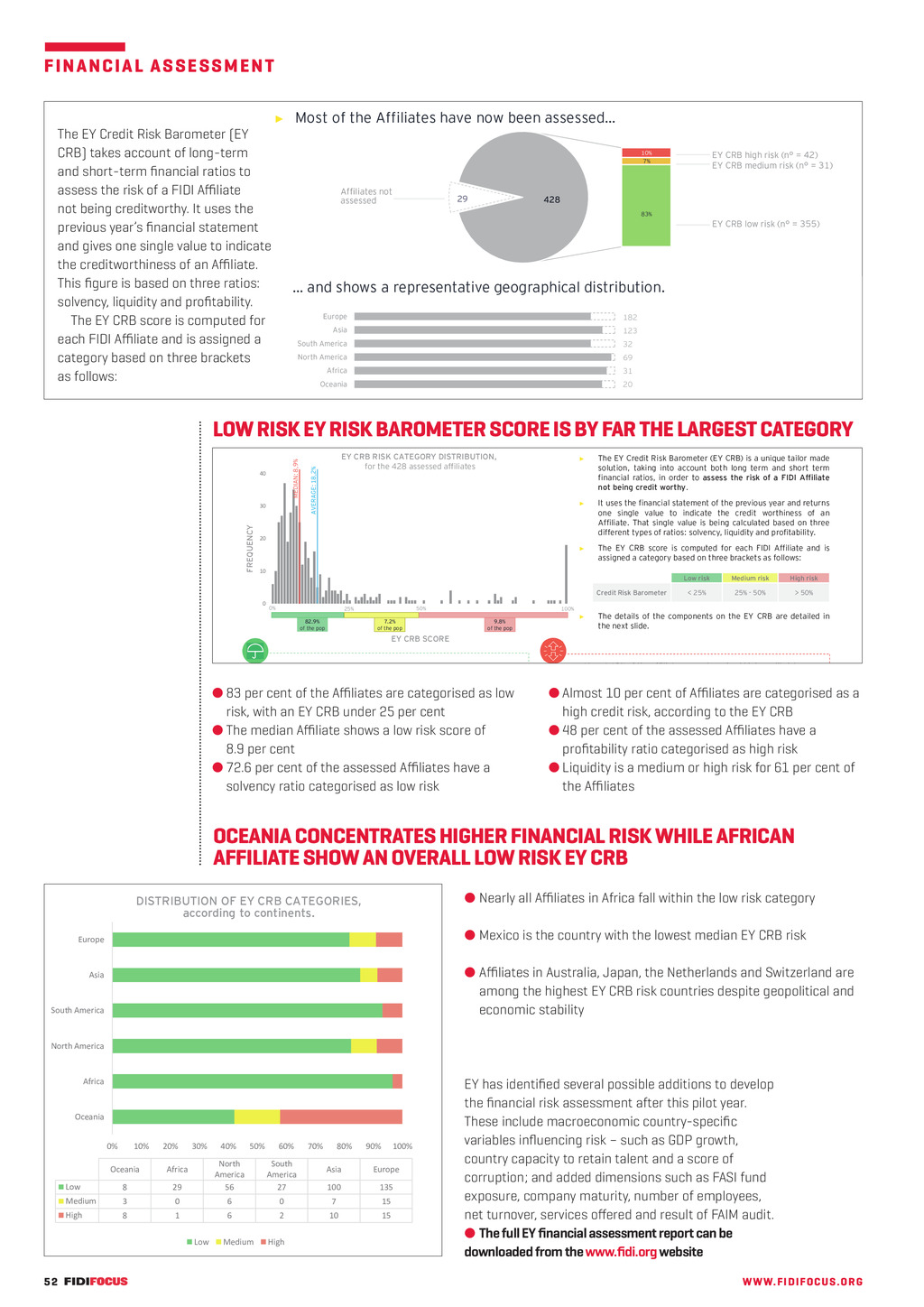

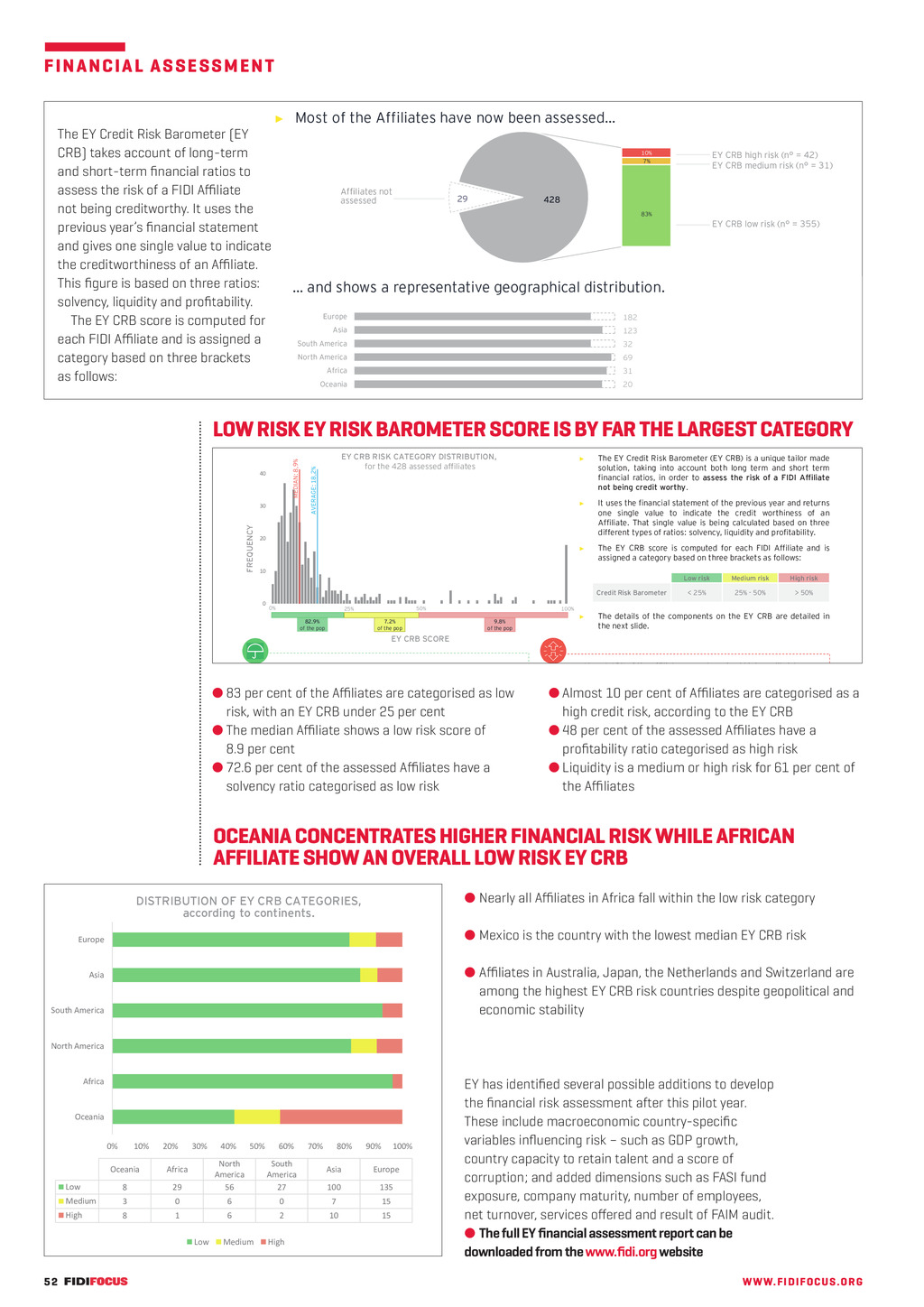

F IN A N C I A L ASSESSMENTMost affiliates have shared their financial statements for assessment The EY Credit Risk Barometer (EY CRB) takes account of long-term and short-term financial ratios to assess the risk of a FIDI Affiliate not being creditworthy. It uses the previous years financial statement and gives one single value to indicate the creditworthiness of an Affiliate. This figure is based on three ratios: solvency, liquidity and profitability. The EY CRB score is computed for each FIDI Affiliate and is assigned a category based on three brackets as follows: Most of the Affiliates have now been assessed EY CRB high risk (n = 42) EY CRB medium risk (n = 31) 10% 7% Affiliates not assessed 29 428 83% EY CRB low risk (n = 355) and shows a representative geographical distribution. Europe 182 Asia 123 South America 32 North America 69 Africa 31 Oceania 20 FIDI Affiliates footprint Low risk EY Credit Risk Barometer score is by far the largest category LOW RISK EY RISK BAROMETER SCORE IS BY FAR THE LARGEST CATEGORY 40 FREQUENCY 30 EY CRB RISK CATEGORY DISTRIBUTION, for the 428 assessed affiliates AVERAGE: 18,2% MEDIAN: 8,9% Page 3 The EY Credit Risk Barometer (EY CRB) is a unique tailor made solution, taking into account both long term and short term financial ratios, in order to assess the risk of a FIDI Affiliate not being credit worthy. It uses the financial statement of the previous year and returns one single value to indicate the credit worthiness of an Affiliate. That single value is being calculated based on three different types of ratios: solvency, liquidity and profitability. The EY CRB score