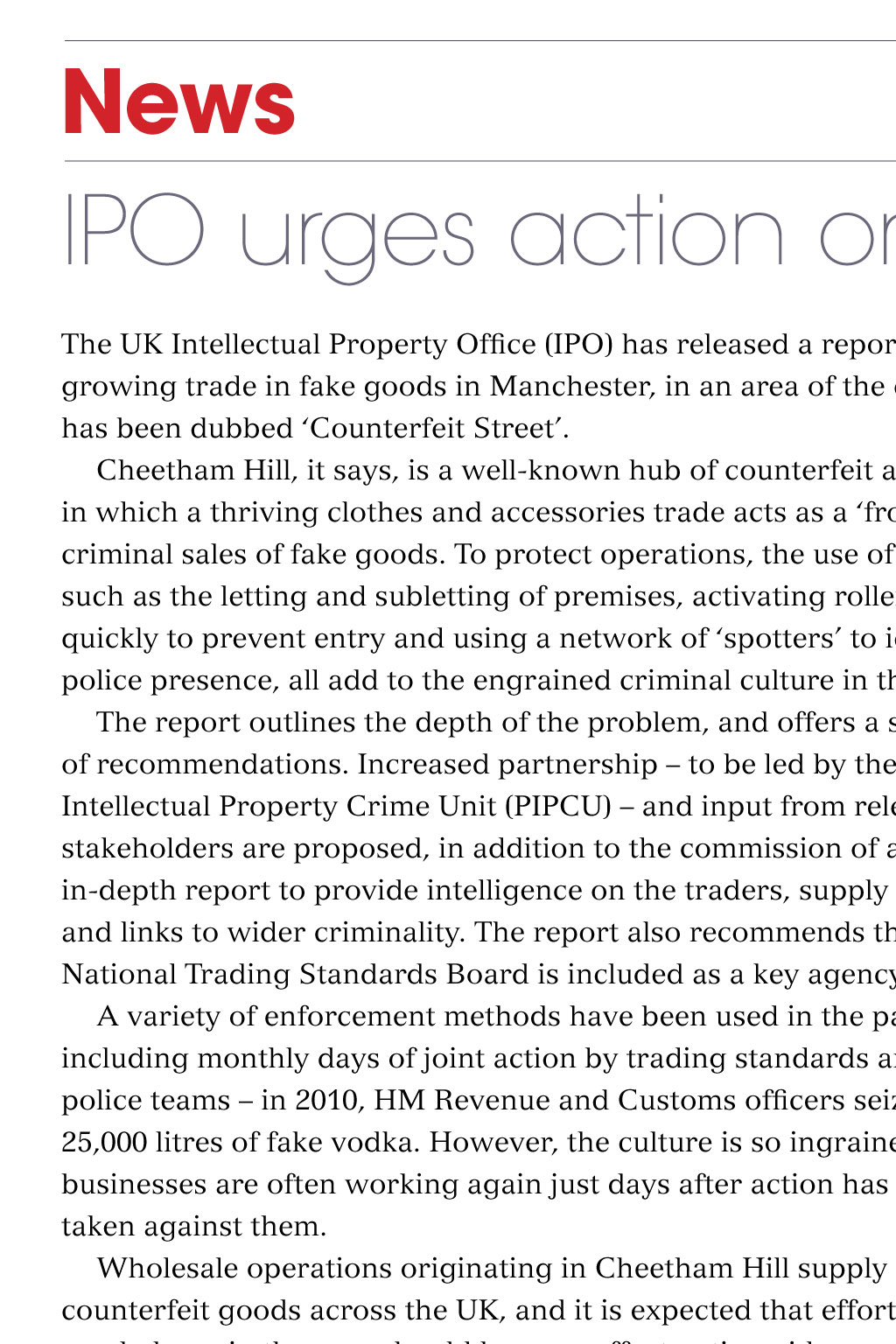

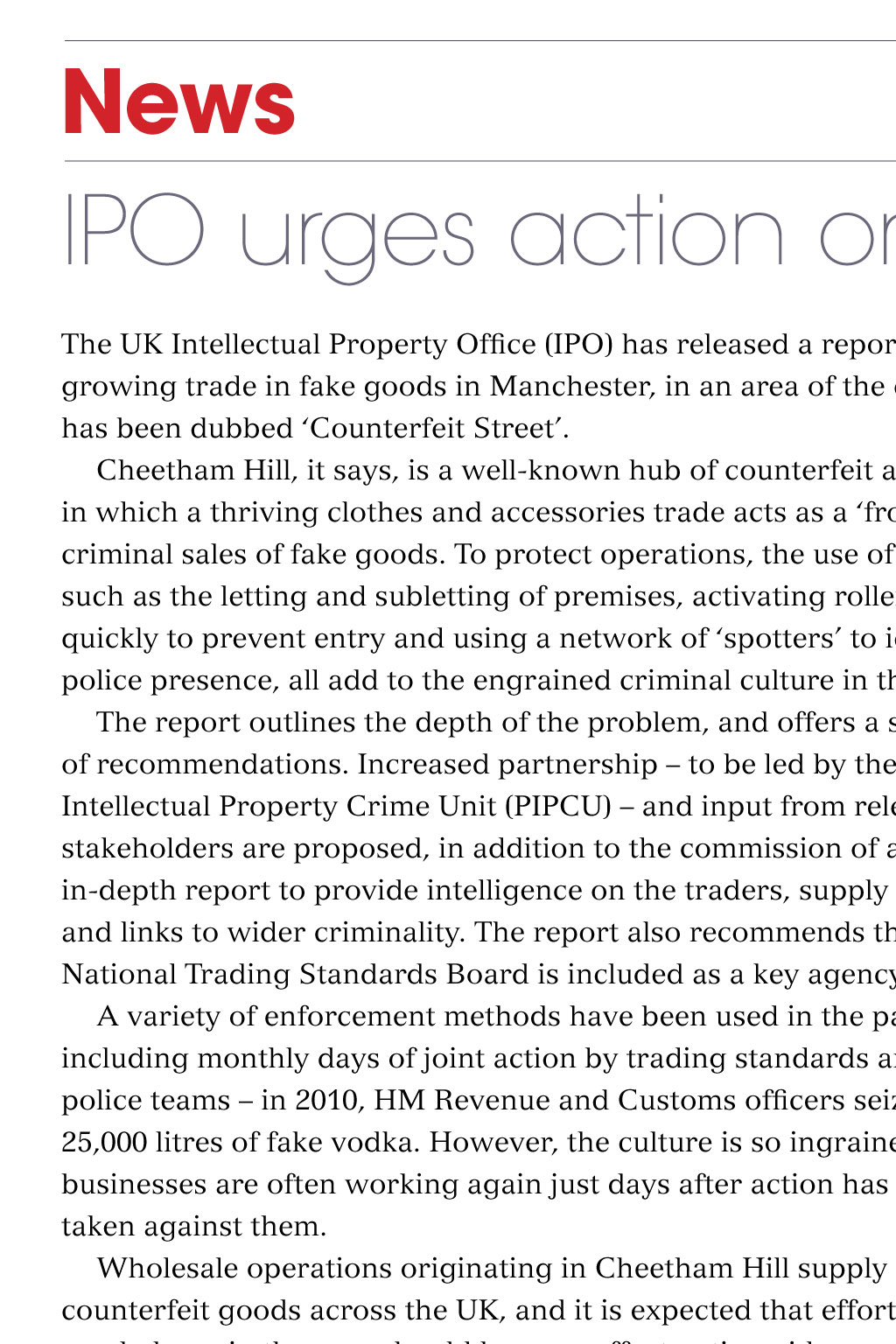

News IPO urges action on Counterfeit Street NEIL MITCHELL / SHUTTERSTOCK The UK Intellectual Property Office (IPO) has released a report on the growing trade in fake goods in Manchester, in an area of the city that has been dubbed Counterfeit Street. Cheetham Hill, it says, is a well-known hub of counterfeit activity, in which a thriving clothes and accessories trade acts as a front for criminal sales of fake goods. To protect operations, the use of methods such as the letting and subletting of premises, activating roller shutters quickly to prevent entry and using a network of spotters to identify police presence, all add to the engrained criminal culture in the area. The report outlines the depth of the problem, and offers a series of recommendations. Increased partnership to be led by the Police Intellectual Property Crime Unit (PIPCU) and input from relevant stakeholders are proposed, in addition to the commission of an in-depth report to provide intelligence on the traders, supply cycle and links to wider criminality. The report also recommends that the National Trading Standards Board is included as a key agency. A variety of enforcement methods have been used in the past, including monthly days of joint action by trading standards and police teams in 2010, HM Revenue and Customs officers seized 25,000 litresof fake vodka. However, the culture is so ingrained that businesses areoften working again just days after action has been taken against them. Wholesale operations originating in Cheetham Hill supply counterfeit goods across the UK, and it is expected that efforts to crack down in the area should have an effect nationwide, particularly where activity is linked to organised crime groups. However, specific challenges are posed by online operations, and the ability to sell via social media is a growing