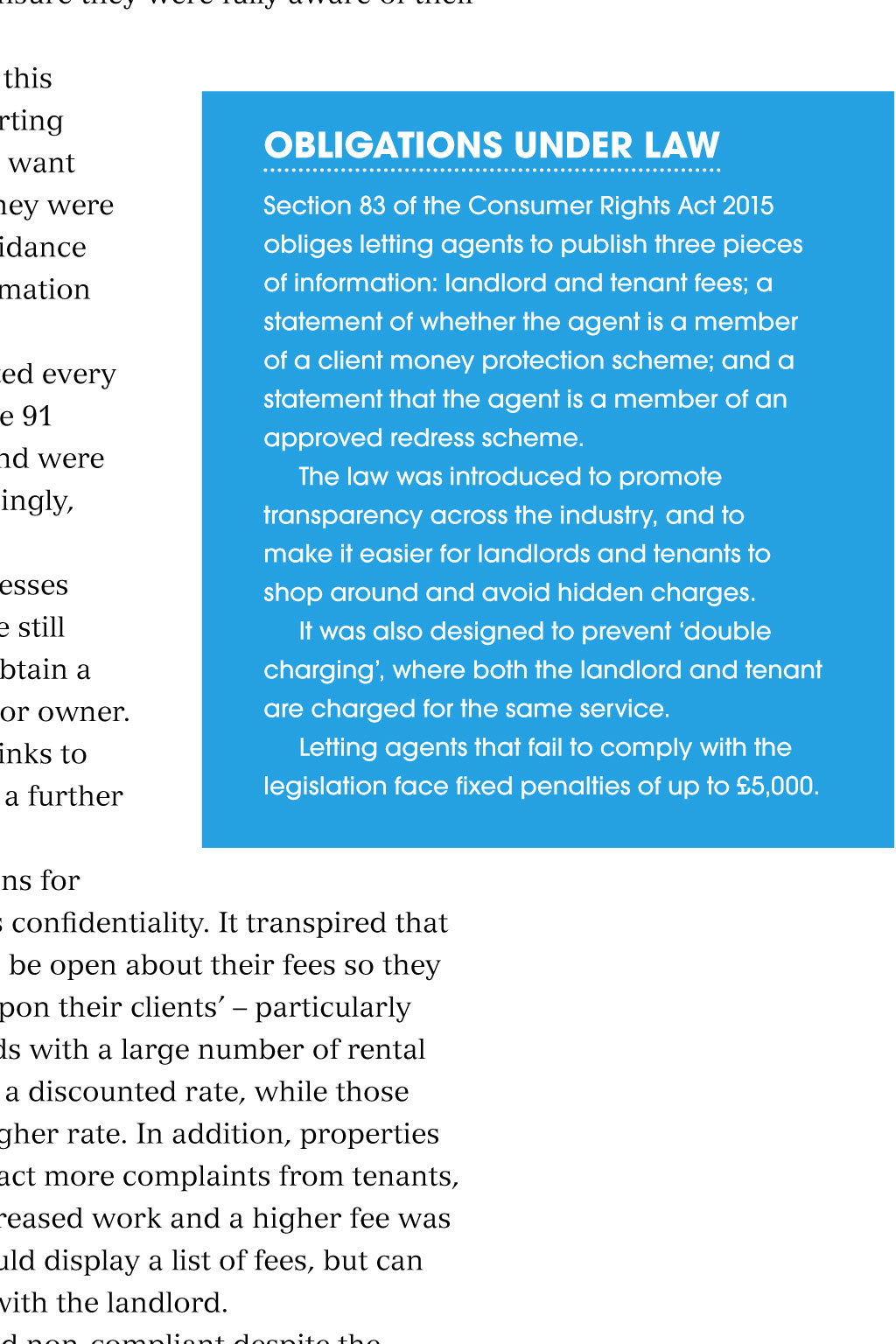

Letting fees campaigns in Milton Keynes and Warwickshire In this feature l consumer rights Act l letting agents l compliance Excuses, lies and letting fees CTSI and The Property Ombudsmans letting fees campaign has moved officers to share their experiences. claire kendall and paul mccabe describe a reluctance to comply with the law in Milton Keynes and Warwickshire I n 2015, the new Consumer Rights Act required all letting agents to publish a list of the fees they charge their clients, typically landlords and tenants. The law was introduced to: promote transparency across the industry; make it easier for landlords and tenants to shop around and avoid hidden charges; and prevent double charging, where both the landlord and tenant are charged for the same service. In two separate strands of work, officers at Milton Keynes and Warwickshire trading standards found high levels of non-compliance and a wide range of excuses after initial searches of agents websites. Ultimately, both teams came to the same conclusion: it was time for a little educational and, if necessary, enforcement action. Compliance requests in Milton Keynes: account by Claire Kendall We found widespread non-compliance on the websites of the 106 agents in our area, so we wrote to all the agents at the end of October 2015, to give them information about the new law. We accompanied thiswith a warning that enforcement action would be taken against those that failed to act on the advice given. In January 2016, we looked again at the agents websites and found that 53 per cent of the companies had acted on our advice. The websites of the remaining aSSESSINg THE OuTCOMES 55 agents gave us cause for concern, because Trading standards officers in Milton Keynes of a lack of information about fees, redress and Warwickshire think the law is very schemes and energy performance certificates reasonable and not too onerous. It allows (EPCs). We carried out a full inspection of landlords and tenants time to shop around, these agents and found that 30 of them were and brings agents into line with most other still non-compliant with the requirements business sectors. of section 83, so we notified them of our Both teams expressed amazement that intention to charge a penalty. rather than comply some businesses chose We would advise other trading standards to wait until a fixed penalty was imposed. officers involved in similar cases to be mindful There has been a positive effect in of the requirement for the amount of the both areas as a result of these projects, with 100 per cent of the agents dealt with penalty and the decision to be reasonable becoming compliant with the legislation. (schedule 9), as these can be used as grounds In Milton Keynes, the legacy of the project for an appeal. is that agents now advise trading standards Agents who chose to appeal against the of any new agents in the area who are not penalty notices we served did, indeed, use compliant. This allows officers to quickly these reasons as the basis for their arguments. identify and educate new businesses, and The tribunal judges involved in our cases ensure that tenants and landlords have were satisfied that we had been reasonable access to all the information they need to both in our approach to the enforcement of make an informed decision about the agent the Act, and in our decisions to determine the they choose. It also ensures that issues are final amount of the penalty for each agent, identified and dealt with before a consumer suffers any detriment. which we could explain logically because we used a matrix that we had developed. The matrix allows us to assess objectively the number and nature of the breaches of section 83, and the willingness of an agent to work with us to become compliant. Each area of compliance earns the agent a discount from the initial 5,000 notice, and this allows us to be consistent in our approach to all the agents. Its a good idea to gather evidence as if you are carrying out a criminal investigation. This proved extremely useful for us, because a significant number of representations contained arguments that we were able to disprove through the evidence we had obtained at the startof the project. One agent even claimed not to have had our advice letter, when they had sent us an email thanking us for it on the day they received it! We also tried to verify any claims made by a company in their representation. We suggested to agents that, if they wished to make a claim for financial hardship, they should supply supporting evidence of this for example, current account statements. Where agents made such a claim but did not offer evidence, we checked their latest accounts where possible by using the Companies House website, for example. If the information did not support their claim, this representation was not taken into account. One agent provided unpaid tax bills as proof of hardship, but no other evidence. A