is computed for each FIDI Affiliate and is assigned a category based on three brackets as follows: 20 10 Credit Risk Barometer 0 0% 50% 25% 82.9% of the pop 100% 7.2% of the pop 9.8% of the pop Low risk Medium risk High risk < 25% 25% - 50% > 50% The details of the components on the EY CRB are detailed in the next slide. EY CRB SCORE 83% of the affiliates are categorized as low risk, with an EY CRB under 25%. The median Affiliate shows a low risk score of 8,9%. 72,6% of the assessed affiliates have a solvency ratio categorized as low risk (more details on the slide on ratios). 83 per cent of the Affiliates are categorised as low risk, with an EY CRB under 25 per cent The median Affiliate shows a low risk score of 8.9 per cent 72.6 per cent of the assessed Affiliates have a solvency ratio categorised as low risk Page 4 Almost 10% of the affiliates are categorized high credit risk according to the EY CRB. 48% of the assessed affiliates have a profitability ratio categorized as high risk (more details on the slide on ratios). Liquidity is a medium or high risk for 61% of the affiliates (more details on the slide on ratios). Almost 10 per cent of Affiliates are categorised as a high credit risk, according to the EY CRB 48 per cent of the assessed Affiliates have a profitability ratio categorised as high risk Liquidity is a medium or high risk for 61 per cent of the Affiliates Oceania concentrates higher financial risk while African affiliates show an overall low risk EY CRB CONCENTRATES HIGHER FINANCIAL RISK WHILE AFRICAN OCEANIA AFFILIATE SHOW AN OVERALL LOW RISK EY CRB Nearly all Affiliates in Africa fall within the low risk category DISTRIBUTION OF EY CRB CATEGORIES, according to