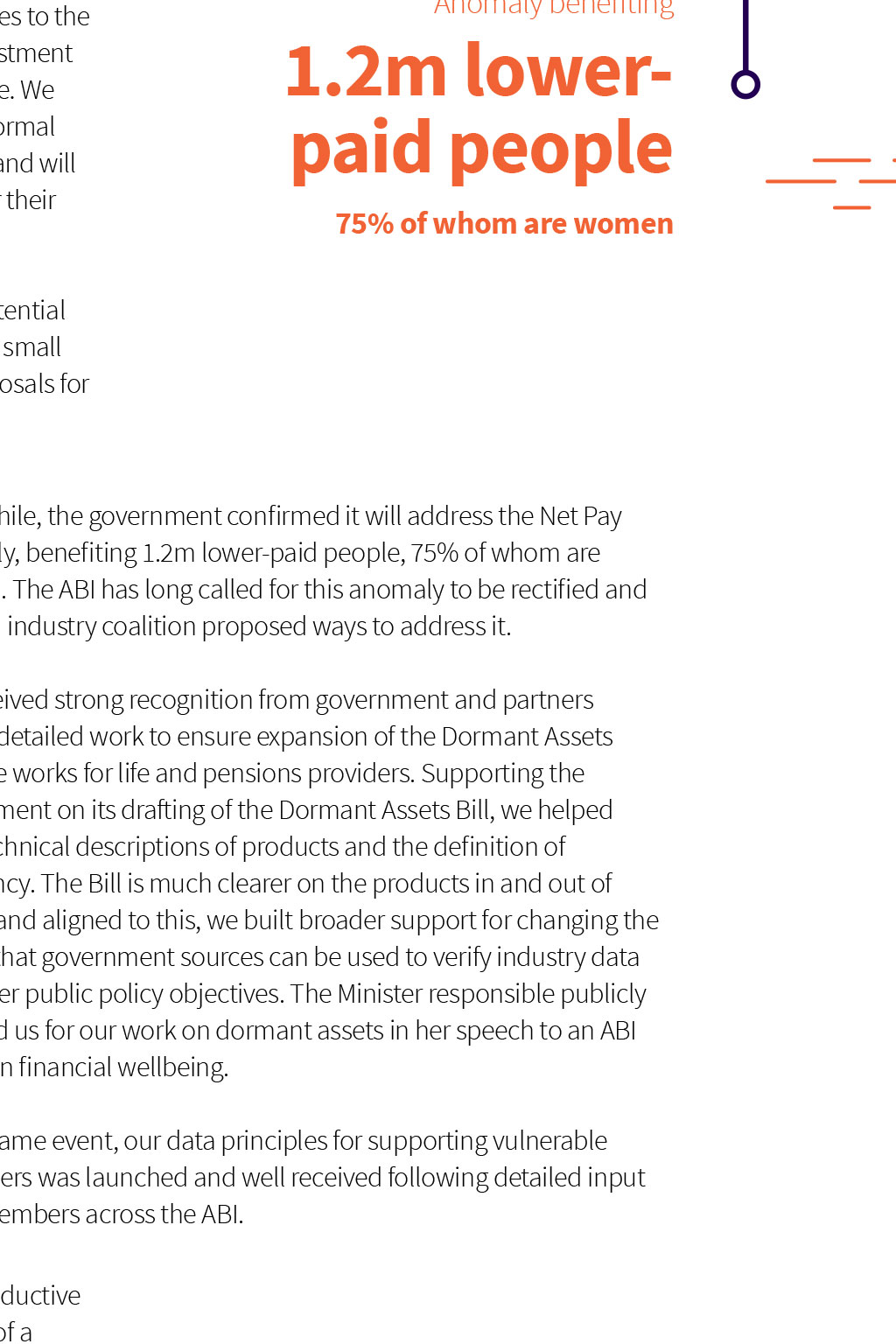

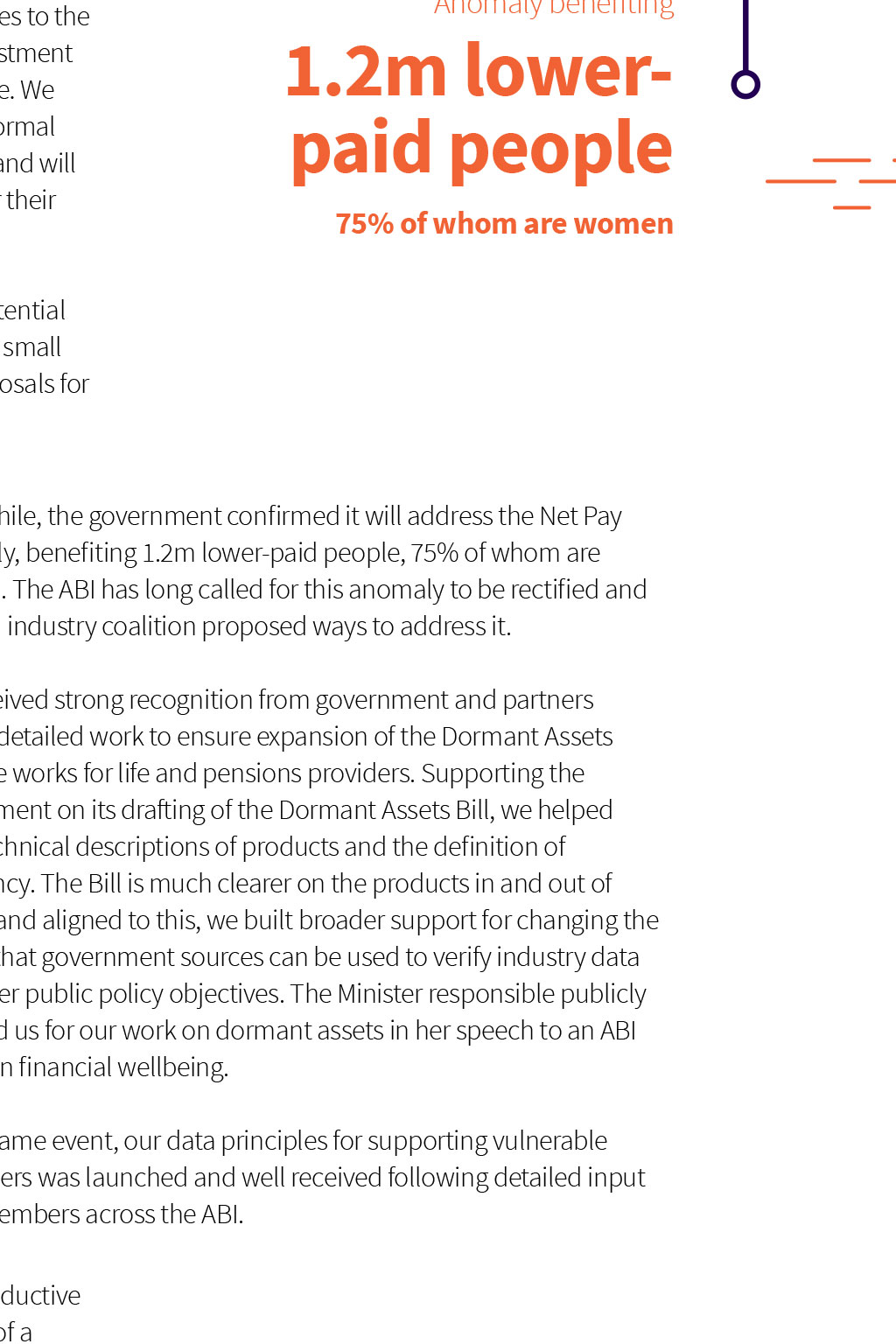

Long-term savings Helping savers make important decisions In 2021, the ABI won the case to include multiple pensions dashboards in new legislation. This was just one of our successes for long-term savers This year we saw the benefits of the ABIs intervention in landmark litigation on the role of the court in Part VII insurance business transfers, the outcome of which provided important legal clarity and certainty to the process for insurers and their customers. We took part in the appeal in 2020 to explain the wider consequences for both customers and businesses if a range of speculative discretionary factors could override the view of independent experts and regulators that a transfer can proceed without any detriment to consumers. The outcome of the appeal late last year has led and will continue to lead to good outcomes for customers by enabling companies who specialise in certain products to look after those customers. We received strong recognition from government and partners for our detailed work to ensure expansion of the Dormant Assets Scheme works for life and pensions providers Working closely with government and the Pensions Dashboards Programme in support of the Pension Schemes Act 2021, we helped to ensure that all pension schemes make data available to consumers via dashboards. We lobbied throughout the Bill process, winning the case for multiple dashboards in a regulated environment, with the government overturning amendments that would delay and restrict dashboards, and committing to proposals to authorise and regulate them. We were also involved in debate about the presentation of Estimated Retirement Income figures. We built a strong evidence base to back our industrys position before the legislation is consulted upon, including commissioning research and conducting interviews with key stakeholders to inform our vision for dashboards. Responding to the groundbreaking provisions on climate risk in the Act, we raised our profile on ESG in pensions, sponsoring the Pensions Policy Institutes research series on ESG, showcasing the research and speaking at its launch. We published industry insights on supporting customers to make decisions about pension withdrawals, and the need for changes to the advice/guidance boundary; and released