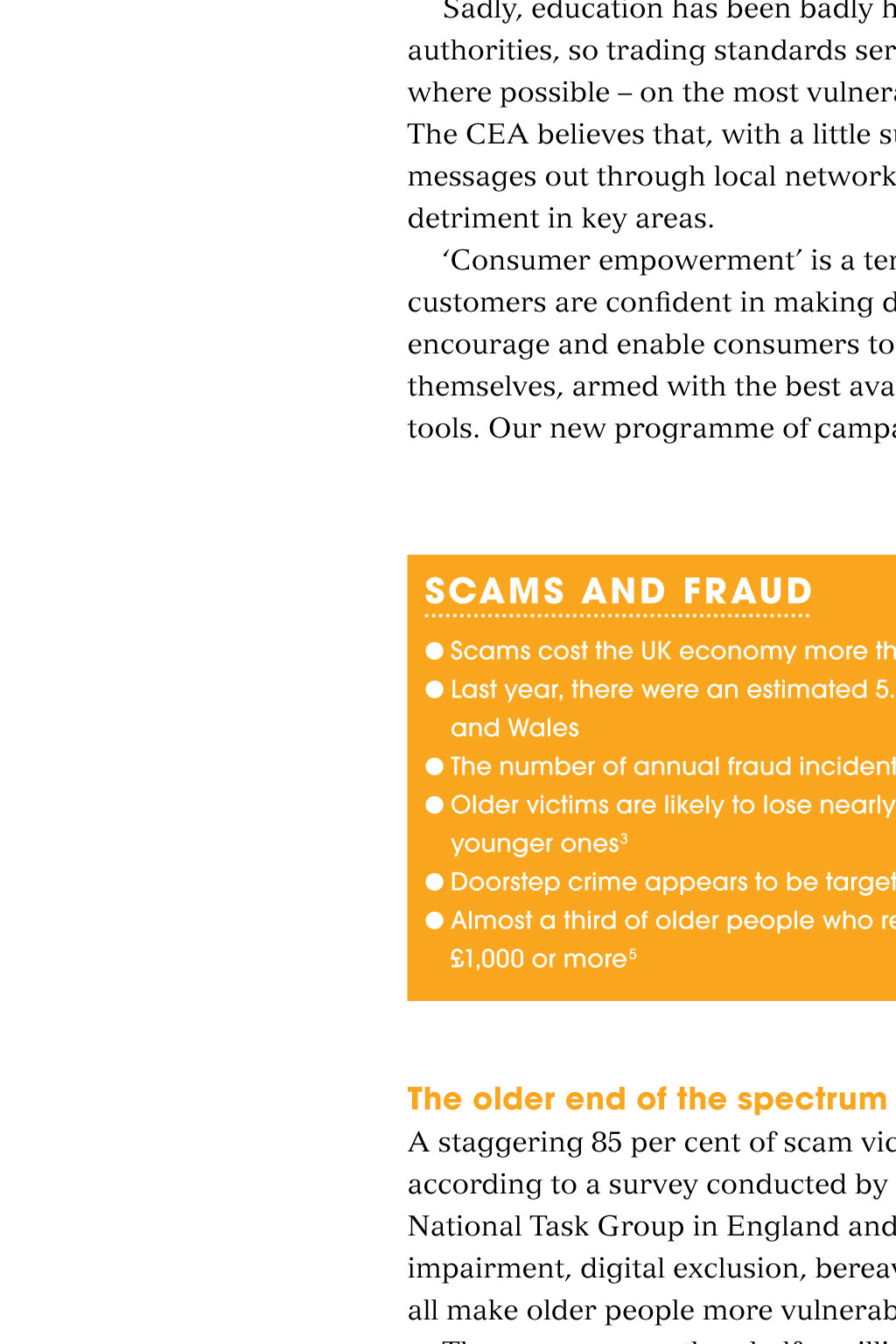

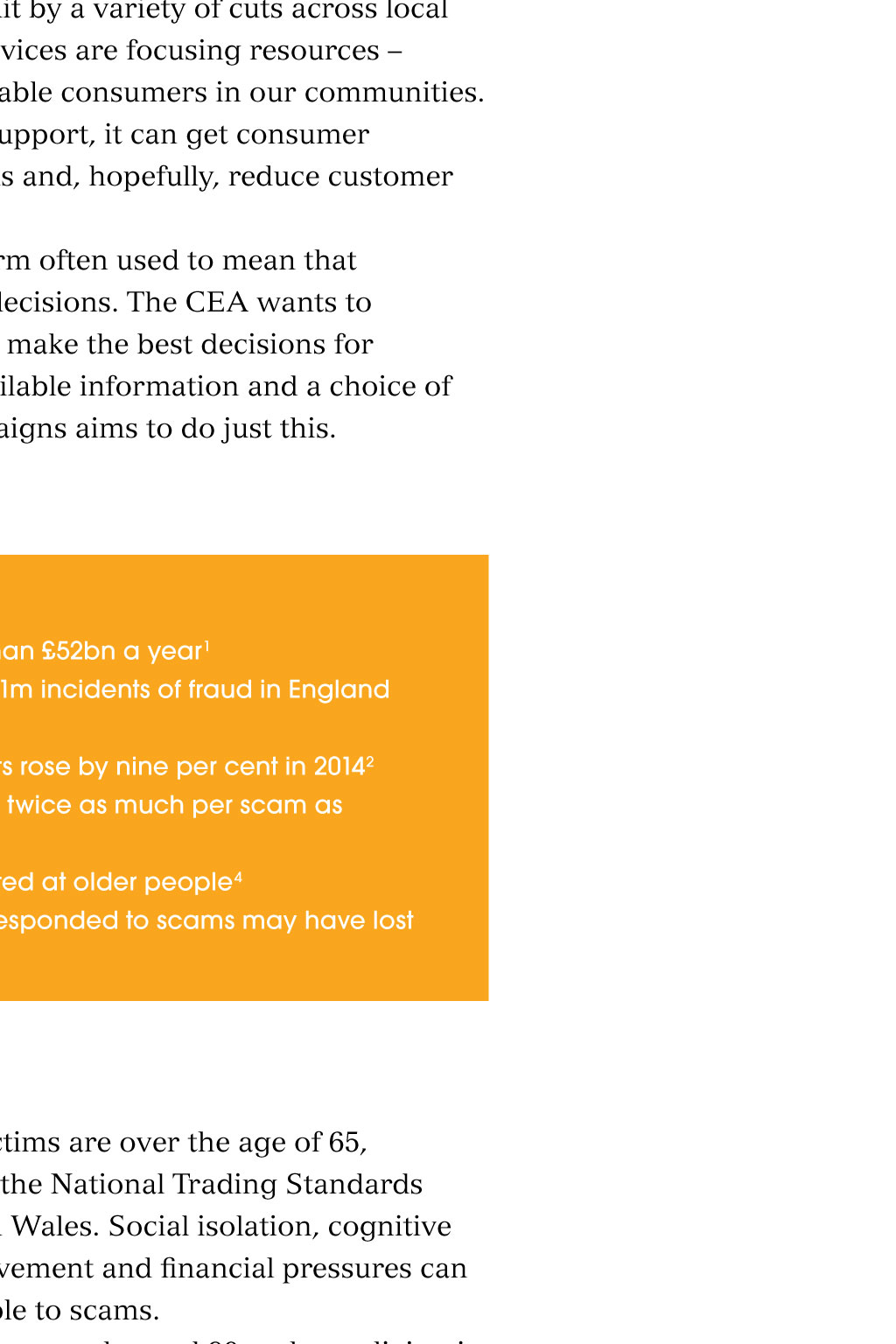

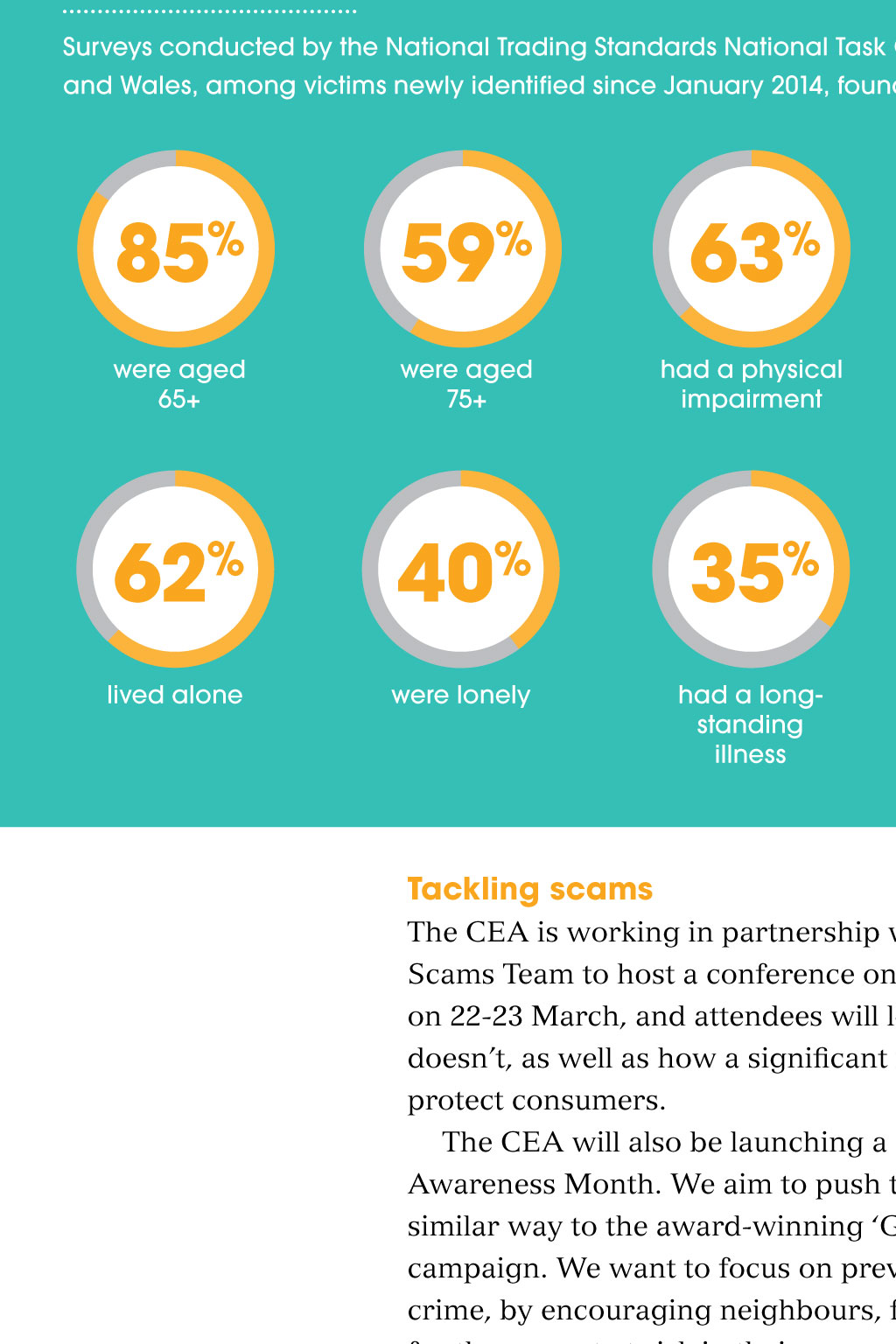

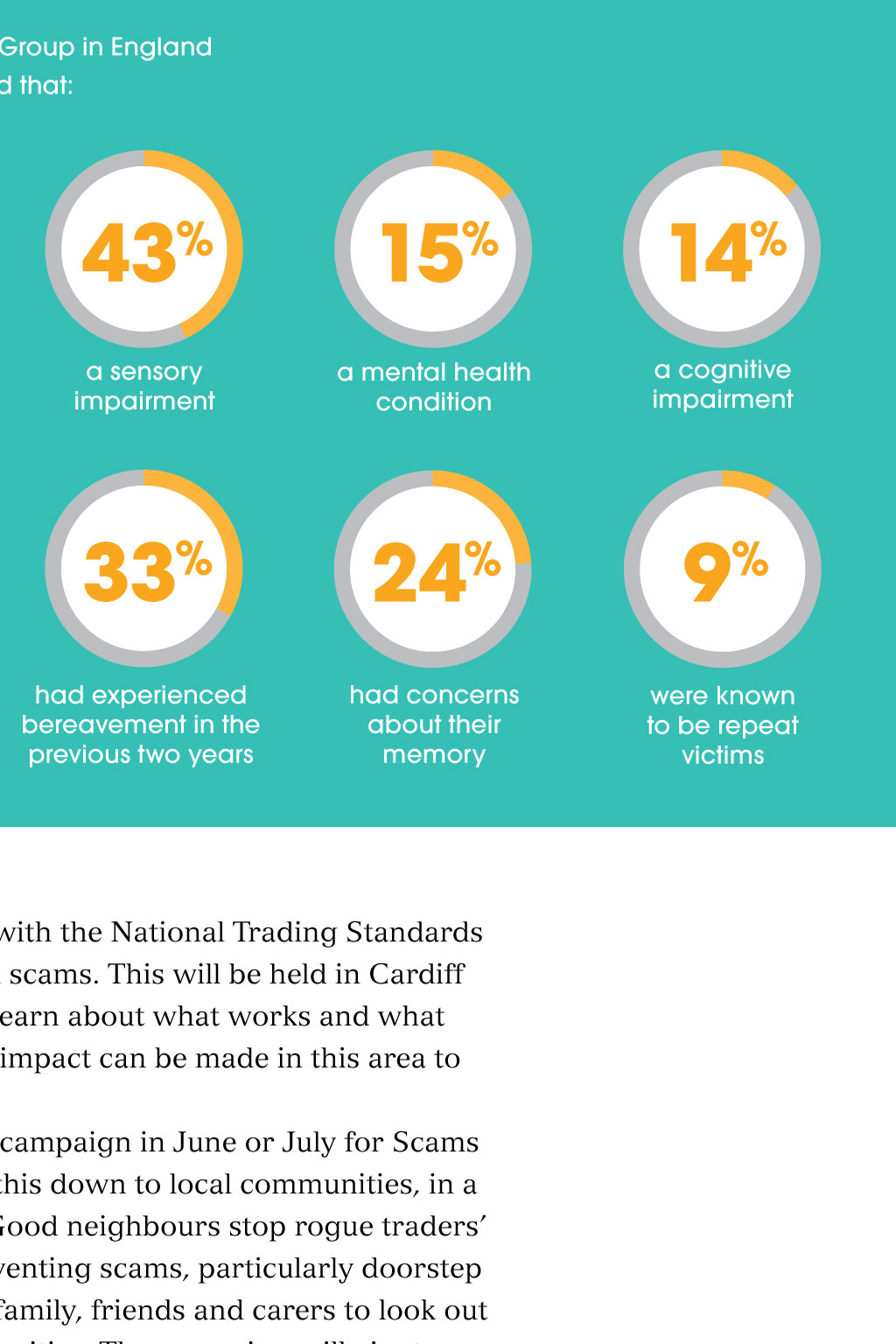

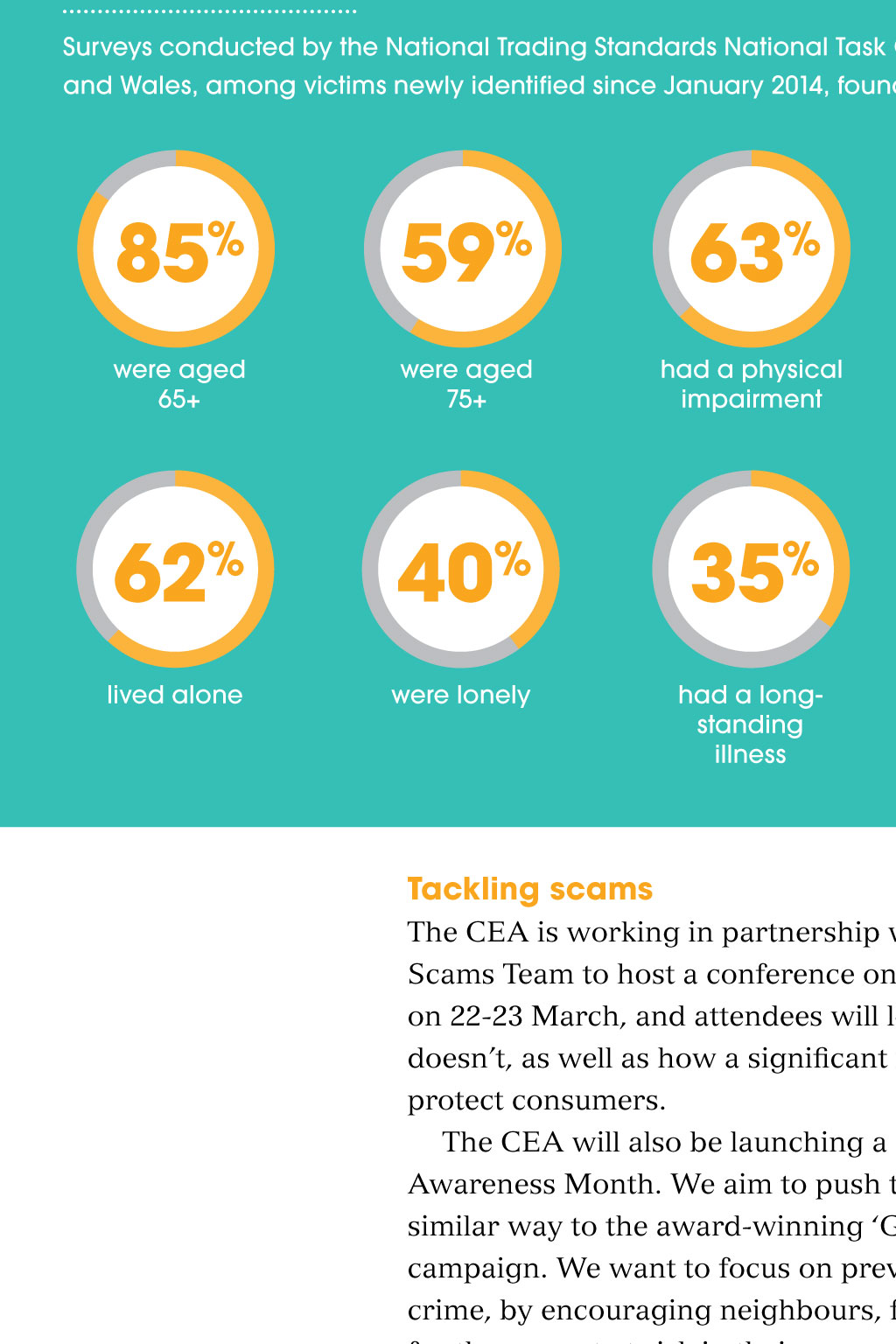

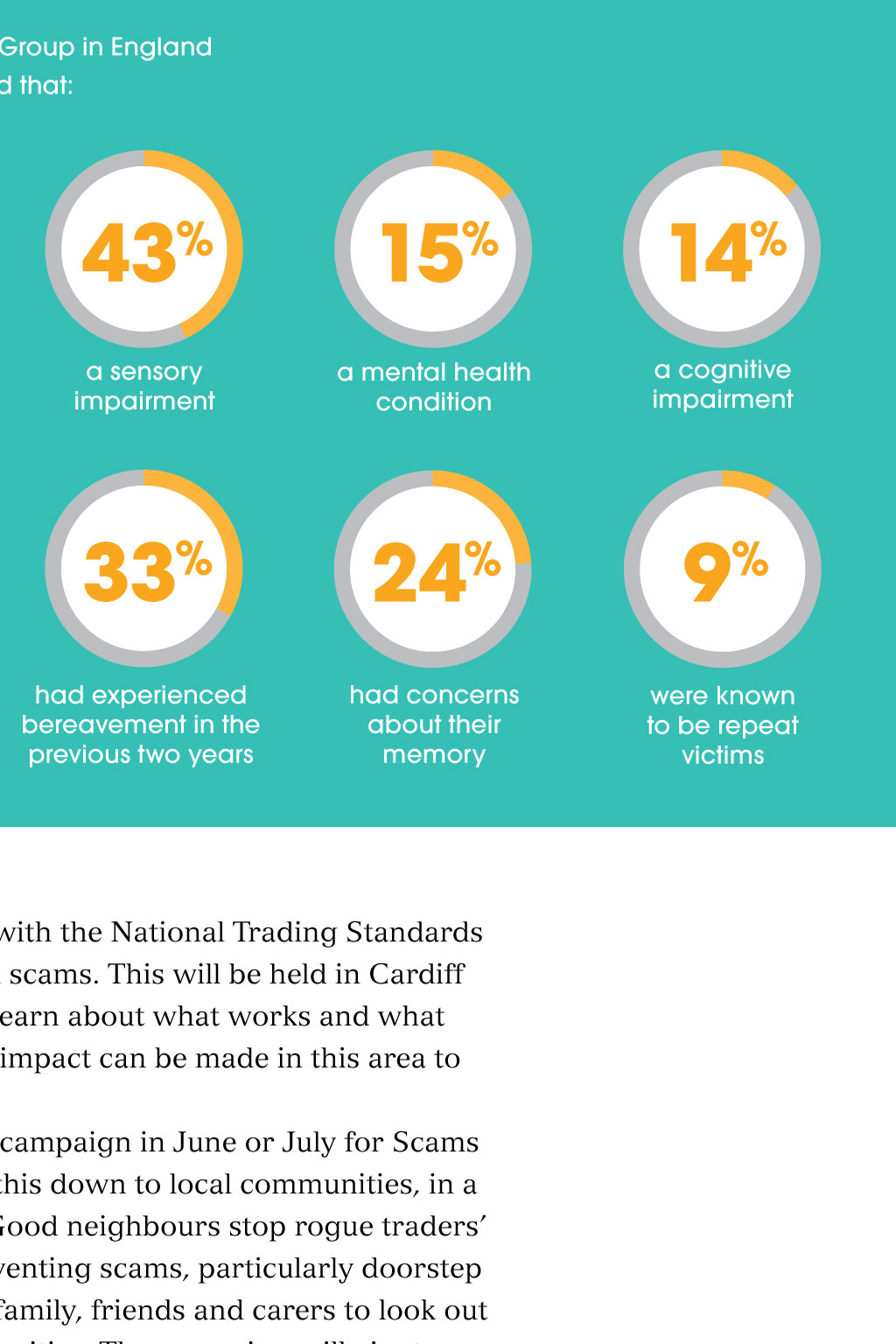

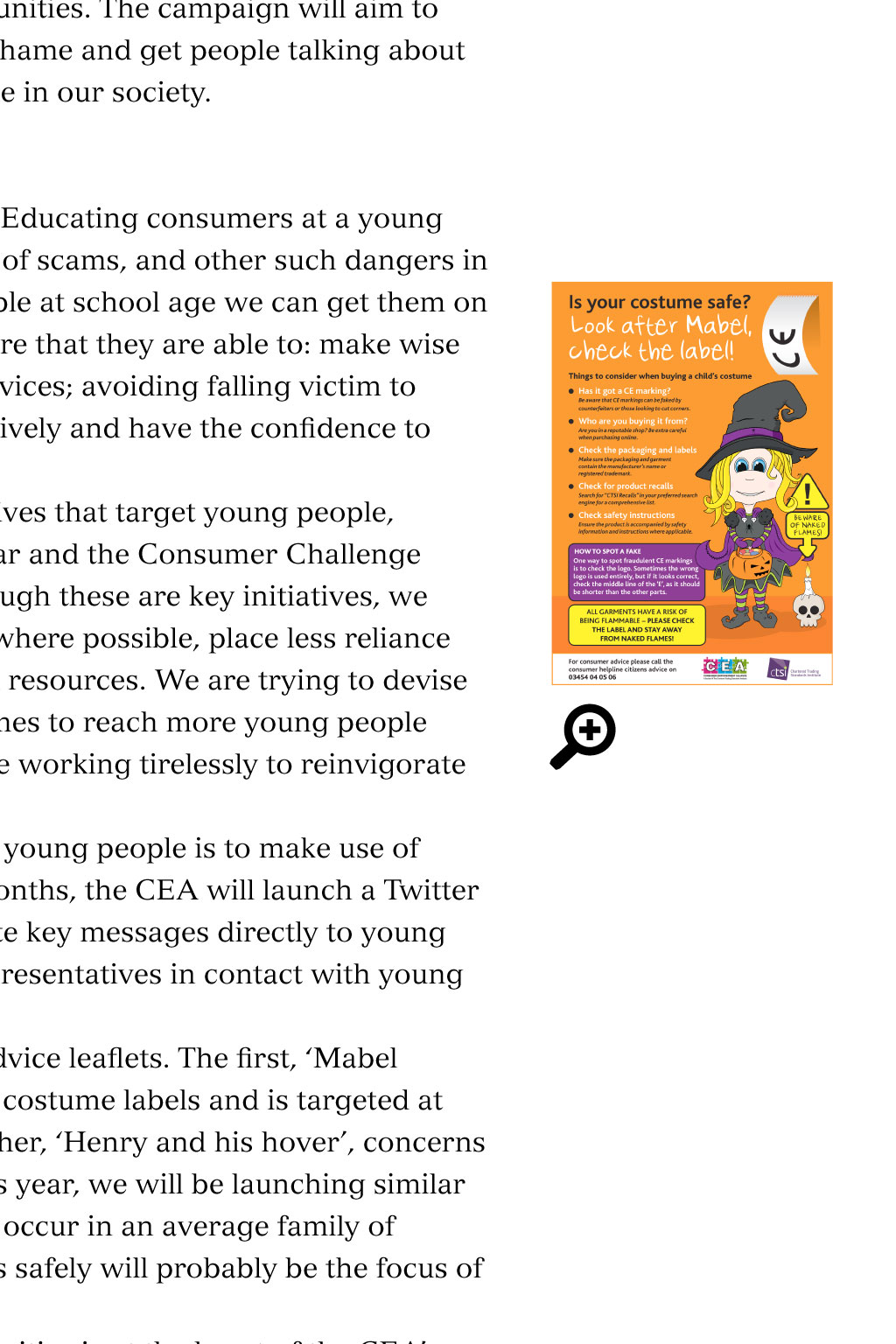

Consumer Empowerment Alliance In this feature survey scams safety campaign Engage Engage age WITH A new programme of campaigns focuses new on supporting the vulnerable young on and old to become empowered and consumers. Louise Baxter tells us more consumers. W hen a 2014 survey asked people if they would define themselves as confident and savvy customers, more than 90 per cent of respondents agreed that they were. In addition, 93 per cent said they carefully weigh up features and price tomake informed purchasing decisions, signalling that the majority of UK consumers are confident, knowledgeable and empowered. This Consumer Engagement and Detriment Survey, conducted by theDepartment for Business, Innovation and Skills, indicated a successful outcome from years of focusing on consumer protection. Initiatives had included the governments launch in 2011, of its consumer empowerment strategy to identify ways of ensuring that customers receive the information and protection they need. Despite the success