have cut back on perks. Chinese airlines offer hub travelling and stopovers to Asia and Oceania, and China Airlines have top-of-the-range exclusive airline Dynasty lounges that include a variety of Asian cultural delights such as tea bars. Regional jet backdrop With more than 1.4 billion potential passengers in China alone twice European numbers there is an argument that any Chinese-made jet doesnt need to leave Chinese airspace, but clearly COMAC and China has the world market in their sights with their premium travel classes. COMACs regional jet, the ARJ21 (meaning Rising Phoenix) has already made significant in-roads ahead of the C919. The Indonesian airline, TransNusa, completed its first commercial (and international) flight between Jakarta and Bali in April 2023. TransNusa now has two deliveries. The littleknown ARJ21, was launched internally within China with Chengdu Airlines in 2016. Its based on the MD-80/90, produced under licence in China, and features a 25-degree swept, supercritical wing designed by Antonov and twin rear-mounted GE-CF34 engines. More than 110 ARJ21s have been built to date and already delivered to Chinese airlines flying solely within China, with 34 deliveries in 2022 alone. This domestic flying schedule has proved the jet without leaving Chinese shores until April 2023. In Indonesia, the ARJ21 has achieved On Time Performance (OTP) > 90% with load factors increasing to 92%, demonstrating international customer confidence in the plane. This is a sound model, proving the aircraft domestically before sending it internationally for certification, and making it extremely difficult for Europeans to compete. Ryanair is in partnership with COMAC to procure the US and European parts of the C919 that are sanction-free Late Russian entry It should also be worth noting that there is another competitor in the marketplace: the Russian-built Irkit MC-21, in the narrow-body airliner class. It also started in 2007 and had its maiden flight in 2017 with an order book of around 300. However, the 2022 International sanctions against Russia placed the plane maker (UAC) on the sanction list and EASA suspended all work on type certification. Russia has been forced to use only Russian-based avionics and engines, adding at least three years to the production schedule to complete the substitution of domestic assemblies. Ryanair is (no surprise) in partnership with COMAC to procure the US and European parts of the C919 that are sanction-free. UAC has stated that deliveries of the MC-21 are expected to start in 2024 and production capacity will be 72 by 2029. This seems extremely over-optimistic given UAC can only use Russian parts and fly within Russian and partner territories. Potential limitations: C919 technical issues The C919 is currently in the 158-168 pax range, which is considerably short of the A320 at 180-194 pax, putting the C919 closer to the 160 seats of the A319neo. The 737 Max 8 can hold up to 210 pax with the MAX 10 configuration topping out at a whopping 230 pax. This lack of capacity is one of the biggest downfalls of the C919, forcing airlines to deploy it on routes with less-consistent demands. However, for domestic and regional routes, the 50+ Chinese carriers should be able to find the correct route planning without much difficulty. The C919 carries 6,000 litres less than the A320 and A320neo, which reduces flight time, though the C919 does have an extended range version, which is still in design. A&B (Airbus & Boeing) both have the footing to produce 60-plus aeroplanes a month compared with C919s new production schedule. The CRAICs (not) great! In 2019, we briefly mentioned the C929, which is the plan for a twin-aisle, long-range, wide-body plane to rival A330s, and plans for a C939 to rival the A380s and B787s. This involved a joint venture (JV) between UAC and COMAC, with the Chinese to develop the fuselage and the Russians developing the composite wing and fin. The airframe would be 50% composite and 15% titanium, aiming to be 10-15% cheaper to run than A&B, with initial deliveries scheduled for the late 2020s. The oddly named CRAIC JV (China-Russia Commercial Aircraft International Corporation) was formed, and while design and funding was planned, progress was slowed because of difficulties of the parties working together. The 2021 Covid-19 impact, immediately followed by multiple sanctions caused by the invasion of Ukraine, brought further uncertainty to the JV, pushing back maiden flights to 2030. In June 2023, it is reported that COMAC has decided to go it alone. A C919 Crash Fire Rescue Chart (CFRC) C919 bottom line While COMAC does not have a C919 list price yet, its original business case proposed US$50m, which would have been a phenomenal discount on its American and European rivals: the A320neo lists at US$111m and the 737Max8 at US$121m. However, Forbes has estimated it is more realistically priced at US$90-100m, because of the estimated US$20bn+ overrun development costs. This higher list price does make it a hard sell outside its home market as airline discounts can often be at 50% off the list price, and with no certification from the FAA and EASA, international orders are some time away. There is only a CAAC (Civil Aviation Administration of China) certification, though Chinese and Asian markets have different pricing constraints and requirements compared with the global market targeted by A&B. Realistically, with Ryanair backing and a statement from Chief Cost Cutter MOL stating that, More competition for A&B would be great, it wouldnt be too far-fetched to imagine a change of key supplier for Ryanair. And some additional state funding from China for COMAC would be all it would need to flood international markets with the C919. Chinese state-owned airlines have been known for flooding the marketplace with long-haul fares that traditional carriers cannot compete with. The Brazil, Russia, India and China (BRIC) economies are likely to provide key markets, before more Western-based economies put up barriers to a worldwide maintenance and parts network for COMAC. This is what happened to the Russian Sukhoi Superjet 100, which was making inroads at Interjet (Mexico) and Cityjet (UK) and has reverted back to domestic Russia. The future A&B may not need to worry in the short and indeed long term, regarding the Russian challenger. However, there should be some medium-term concerns for the duopoly regarding the C919 while production is likely to be slow for the next few years, there could be potentially close to 1,000 C919s flying by 2030. Unlike the Irkut MC-21, the C919 wont have the same restrictions to fly to their neighbours in Europe. An interesting fact is that the model number, 919, stands for Comac and China, it also forms an ABC parallel with Airbus and Boeing. If COMAC can make good headway in the Chinese domestic market following the success of the ARJ21 and can make inroads internationally within Asia, we can expect US and French politicians to wade in and ensure that A&B maintain their market share. Expect to see and hear a lot more about COMAC-made planes by the end of the decade and a possible duopoly change to a triopoly! To be continued in 2024 By Matthew Martin, Log Board member