problem. The report concludes that the concentration of intellectual property crime has a negative impact on the local community and economy in Cheetham Hill, and is linked to other associated crimes. Harmful products found in skin-lightening creams Enforcement Regulations 2013. Products containing these ingredients which can cause permanent skin damage are banned within the EU, although legal in some other countries. The products that failed the test were RDL Hydroquinone Tretinoin Babyface Solution No.2 and No.3, as well as Faiza Beauty Cream (bleach and freckle). Tower Hamlets Council is giving advice to traders and will carry out further inspections to ensure customer safety in the borough. If businesses do not comply, trading standards will take enforcement action. PRESSMASTER / SHUTTERSTOCK Skin-lightening creams containing harmful ingredients have been seized by trading standards in the London Borough of Tower Hamlets. Three of the products tested by officers were found to contain high levels of hydroquinone and mercury, which means they do not comply with the Cosmetic Products Licence stripped from PPI firm Travel operator fined for failing to protect customers A London-based travel operator has been found guilty of failing to protect customers who purchased Hajj pilgrimage packages, following an investigation by Tower Hamlets Trading Standards. Al Kabir Travel & Tours was fined 12,644 by Thames Magistrates Court in January for not sufficiently protecting 120 pilgrims who travelled to Saudi Arabia last year for the annual pilgrimage. The business had none of the required contingencies to allow the repatriation of its consumers in the event of an emergency, nor did it have the facility to refund consumers money. These two consumer protection offences were contrary to the Package Travel, Package Holidays and Package Tours Regulations 1992, and to part of the Consumer Protection from Unfair