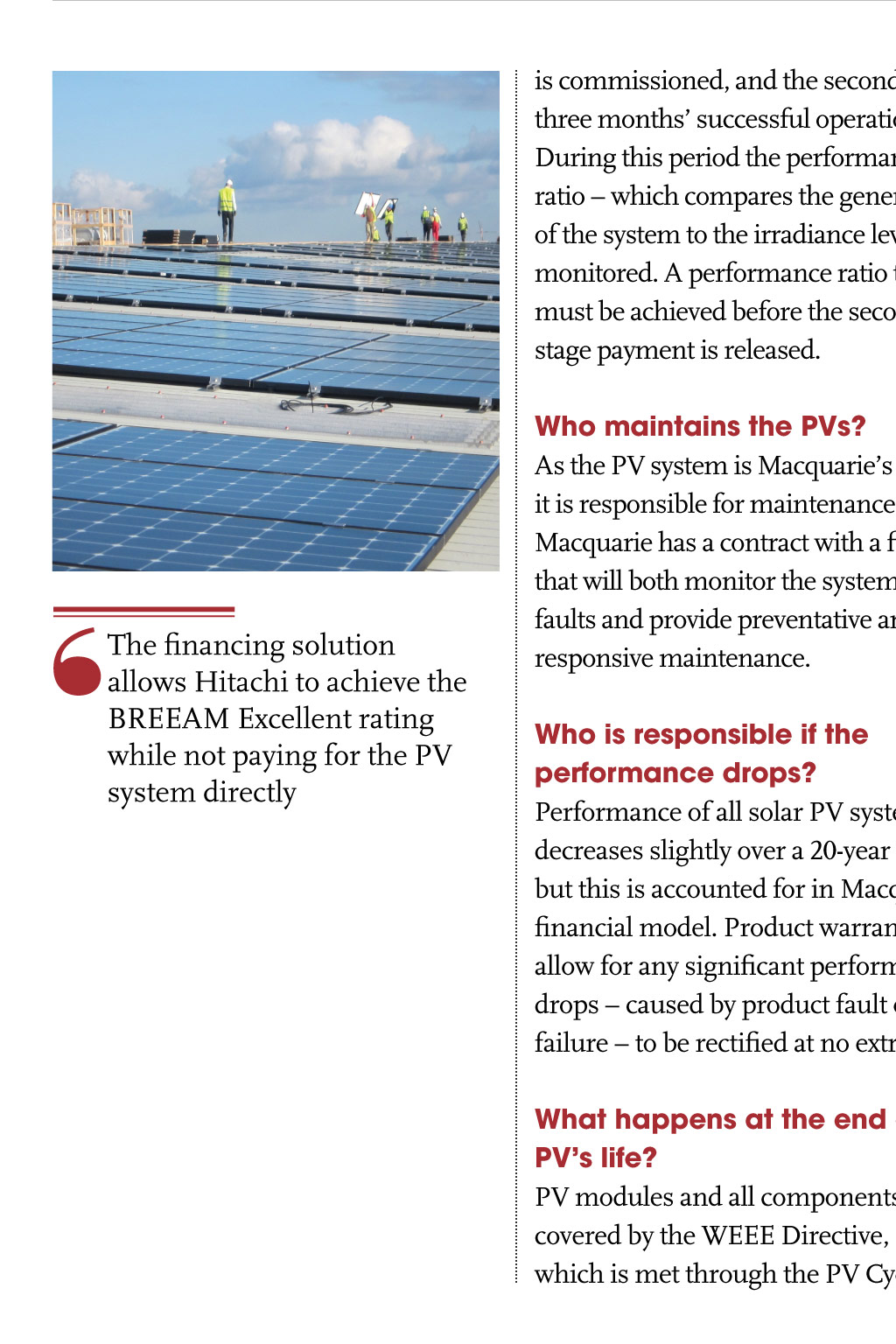

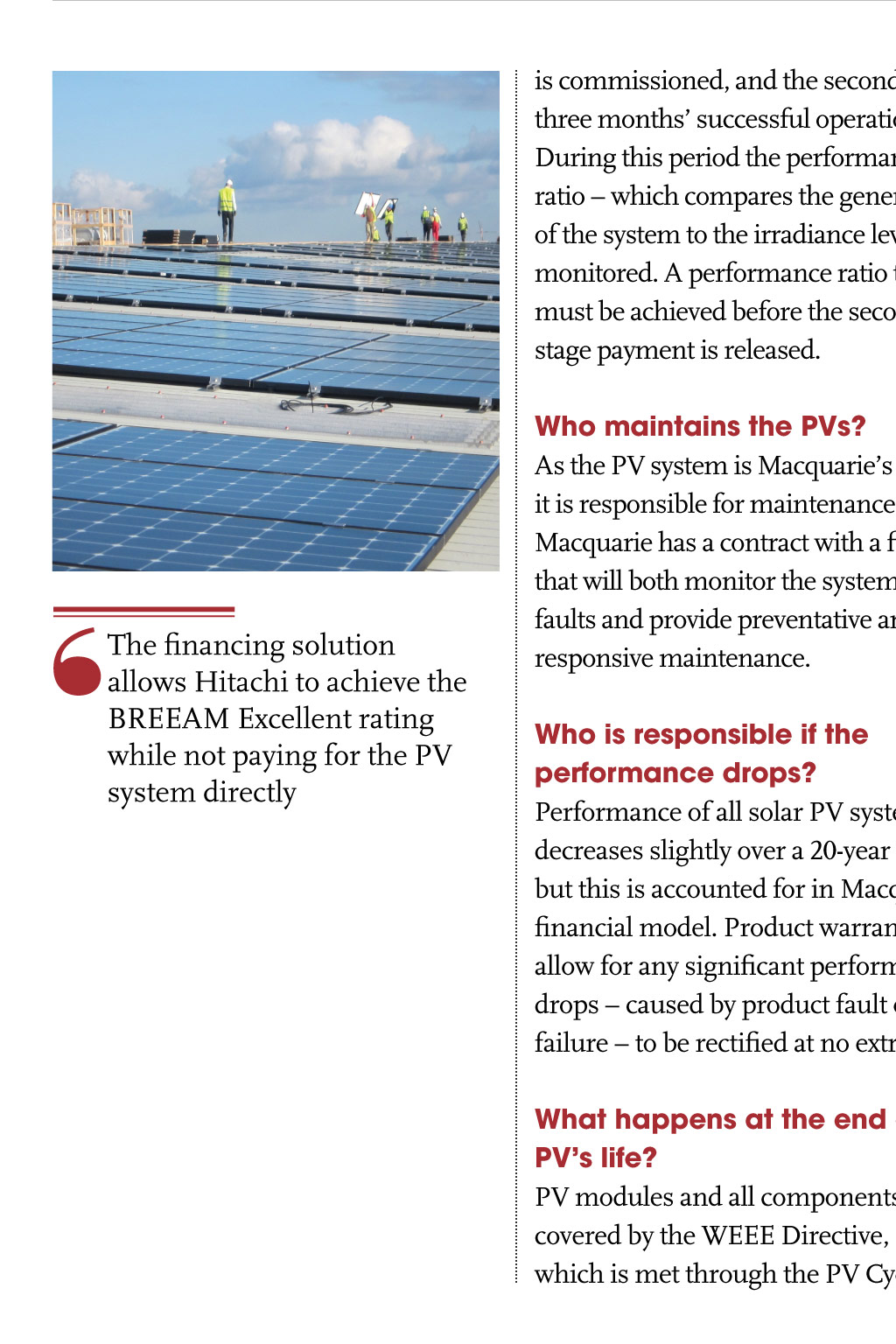

Change agent Jenny Palfreyman plugging into finance hitachis first train-manufacturing plant in Europe features a large PV array costing nearly 1m. Photons Jenny Palfreyman tells CIBSE Journal how technical and financial barriers were overcome H itachi Rail Europes new 82m manufacturing facility in Newton Aycliffe, County Durham, will be used to build new Intercity Express trains for the Great Western and East Coast Main Lines. There was a requirement from the planners to include a 1MW photovoltaic (PV) array on the 44,000m2 building, which potentially meant a high capital cost for Hitachi. Photon Energy, in partnership with Macquarie Lending, were able to come up with a financial package that enabled Hitachi to avoid the large upfront costs. Jenny Palfreyman is a senior engineer at Photon. She explains how it overcame the technical challenges of such a large installation, and discusses the innovative lending model that moves costs out of the capital budget. What were the technical challenges of such a large array? The interaction between the PV mounting system and the roof sheet was critical. There are warranties from the roof manufacturer, Euroclad, and mounting system supplier, K2 Systems, that must be maintained, and it is vital to have agreement on fixing methods from both parties. The roof on this project was very lightweight. Not only did the installed weight of the PV system have to be taken into account, but also that of the modules and mounting system, when they were being loaded onto the roof. Packs and pallets had to be split and loaded onto ply sheets, to spread the weight and avoid any issues with excess point loading. Because of the size of the roof, it was important to reduce both the DC and AC cable runs to minimise system is commissioned, and the second after three months successful operation. During this period the performance ratio which compares the generation of the system to the irradiance level is monitored. A performance ratio target must be achieved before the second stage payment is released. The financing solution allows Hitachi to achieve the BREEAM Excellent rating while not paying for the PV system directly Who maintains the Pvs? As the PV system is Macquaries