unique data on investment pathways, cited by the FCA and Work and Pensions Committee. We led calls for the government to simplify its plans to raise the normal minimum pensions age, with our concerns picked up widely. Preparatory work means we are well poised for activity on potential major issues in 2022: intensive industry-wide engagement on small pots, member feedback on MiFID reform and analysis of proposals for social care funding reform. Successful lobbying on Pensions Dashboards means that customers will be able to access their data in a safe way through modern means The government confirmed it will address the Net Pay Anomaly benefiting 1.2m lowerpaid people 75% of whom are women Meanwhile, the government confirmed it will address the Net Pay Anomaly, benefiting 1.2m lower-paid people, 75% of whom are women. The ABI has long called for this anomaly to be rectified and a broad industry coalition proposed ways to address it. We have campaigned for greater clarity around changes to the national minimum pension age to ensure savers can plan for their retirement with certainty. We received strong recognition from government and partners for our detailed work to ensure expansion of the Dormant Assets Scheme works for life and pensions providers. Supporting the government on its drafting of the Dormant Assets Bill, we helped with technical descriptions of products and the definition of dormancy. The Bill is much clearer on the products in and out of scope, and aligned to this, we built broader support for changing the law so that government sources can be used to verify industry data to deliver public policy objectives. The Minister responsible publicly thanked us for our work on dormant assets in her speech to an ABI event on financial wellbeing. At the same event, our data principles for supporting vulnerable customers was launched and well received following detailed input from members across the ABI. We are also involved in several cross-industry projects, on productive finance, small pots, cost and charge disclosure, and the idea of a statement season. We successfully lobbied for a more practical and customer-orientated outcome to the proposals for Simpler Annual Benefit Statements final regulations are more flexible on content and the implementation date gives more time for industry to deliver changes that work well for customers.