continents. Nearly all affiliates in Africa fall within the low risk category. is the country with the lowest median EY risk CRB risk. Mexico isMexico the country with the lowest median EY CRB Europe Affiliates in Australia, Japan, the Netherlands and Switzerland are among the highest EY CRB risk countries despite geopolitical and economic stability Asia South America 50% of Australias affiliates have been assessed as high risk. Affiliates in Netherlands, Switzerland and Japan are among the highest EY CRB risk countries despite geopolitical and economic stability. EY has identifi ed several possible additions to develop North America Africa Oceania 0% 10% 20% 30% 40% Oceania Africa Low 8 29 North America 56 Medium 3 0 6 High 8 1 6 Low 50% Medium 60% South America 27 70% 80% 90% 100% Asia Europe 100 135 0 7 15 2 10 15 High the financial risk assessment after this pilot year. These include macroeconomic country-specific 1 GDP growth, variables such as LOWEST in EY uencing CRB RISKrisk COUNTRIES HIGHEST EY CRB RISK COUNTRIES1 country capacity talent and a score of(n reports) Country (n reports) to retain EY CRB Median Country EY CRB Median corruption; such Australia as FASI(12) fund Mexico (10) and added dimensions 4,3% 51,9% Brazil (6) company maturity, 5,2%number ofNew Zealand (7) 22,6% exposure, employees, Ireland (6) 5,2% Japan (9) 18,4% net turnover, services offered and result of FAIM audit. Pakistan (5) 5,8% Switzerland (12) 17,6% Spain The(8) full EY financial assessment reportNetherlands can be (22) 6,6% 15,4% downloaded from the4www.fi di.org website among countries with minimum reports available 1 52 Page 7 FF298 AugSept20 pp50-53 EY.indd 52 WW W. F I D I FOC U S . OR G 21/07/2020 11:41