Trading Regulations 2008. Last August, the travel company was fined 9,606 for similar offences in action brought by Birmingham City Council. A company that made almost 40 million nuisance calls in just three months has had its licence to provide claims management services revoked. Hundreds of complaints were received after Falcon & Pointer used automatic-dialling technology to make millions of calls mis-selling payment protection insurance (PPI) across a period of 12 weeks. TheClaims Management Regulator (CMR) also found that the Swansea-based company had coerced people into signing contracts without giving them time to understand the terms and conditions. Falcon & Pointer had previously ignored warnings from both the CMR and the Information Commissioners Office (ICO) and continued its action. The investigation found a serious breach of the regulators rules on conduct, and the South Wales firm has been stripped of its licence. Kevin Rousell, head of the CMR, said: Falcon & Pointer has demonstrated the worst excesses of the industry. The firm clearly set out to plague the public and rip off consumers. The licence removal is the latest move in a comprehensive crackdown on rogue actions within the claims management industry. More than a thousand licences have been removed since 2010. In December 2014, the regulator obtained a new power to impose financial penalties for breaches, and fines totalling more than 1.7m have so far been issued. The CMR, based at the Ministry of Justice, is responsible for regulating companies that offer to help people with compensation claims for issues such as personal and criminal injury, as well as mis-sold financial products. Justice Minister Lord Faulks said: The government will continue to take action against rogue firms that put their own profits before the rights of consumers. Falcon & Pointer customers with an outstanding claim could be entitled to repayment of fees.