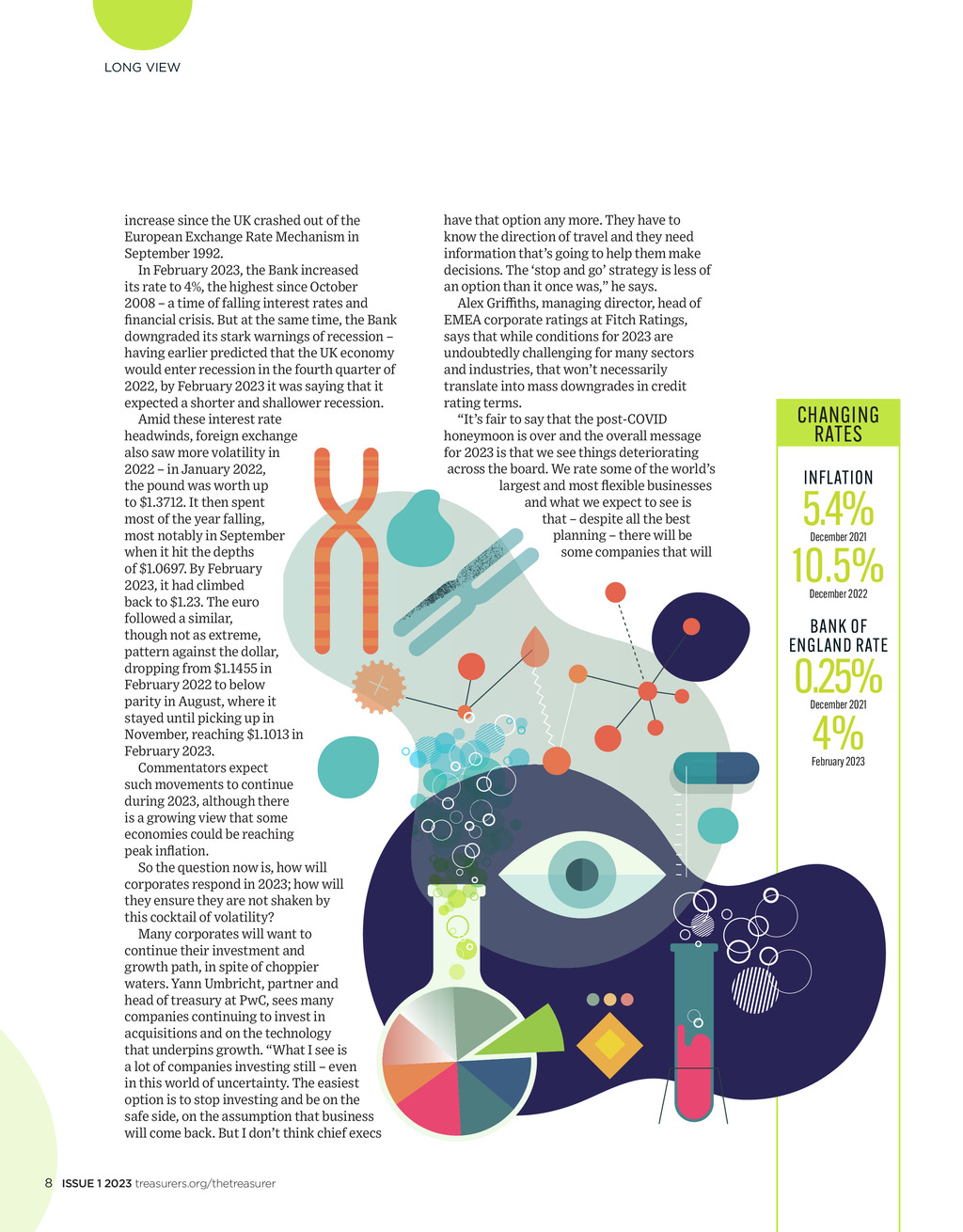

LONG VIEW increase since the UK crashed out of the European Exchange Rate Mechanism in September 1992. In February 2023, the Bank increased its rate to 4%, the highest since October 2008 a time of falling interest rates and financial crisis. But at the same time, the Bank downgraded its stark warnings of recession having earlier predicted that the UK economy would enter recession in the fourth quarter of 2022, by February 2023 it was saying that it expected a shorter and shallower recession. Amid these interest rate headwinds, foreign exchange also saw more volatility in 2022 in January 2022, the pound was worth up to $1.3712. It then spent most of the year falling, most notably in September when it hit the depths of $1.0697. By February 2023, it had climbed back to $1.23. The euro followed a similar, though not as extreme, pattern against the dollar, dropping from $1.1455 in February 2022 to below parity in August, where it stayed until picking up in November, reaching $1.1013 in February 2023. Commentators expect such movements to continue during 2023, although there is a growing view that some economies could be reaching peak inflation. So the question now is, how will corporates respond in 2023; how will they ensure they are not shaken by this cocktail of volatility? Many corporates will want to continue their investment and growth path, in spite of choppier waters. Yann Umbricht, partner and head of treasury at PwC, sees many companies continuing to invest in acquisitions and on the technology that underpins growth. What I see is a lot of companies investing still even in this world of uncertainty. The easiest option is to stop investing and be on the safe side, on the assumption that business will come back. But I dont think chief execs have that option any more. They have to know the direction of travel and they need information thats going to help them make decisions. The stop and go strategy is less of an option than it once was, he says. Alex Griffiths, managing director, head of EMEA corporate ratings at Fitch Ratings, says that while conditions for 2023 are undoubtedly challenging for many sectors and industries, that wont necessarily translate into mass downgrades in credit rating terms. Its fair to say that the post-COVID honeymoon is over and the overall message for 2023 is that we see things deteriorating across the board. We rate some of the worlds largest and most flexible businesses and what we expect to see is that despite all the best planning there will be some companies that will CHANGING RATES INFLATION 5.4% 10.5% December 2021 December 2022 BANK OF ENGLAND RATE 0.25% 4% December 2021 February 2023 8 ISSUE 1 2023 treasurers.org/thetreasurer TT ISSUE 1 23 pp6-11 cover feature.indd 8 23/02/2023 09:03