flagged up by the survey, there are groups within our communities that remain vulnerable in consumer affairs. These may be older people who fall victim to a scam, or young people who have not yet been informed about finances, purchasing and how to become a savvy customer. The Consumer Empowerment Alliance (CEA), part of CTSI, is campaigning this year to educate, empower and assist the vulnerable consumers in our society. The Consumer Empowerment Alliance Anyone can be vulnerable at any point in life, and people often fall in and out of periods of vulnerability. This could be due to bereavement, redundancy, ill health, or any life-changing situation. At CEA, we focus on the younger and older groups within society. Young people, at the start of their journey as consumers, may lack the necessary education to fare well and thrive on the consumer ladder. Older citizens may fall into the vulnerable bracket because of loneliness, isolation, cognitive decline or other issues. Sadly, education has been badly hit by a variety of cuts across local authorities, so trading standards services are focusing resources wherepossible on the most vulnerable consumers in our communities. The CEA believes that, with a little support, it can get consumer messages out through local networks and, hopefully, reduce customer detriment in key areas. Consumer empowerment is a term often used to mean that customers are confident in making decisions. The CEA wants to encourage and enable consumers to make the best decisions for themselves, armed with the best available information and a choice of tools. Our new programme of campaigns aims to do just this. SCAMS AND FR AUD G Scams cost the UK economy more than 52bn a year 1 G Last year, there were an estimated 5.1m incidents of fraud in England and Wales G The number of annual fraud incidents rose by nine per cent in 2014 2 G Older victims are likely to lose nearly twice as much per scam as younger ones 3 G Doorstep crime appears to be targeted at older people 4 G Almost a third of older people who responded to scams may have lost 1,000 or more 5 The older end of the spectrum A staggering 85 per cent of scam victims are over the age of 65, according to a survey conducted by the National Trading Standards National Task Group in England and Wales. Social isolation, cognitive impairment, digital exclusion, bereavement and financial pressures can all make older people more vulnerable to scams. There were more than half a million people aged 90 and over living in the UK in 2014, and it is estimated that 60 per cent of the over-65s do not have Wi-Fi in their