check of their last published accounts showed the company was quite profitable, and these were accepted by the First Tier Tribunal as evidence that the penalty would not cause financial hardship. In the end, only two agents chose to appeal our final decision to the First Tier Tribunal. At the beginning of February 2017, we received confirmation that both appeals had been dismissed, so we are now able to collect the fines from the remaining agents. The fines from this project total around 36,000. Gather evidence as if you are carrying out a criminal investigation. A significant number of representations contained arguments that we were able to disprove through the evidence we had obtained at the start of the project Warwickshires project: account by paul McCabe It transpired that many letting agents preferred not to be open about their fees so they could levy different charges based upon their clients particularly landlords circumstances We also carried out research into compliance with the law by looking atagents websites. The excuses we heard from agents ranged from We didnt know we had to and Nobody else does it, so why should we?, to Its sensitive business information, Our fees are too numerous to list, and perhaps most revealing of all What? Let people know our prices!. Initially, we looked at a sample of 25 agents, but because of the high levels of non-compliance and the excuses given we decided to carry out a much larger survey of Warwickshires letting industry. We identified 91 agents across the county and wrote to every one, giving detailed help and advice, to ensure they were fully aware of their responsibilities under the law. We took an advisory approach to this project because we believe in supporting OBLIgaTIONS uNDEr LaW our local businesses, and we did not want Section 83 of the Consumer Rights Act 2015 tohinder or disrupt their growth. They were obliges letting agents to publish three pieces given plenty of time to act on the guidance of information: landlord and tenant fees; a we sent out, and to display the information statement of whether the agent is a member required by law. of a client money protection scheme; and a After eight months, we re-inspected every statement that the agent is a member of an website and discovered that 58 of the 91 approved redress scheme. businesses had heeded our advice and were The law was introduced to promote fully compliant with the law. Surprisingly, transparency across the industry, and to 33remained non-compliant. make it easier for landlords and tenants to We contacted each of these businesses shop around and avoid hidden charges. by phone to ascertain why they were still It was also designed to prevent double charging, where both the landlord and tenant not complying with the law and to obtain a are charged for the same service. contact email address for a director or owner. Letting agents that fail to comply with the They were then sent an email, with links to legislation face fixed penalties of up to 5,000. advice on how to comply, and given a further month to rectify their websites. One of the more interesting reasons for non-compliance concerned business confidentiality. It transpired that many letting agents preferred not to be open about their fees so they could levy different charges based upon their clients particularly landlords circumstances. Landlords with a large number of rental properties were sometimes charged a discounted rate, while those with a single property attracted a higher rate. In addition, properties in a poorer state of repair could attract more complaints from tenants, so agents would need to take on increased work and a higher fee was levied. Of course, letting agents should display a list of fees, but can offer a discount after a negotiation with the landlord. Of the 33 businesses that remained non-compliant despite the advisory letter, 29 complied after the phone call and email, and updated their websites. Disappointingly, four decided to remain non-compliant and each of these was served with a notice of intent. This gave each business a final 28-day period to comply, after which a fixed penalty of 5,000 would be issued. We chose the maximum deterrent level because we had built in plenty of time and opportunity to comply, and we offered a 50 per cent discount for payment within 14 days. After the 28-day period expired, three businesses had complied, but one had not, so this one was served with a final notice and had to pay the fixed penalty. They took up the discount offer and paid 2,500, so we did not have any appeal and did not need to go to the small claims court to recover the penalty. Credits Images: inerva Studio / Shutterstock Claire Kendall is senior enforcement officer at Milton Keynes Trading Standards, and Paul McCabe is a trading standards officer at Warwickshire Trading Standards. You might also like Fee-display law: agents beware To share this page, in the toolbar click on January2017