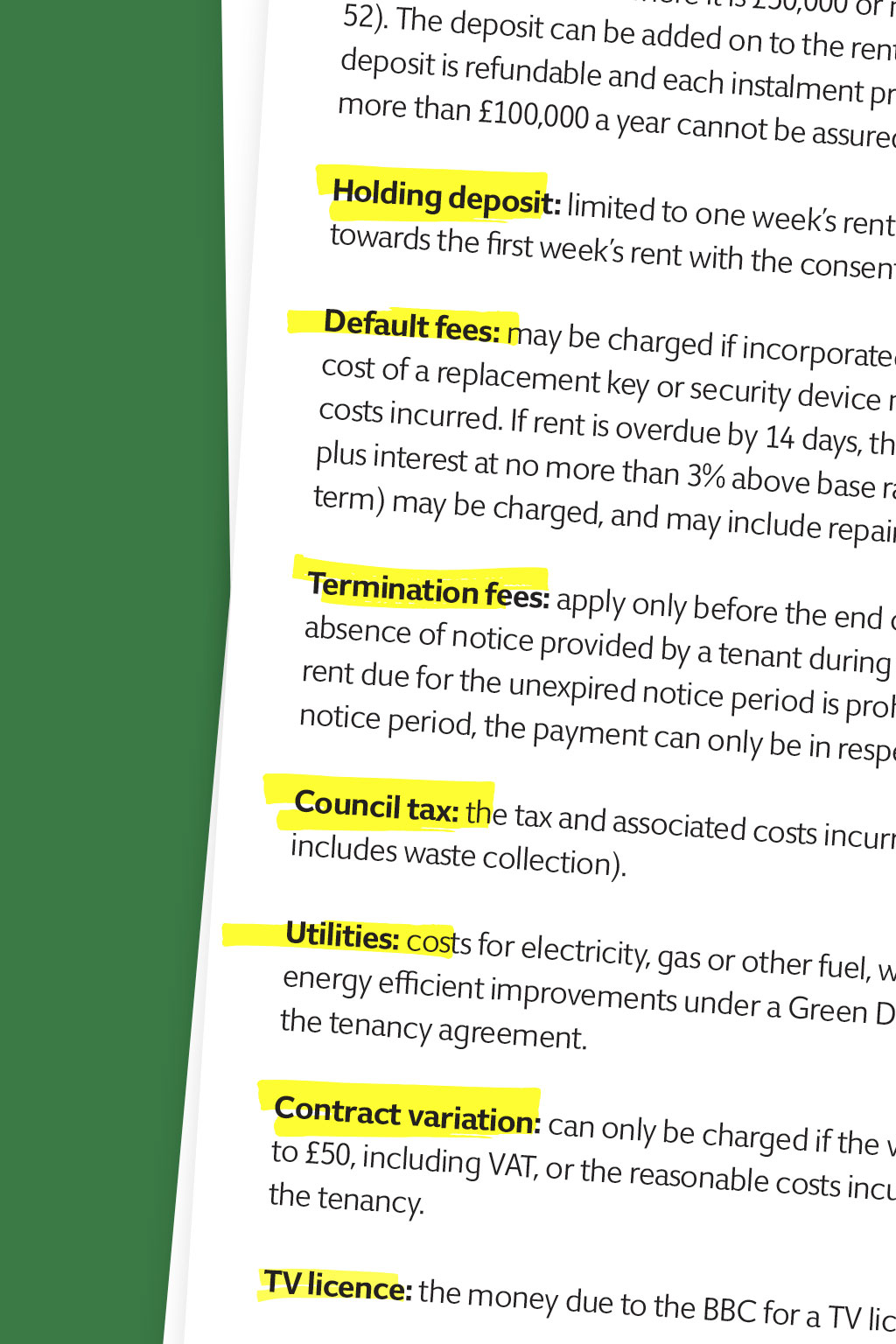

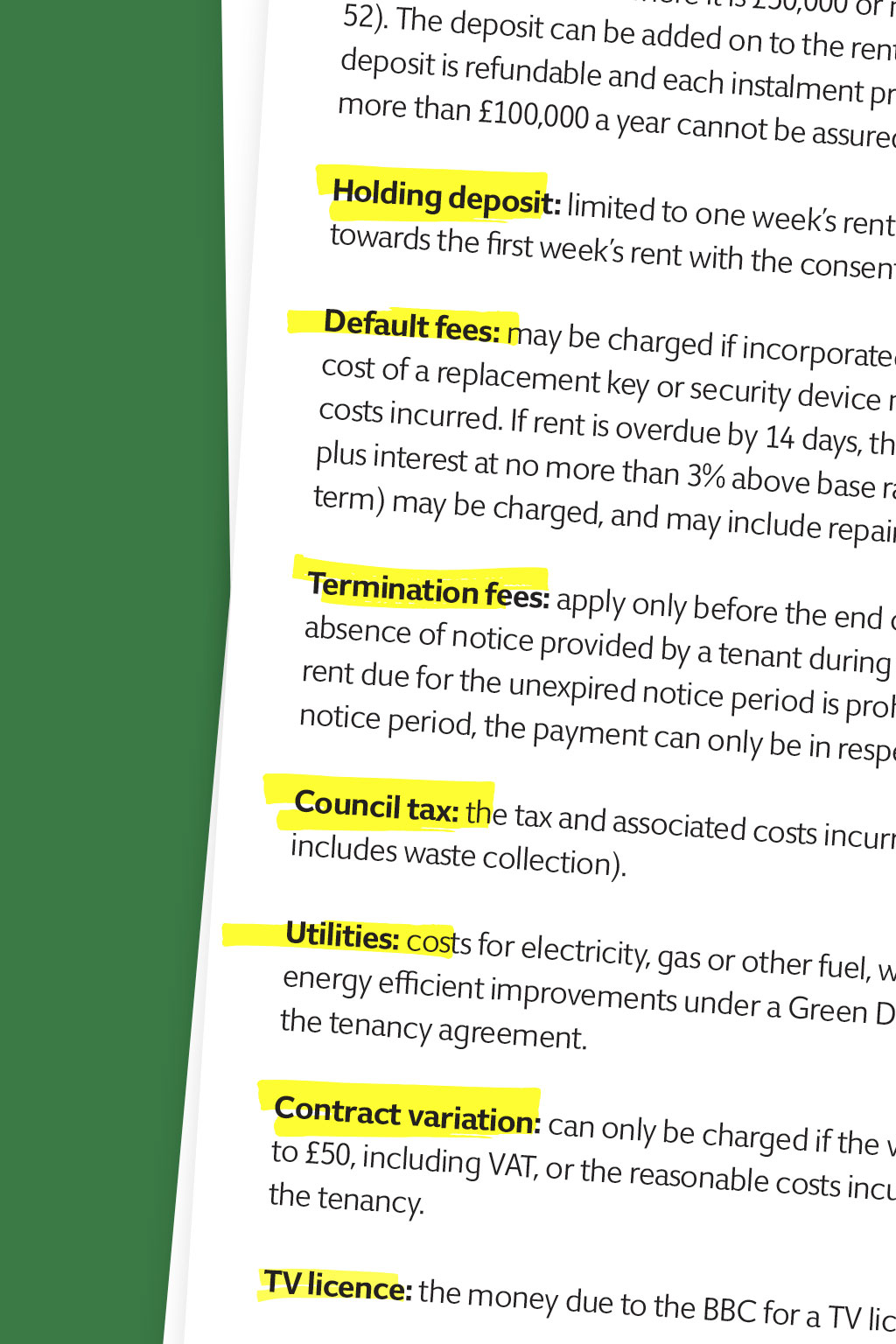

SPRING 2020 LETTINGS FEES Fees-ability study TO LET In June, the Tenant Fees Act will apply to all assured shorthold tenancies, so landlords and property managers should gen up on the rules Rent payments must be in equal instalments; you cannot charge more in some months for example, during term time The Tenant Fees Act 2019 was introduced so tenants would know exactly what they were expected to pay for a property and when and to ensure they would not incur additional costs or hidden charges. If you are engaged in lettings agency or property management work (with the exception of registered social landlords or fully mutual housing associations), you must under the act publish all your permitted fees at your business premises and on your website. This includes third-party websites, such as portals. You are not allowed to charge tenants for credit referencing before a tenancy, professional cleaning, check-in, inventory checks or personal references. The permitted fees are: Rent: payments must be in equal instalments; you cannot charge more in some months – for example, during term time. Any differences are prohibited payments unless agreed by the tenant after the tenancy agreement is in effect. Tenancy deposit: limited to five weeks’ rent where the annual rental income is less than £50,000, and to six weeks’ rent where it is £50,000 or more (one week’s rent is the annual rent divided by 52). The deposit can be added on to the rent in regular instalments, but it must be clear that the deposit is refundable and each instalment protected in a scheme. Properties for which the rent is more than £100,000 a year cannot be assured shorthold tenancies, so are exempt from the act. Holding deposit: limited to one week’s rent before the start of the tenancy, and can be offset towards the first week’s rent with the consent of the tenant. Default fees: may be charged if incorporated into the tenancy agreement. The reasonable cost of a replacement key or security device may be charged with supporting evidence of the costs incurred. If rent is overdue by 14 days, the reasonable costs of recovery may be charged, plus interest at no more than 3% above base rate. Damages for a breach of tenancy (contractual term) may be charged, and may include repair costs if the tenant has damaged the