homes. So how do we get key consumer messages to those people? Long gone are the days when trading standards had enough resources to reach out to every Womens Institute, older peoples forum and parish council meeting. However, we can still use these networks and encourage people to keep an eye on their neighbours wellbeing. One of the biggest issues that affects this age group is scams which is why one of our campaigns will link in with Scams Awareness Month. It is estimated that scams cost the UK economy more than 52bn a year, and that older victims are likely to lose nearly twice as much per scam as younger ones. The statistics demonstrate this is an issue with a pressing need to be tackled. We have had an avalanche of support for raising awareness of scams, prevention and intervention in the past two years. The key is to ensure we all head in the same direction and share our resources, to avoid duplicating efforts. Scams are a community issue and need to be dealt with by all of us. There is strong evidence to suggest fraudsters deliberately target older people whose circumstances can make them vulnerable to scams, such as those living alone, often with savings and access to cash. Changes to pensions, introduced in April 2015, have exacerbated the situation, giving people the freedom to gain quicker access to their pension pots, increasing the likelihood of attracting scammers. The effects of scams on older people can be devastating not just financially, but physically and psychologically too. Some victims become isolated from their families and friends, lose self-confidence and develop extreme anxiety. SCAM VICTIMS Surveys conducted by the National Trading Standards National Task Group in England and Wales, among victims newly identified since January 2014, found that: 85 59 were aged 65+ were aged 75+ 62 40 lived alone were lonely % % 63 % % had a physical impairment 35 % % had a longstanding illness 43 15 % % a sensory impairment a mental health condition 33 24 % % had concerns about their memory had experienced bereavement in the previous two years 14 % a cognitive impairment 9 % were known to be repeat victims Tackling scams The CEA is working in partnership with the National Trading Standards Scams Team to host a conference on scams. This will be held in Cardiff on 22-23 March, and attendees will learn about what works and what doesnt, as well as how a significant impact can be made in this area to protect consumers. The CEA will also be launching a campaign in June or July for Scams Awareness Month. We aim to push this down to local communities, in a similar way to the