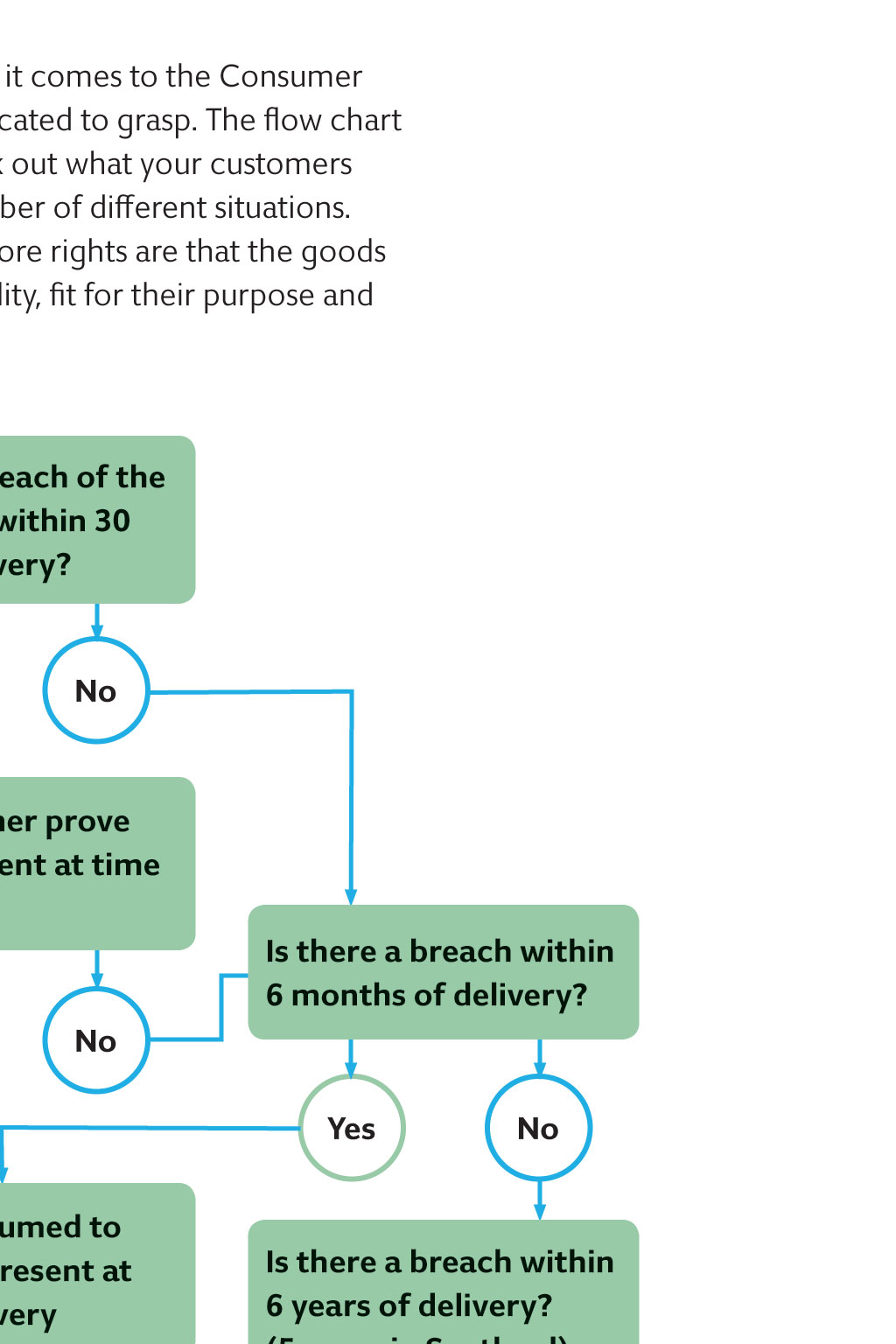

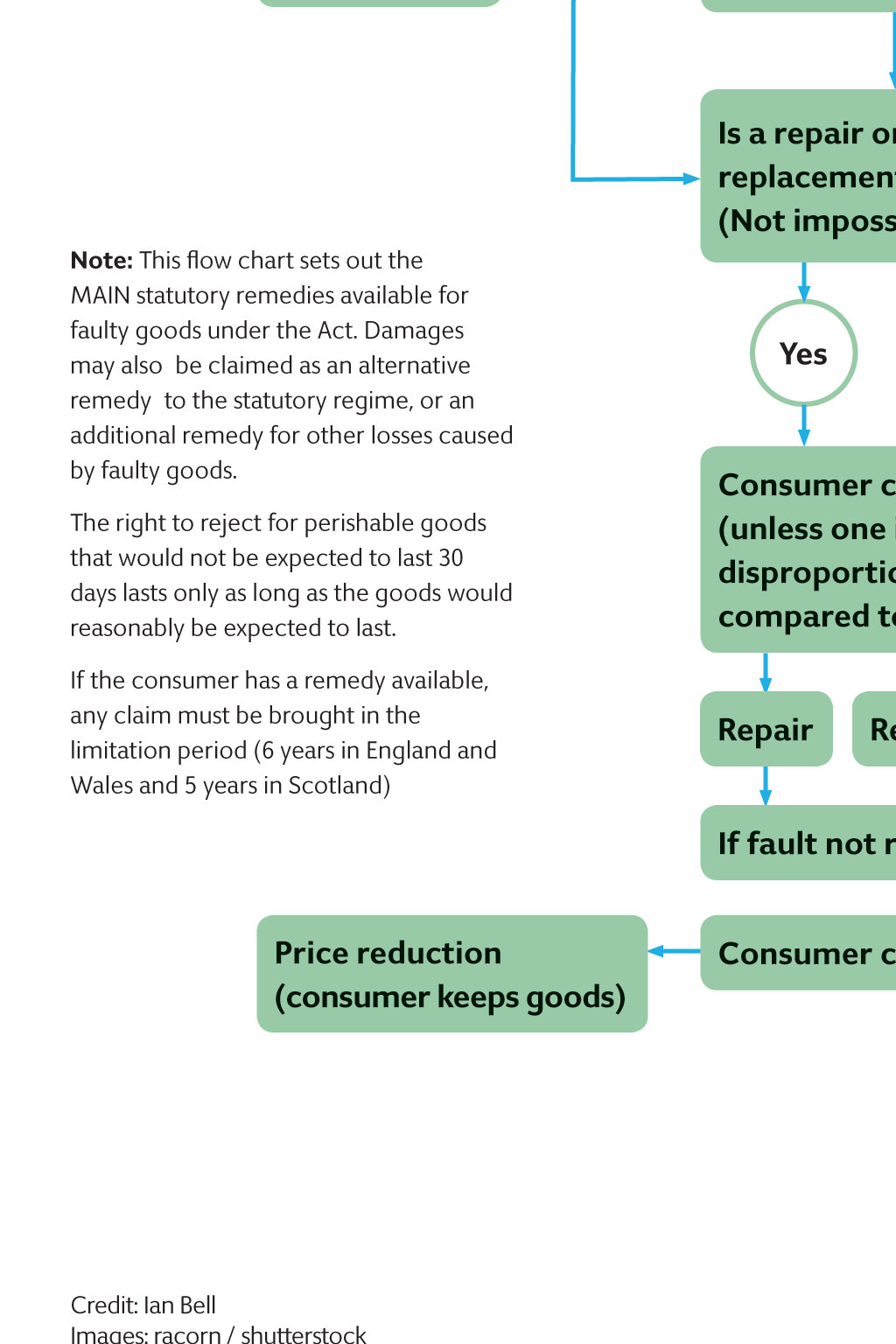

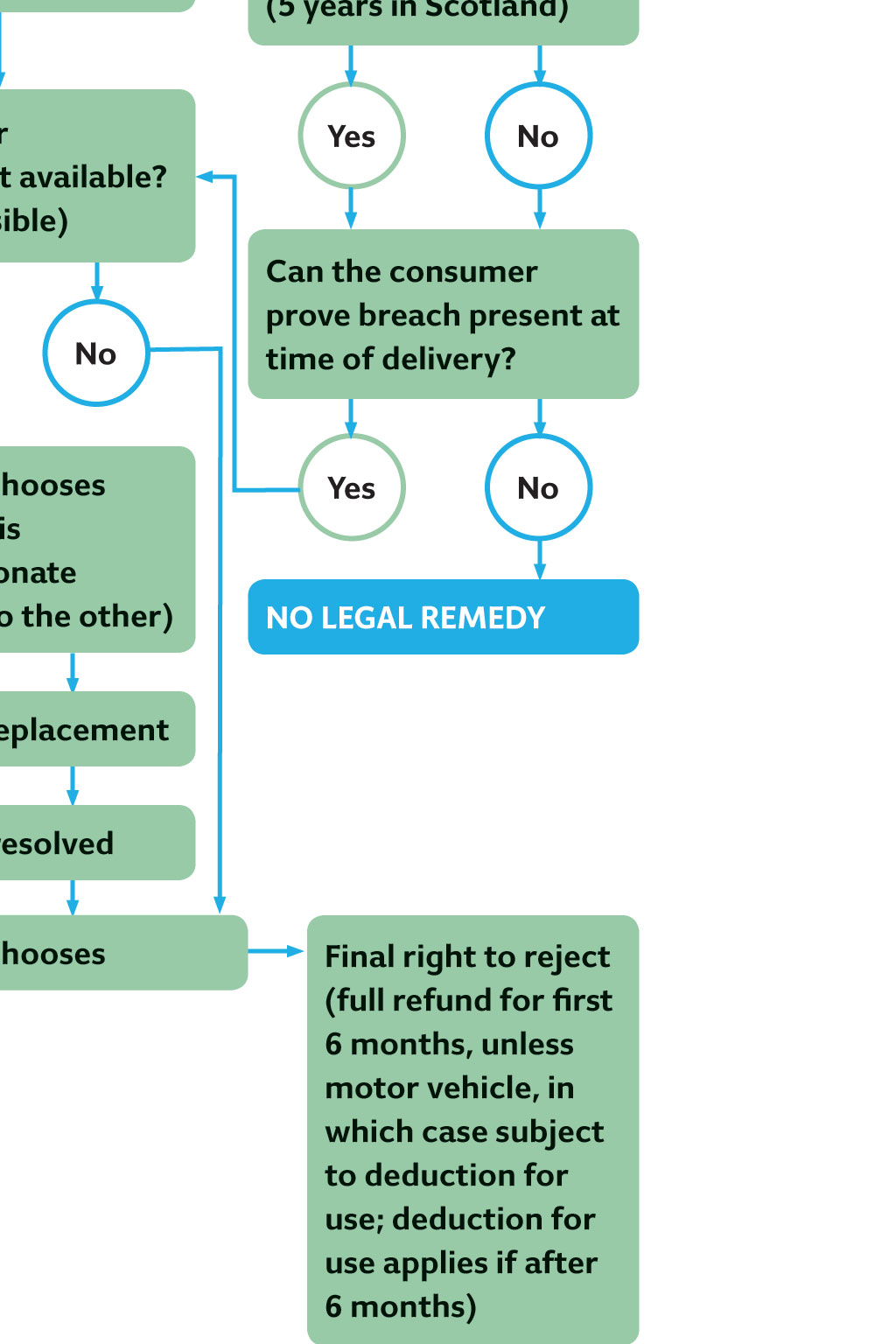

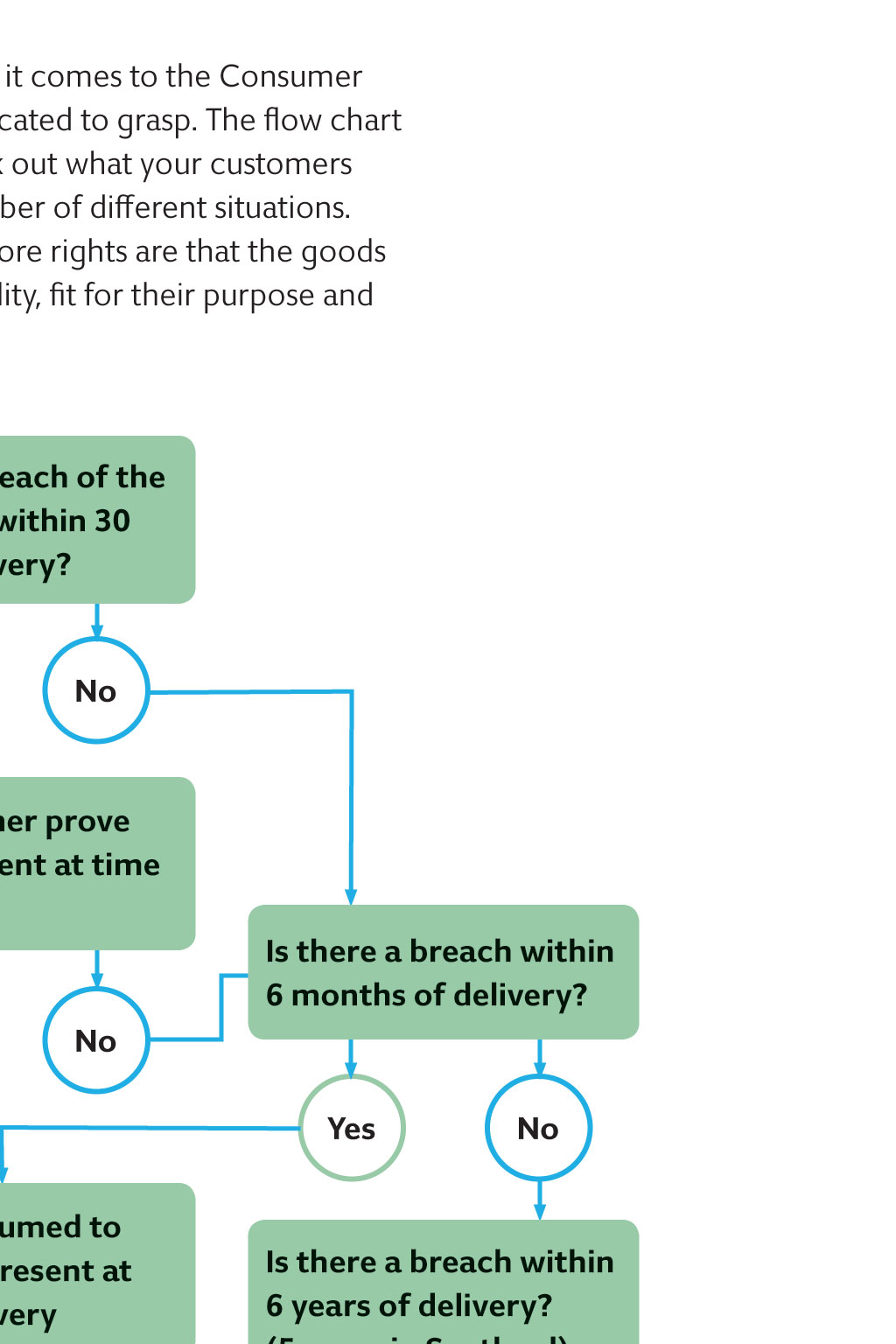

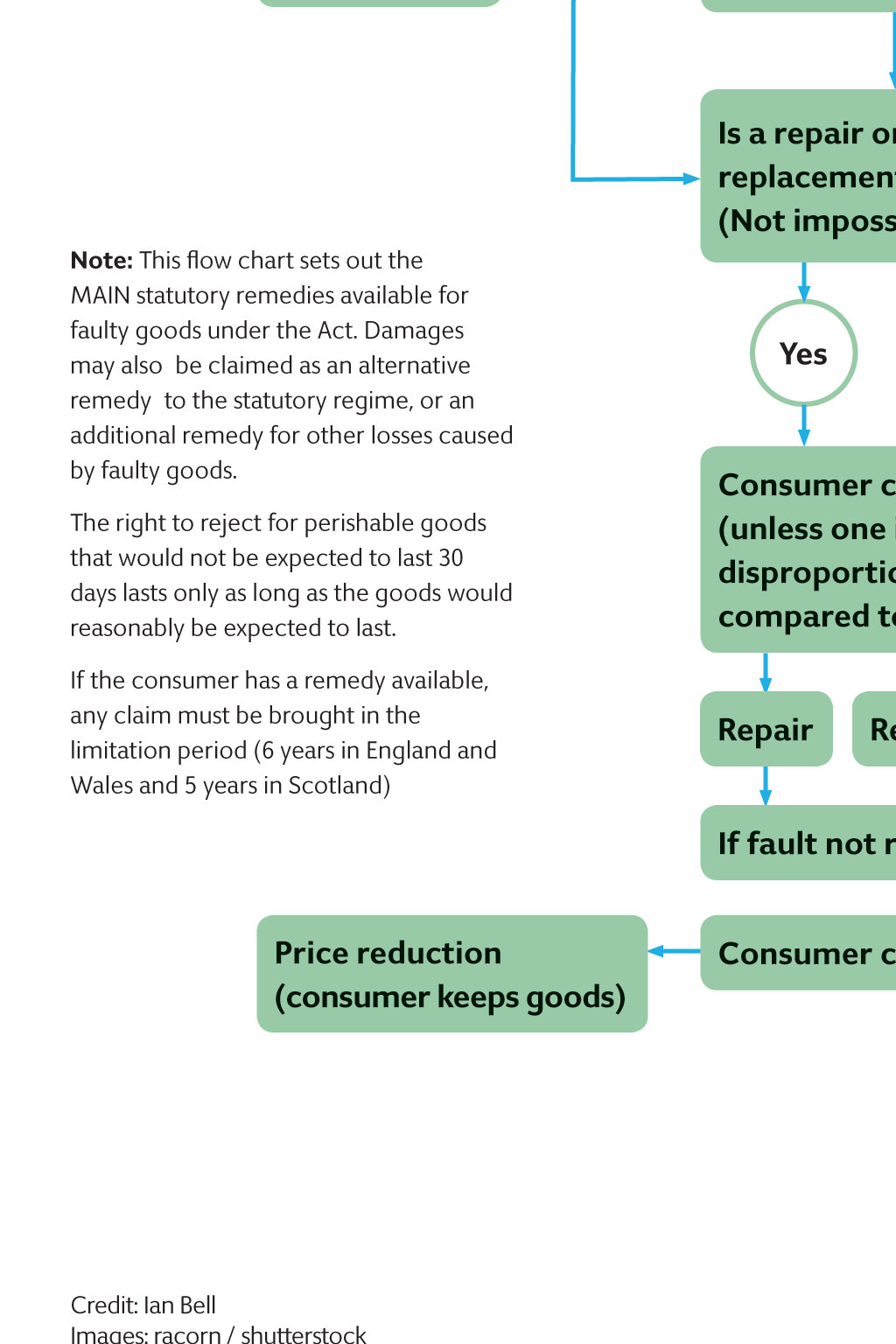

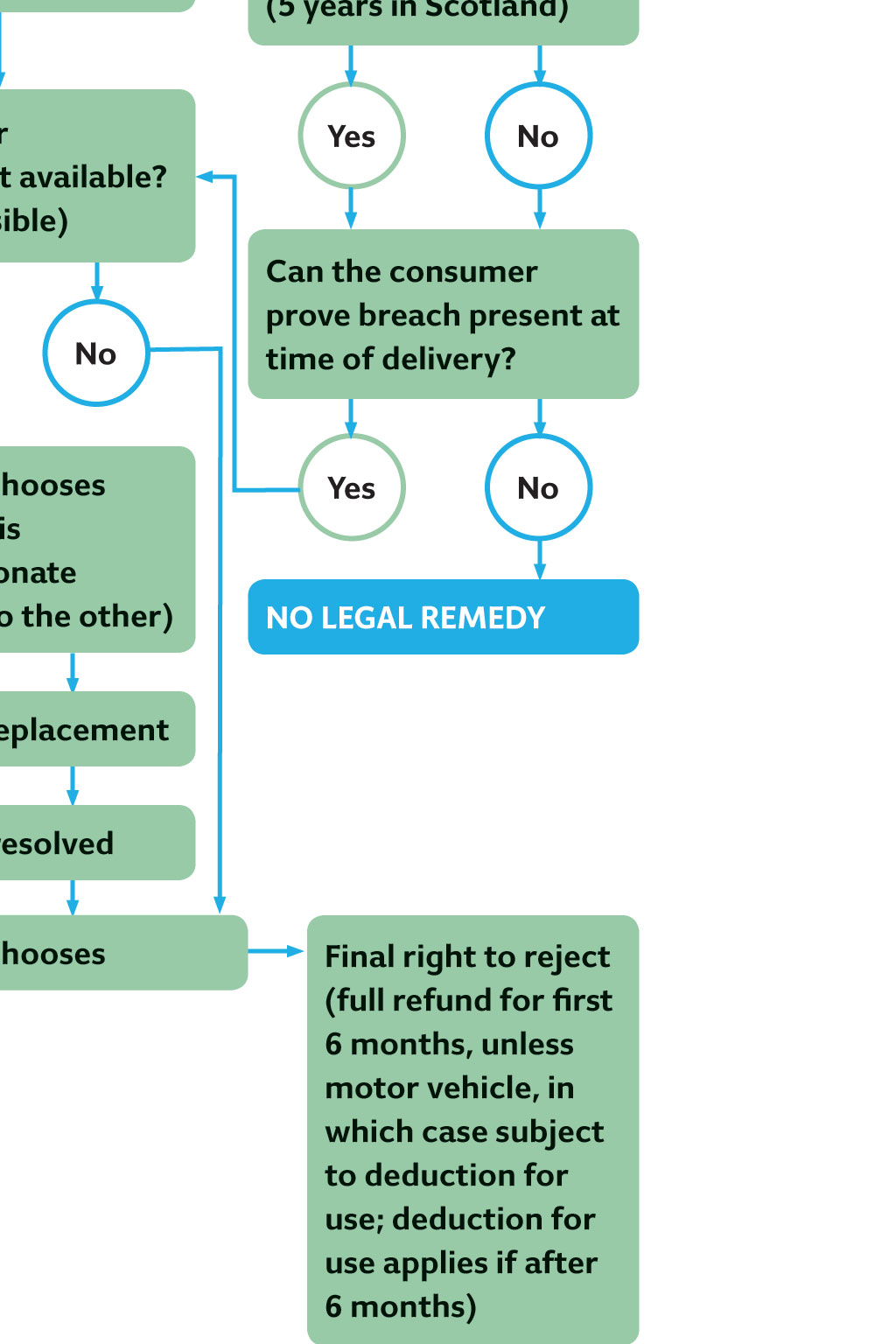

SPRING 2016 CONSUMER RIGHTS ACT GET IT RIGHT, EVERY TIME The Consumer Rights Act and how it affects your business Retailers responsibilities when it comes to the Consumer Rights Act can be fairly complicated to grasp. The flow chart below should help you to work out what your customers are entitled to ask for in