property. Termination fees: apply only before the end of the assured shorthold tenancy or in the absence of notice provided by a tenant during a periodic tenancy. Any amount in excess of the rent due for the unexpired notice period is prohibited. If the property can be re-let during the notice period, the payment can only be in respect of rent actually lost. Council tax: the tax and associated costs incurred by the billing authority is permitted (this often includes waste collection). Utilities: costs for electricity, gas or other fuel, water and sewerage, and sums required for energy efficient improvements under a Green Deal plan may be charged, if incorporated into the tenancy agreement. Contract variation: can only be charged if the variation is at the tenant’s request, and is limited to £50, including VAT, or the reasonable costs incurred in varying, assigning or novation of the tenancy. TV licence: the money due to the BBC for a TV licence. Any charge in excess of this is prohibited. Communication services: costs for a landline telephone, internet connection, or cable or satellite television, for example, may be charged if they are incorporated into the tenancy agreement. Lettings agents or property management firms must be a member of one of the two approved redress schemes The Property Ombudsman and the Property Redress Scheme. In addition, if you hold client money, you must have indemnity to cover all of the money held. You must display a certificate of membership at your premises and on your website (including third-party sites), and supply a free copy of the certificate to tenants on demand. If you rent out property on an assured shorthold tenancy that started after 6 April 2007, your tenants deposit must be placed in a government-backed tenancy deposit protection (TDP) scheme. These ensure tenants get their deposit back if they meet the terms of the tenancy agreement, dont damage the property, and pay the rent and bills. Credit: Alison Farrar National Trading Standards Estate & Letting Agency Team Image: iStock / jallfree / olegback / Cheremuha / bgblue / ioanmasay A tenants deposit must be placed in a scheme within 30 days of you receiving it. If you add the deposit in small increments, on top of the rent, each payment must be put into the scheme. Valuable items, such as a car or watch, that are used as a deposit instead of money do not have to be put