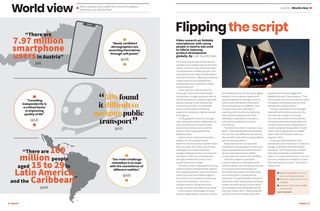

Austria World view Flipping the script Video research on foldable smartphones with young people in Austria was used to inform Samsung product development globally. By Liam Kay-McClean For anyone over the age of 30, flip phones are likely to be a positive memory from their relative youth, but a relic of the recent past. The phones were incredibly popular in the early 2000s, but the onset of the BlackBerry and then the iPhone effectively ended their market superiority and heralded their disappearance from mainstream mobile phone production. That is until 2021, with the launch of Samsungs Z Flip3 and Z Fold3 foldable smartphones. Younger consumers had not had the experience of using the original flip phones, however, so Samsung wanted to know how the return of the foldable phone, married with the processing power of a smartphone, might be received by this group. To help gauge the reactions of younger users, Samsungs Austrian insights team set up its own pop-up community among Austrian Gen Z phone users to test the potential mass market appeal of the foldable phones. Austrias phone market posed another problem for Samsung that helped determine why its local team wanted to form the community: the company was facing a challenge to its audience share from younger challenger brands, such as Huawei and Xiaomi, while it was simultaneously aiming to overtake the countrys most popular phone brand, Apple. We have a certain challenge with a young audience. We are tackling that with research and marketing activities, says Florian Bauer, head of consumer and market insights (IT and mobile communications) at Samsung Austria and Switzerland. We are in a sandwich position. We see that across Europe, and that is the reality we are facing. A 2021 product trial provided 10 young Austrians, aged between 16 and 24, with the new foldable phones. The aim was to gather feedback on the customer experience of using foldable phones through a series of video diaries, starting with unboxing the phone and leading on to different micro moments over a two-week period capturing small moments during the day when the phone played a role in their wellbeing or happiness, for example, as well as demonstrating how it fared in everyday use. We didnt know how it would land, says Bauer. There were foldable devices before this one, but it was difficult to estimate how they would be received by a young audience and the wider population. Researchers learned a lot about the expectations of young people in Austria, but also found apprehension towards the new devices, particularly because of their unusual style and concerns over durability. In the diary research covering the customer experience of foldable phones, Austrian triallists use of the devices was able to counteract most of the doubts and barriers the participants had before using and receiving them. For example, the enjoyment of using the fold/flip element of the phones while creating videos and taking photos overrode practical concerns about how a foldable screen would fare over the short and medium term. What we learned was that, over the two weeks, there were powerful moments and triggers that delighted the users, Bauer explains. They had durability concerns, and concerns about the features of the devices, and we could alleviate and counteract those. The team understood which messages resonated with the phone users and why, and what was missing in Samsungs communications about the new phones. The results were widely shared within the company at its European headquarters in London and global headquarters in South Korea. The findings fed into an updated Flip4 model of the phones, which was released in 2022. It was very well received from the business because we had such rich data and footage, as [triallists] filmed themselves, says Bauer. The findings were consistent with what we had seen and heard from others, so it made intuitive sense. It was nice, as it was a small piece of research in Austria that made its way to London that doesnt happen a lot. Apple has a 44.33% share of the Austrian mobile phone market Samsungs market share in Austria is 33.41% Huawei has 7.7%, Xiaomi 6.15% and others 3% Source: Statcounter 9 Impact ISSUE 42 2023_pp9 WV Austria.indd 9 16/06/2023 16:52