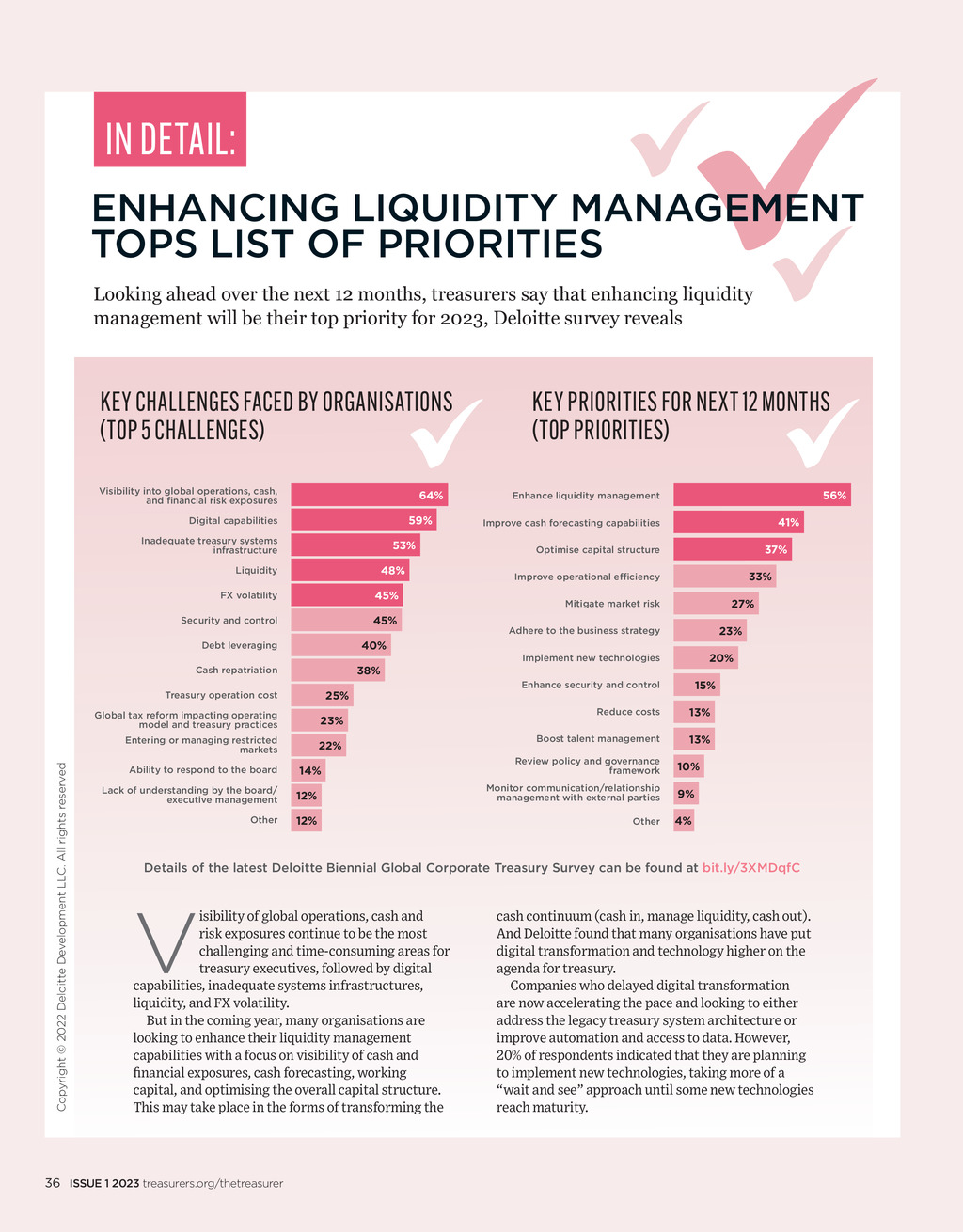

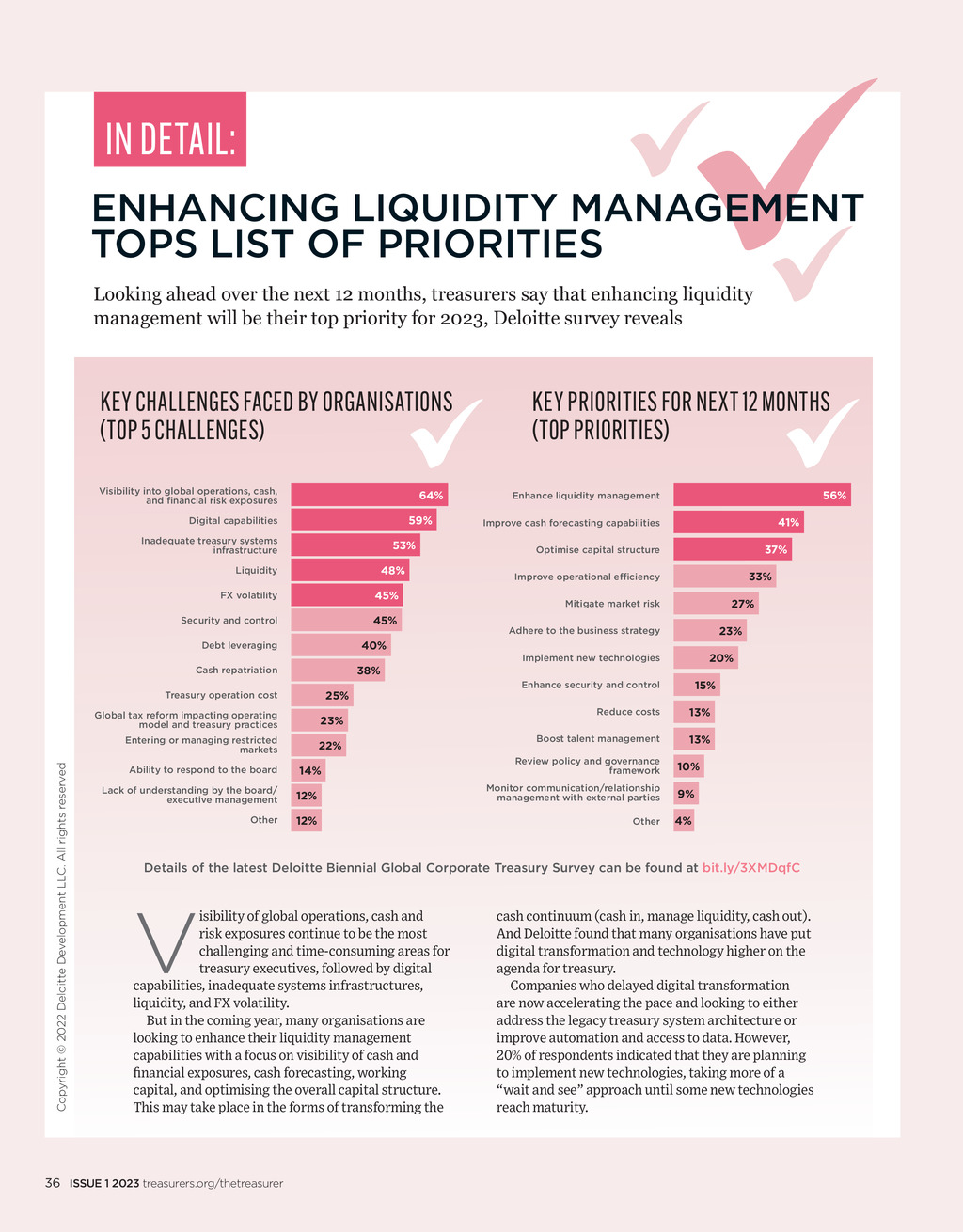

IN DETAIL: ENHANCING LIQUIDITY MANAGEMENT TOPS LIST OF PRIORITIES Looking ahead over the next 12 months, treasurers say that enhancing liquidity management will be their top priority for 2023, Deloitte survey reveals KEY CHALLENGES FACED BY ORGANISATIONS (TOP 5 CHALLENGES) Visibility into global operations, cash, and financial risk exposures 64% 59% Digital capabilities Inadequate treasury systems infrastructure 53% 48% Liquidity FX volatility 45% Security and control 45% 40% Debt leveraging 38% Cash repatriation 25% Copyright 2022 Deloitte Development LLC. All rights reserved Treasury operation cost Global tax reform impacting operating model and treasury practices 23% Entering or managing restricted markets 22% Ability to respond to the board 14% KEY PRIORITIES FOR NEXT 12 MONTHS (TOP PRIORITIES) 56% Enhance liquidity management 41% Improve cash forecasting capabilities 37% Optimise capital structure 33% Improve operational efficiency 27% Mitigate market risk 23% Adhere to the business strategy 20% Implement new technologies 15% Enhance security and control Reduce costs 13% Boost talent management 13% Review policy and governance framework 10% Lack of understanding by the board/ executive management 12% Monitor communication/relationship management with external parties 9% Other 12% Other 4% Details of the latest Deloitte Biennial Global Corporate Treasury Survey can be found at bit.ly/3XMDqfC V isibility of global operations, cash and risk exposures continue to be the most challenging and time-consuming areas for treasury executives, followed by digital capabilities, inadequate systems infrastructures, liquidity, and FX volatility. But in the coming year, many organisations are looking to enhance their liquidity management capabilities with a focus on visibility of cash and financial exposures, cash forecasting, working capital, and optimising the overall capital structure. This may take place in the forms of transforming the cash continuum (cash in, manage liquidity, cash out). And Deloitte found that many organisations have put digital transformation and technology higher on the agenda for treasury. Companies who delayed digital transformation are now accelerating the pace and looking to either address the legacy treasury system architecture or improve automation and access to data. However, 20% of respondents indicated that they are planning to implement new technologies, taking more of a wait and see approach until some new technologies reach maturity. 36 ISSUE 1 2023 treasurers.org/thetreasurer TT ISSUE 1 23 pp36 infographic.indd 36 23/02/2023 09:42