in a TDP. For further advice and guidance, visit the NTS teams website or contact your local Trading Standards department. The maximum penalties under the Tenants Fees Act 2019 are: n Requiring prohibited payments: 5,000 for a first breach and up to 30,000 or criminal prosecution for a subsequent breach within five years n Non-publication of permitted fees: 5,000 n Non-membership of a redress scheme: 5,000 for lettings and property management. 1,000 fixed penalty and, potentially, a ban from doing estate agency work n Not having client money protection: 30,000 The local policy for issuing penalties will be on each local authoritys website. It will include details on how penalties are set and what circumstances can be taken into account when issuing them. National Trading Standards team Powys County Council, the lead enforcement authority under the Estate Agents Act 1979 (the EAA), runs the National Trading Standards Estate and Letting Agency Team in partnership with Bristol City Council, the lead enforcement authority under the Tenant Fees Act 2019 (the TFA). The teams responsibilities under the EAA include: n Issuing prohibition and warning orders (and keeping a public register of such orders) n Managing and approving the UKs consumer redress schemes n Giving sector-specific advice about the obligations and responsibility of businesses Under the TFA for letting agency work in England, it: n Oversees the implementation of relevant legislation n Issues guidance to enforcement authorities n Gives information and advice to the public about legislation n Discloses information to relevant authorities so they can determine whether a breach of or offence under the legislation has occurred n Advises government on developments in the letting agency sector The team seeks to ensure a consistent approach to enforcement by offering advice, support and guidance to local authorities. By working with stakeholders such as businesses, trade associations and other networks, it also aims to ensure estate agency and letting agency work in the UK is carried out in the best interests of clients and businesses, and that consumers are dealt with honestly and promptly in a fair marketplace. You can contact the NTS Estate and Letting Agency Team by email. Credit: Bob Charnley, Trading Standards consultant For further information, please contact your local Trading Standards Service