asset, it is responsible for maintenance. Macquarie has a contract with a firm that will both monitor the system for faults and provide preventative and responsive maintenance. Who is responsible if the performance drops? Performance of all solar PV systems decreases slightly over a 20-year project, but this is accounted for in Macquaries financial model. Product warranties allow for any significant performance drops caused by product fault or failure to be rectified at no extra cost. What happens at the end of the Pvs life? PV modules and all components are covered by the WEEE Directive, which is met through the PV Cycle losses. The system was connected into four low voltage panel boards in the building, enabling us to reduce the length of DC cables coming off the roof. Inverters were installed on top of the internal plant rooms, allowing the AC runs to be short as well. how were the Pvs funded? Macquarie was brought in by Photon when it was clear that Hitachi wanted a funded solution, and it agreed to provide the finance. Photon is one of four UK installers that carry out these types of installations for Macquarie. The cost for this project is just under 1m. Payment is made in two stages, with the first released after the system scheme, ensuring they are fully recyclable at the end of life. The reality of this project is that the ownership of the asset transfers from Macquarie to Hitachi after 20 years, which means the system is expected to be left operational for at least 40 years. Will the Photon funding model be employed again? Yes, Macquarie has an initial tranche of 50m to be spent on this model and, if successful, the fund is likely to be increased. Photon is actively seeking other clients interested in a financed PV system and low-cost solar electricity. Would hitachi have gone ahead with the Pv option without the financing? The PV system was required as part of the planning conditions for the building. However, Hitachi also wanted to achieve BREEAM excellence, which the financing solution allows it to do without paying for the PV system directly. Instead Hitachi pays a discounted rate of about 6p/kWh for the solar electricity, which it commits to buying for 20 years under a Power Purchase Agreement. After that, ownership of the PV system reverts to Hitachi.