award-winning Good neighbours stop rogue traders campaign. We want to focus on preventing scams, particularly doorstep crime, by encouraging neighbours, family, friends and carers to look out for those most at risk in their communities. The campaign will aim to share key messages, take away the shame and get people talking about scams, to protect the most vulnerable in our society. Young people Prevention is far cheaper than cure. Educating consumers at a young age may help reduce the prevalence of scams, and other such dangers in consumer affairs. If we educate people at school age we can get themon a savvy customer path. We can ensure that they are able to: make wise decisions when buying goods or services; avoiding falling victim to ascam; manage their finances effectively and have the confidence to shop around. The CEA supports existing initiatives that target young people, suchas Young Consumers of the Year and the Consumer Challenge Quiz (CCQ), organised by CTSI. Though these are key initiatives, we need to develop our approach and, where possible, place less reliance on local authorities and their limited resources. We are trying to devise new ways to deliver these programmes to reach more young people with our important message, and are working tirelessly to reinvigorate other initiatives. One of the obvious ways to reach young people is to make use of social media. Within the next few months, the CEA will launch a Twitter page, through which we can promote key messages directly to young people, as well as to schools and representatives in contact with young people. We have already produced two advice leaflets. The first, Mabel and her labels, is about fancy-dress costume labels and is targeted at parents of young consumers. The other, Henry and his hover, concerns safety when using hoverboards. This year, we will be launching similar campaigns based on real issues that occur in an average family of consumers. How to buy event tickets safely will probably be the focus of our March campaign. Protecting customers and communities is at the heart of the CEAs new programme of campaigns. Creating a safety net to catch the most vulnerable people at risk in consumer affairs is not only an important part of trading standards work, but also the mark of a caring society. References 1 National Fraud Authority, Annual Fraud Indicator, June 2013 2 Ofce for National Statistics, Crime in England and Wales report, October 2015 3 National Fraud Intelligence Bureau, November 2014 4 National Trading Standards Consumer Harm Report 2014-15, October 2015 5 Age UK, Only the tip of the iceberg: Fraud against older people evidence review, April 2015 For more information on the March scams conference, membership or to see how you can contribute to wider consumer empowerment, contact Felicity Broder. C ONSUMER EMPOWERMENT ALLIANCE (CEA) The CEA is launching a new programme of campaigns, but it cannot succeed without the support of local trading standards and communities. If you are interested in joining the CEA for 75 per year, members receive: G Annual training and conferences, featuring topical issues, that are free or at a reduced cost for members G Priority access to campaign and promotional material G Access to a wide range of stakeholders and information from other organisations G The opportunity to exchange opinions and ideas on successful delivery of consumer information and education across the country, giving a cost-effective service for members authorities G Opportunities to influence consumer and business education, campaigns and policy by working in partnership with other stakeholders Credits Louise Baxter is a CTSI lead officer for consumer advice, and chairman of the Consumer Empowerment Alliance. Images: SaferTim / Shutterstock To share this page, in the toolbar click on You might also like Academic research article, Home alone, page 24 of TS Review, February 2016