a number of dierent situations. And remember, a customers core rights are that the goods should be of a satisfactory quality, t for their purpose and as described. KEY: Intermediate step Legal principle (not part of Act) Remedy Is there a breach of the core rights within 30 days of delivery? Yes No Can consumer prove breach present at time of delivery? Is there a breach within 6 months of delivery? Yes No Yes Consumer chooses Rejection and full refund Breach presumed to have been present at time of delivery Is a repair or replacement available? (Not impossible) Note: This flow chart sets out the MAIN statutory remedies available for faulty goods under the Act. Damages may also be claimed as an alternative remedy to the statutory regime, or an additional remedy for other losses caused by faulty goods. The right to reject for perishable goods that would not be expected to last 30 days lasts only as long as the goods would reasonably be expected to last. If the consumer has a remedy available, any claim must be brought in the limitation period (six years in England and Wales and ve years in Scotland) Yes No Consumer chooses (unless one is disproportionate compared to the other) Repair No Is there a breach within 6 years of delivery? (5 years in Scotland) Yes No Can the consumer prove breach present at time of delivery? Yes No NO LEGAL REMEDY Replacement If fault not resolved Price reduction (consumer keeps goods) Credit: Ian Bell Images: racorn / Shutterstock Consumer chooses Final right to reject (full refund for rst six months, unless motor vehicle, in which case subject to deduction for use; deduction for use applies if after six months) CREDIT AND DEBIT CARD RULES Businesses are allowed to make a charge for accepting a payment by credit or debit card, or by any other method for example, cash, electronic money services, cheques, prepaid cards, charge cards and direct debits. However, where a customer has to pay a surcharge for using a particular method of payment, the Consumer Rights (Payment Surcharges) Regulations 2012 stipulate that surcharges must not amount to more than it costs the business to process that particular method of payment. A business can only apply the payment surcharge on the basis of the average cost it incurs in processing payment by a particular means. Where a surcharge is made for any payment method, this information should be made clear to the customer and must not be hidden. Under the Consumer Protection from Unfair Trading Regulations 2008, a business must not give false or misleading information to consumers, and must not hide or omit information that the consumer needs in order to make an informed decision. This means that information about the existence and amount of any payment surcharges must be made available to the consumer up front, alongside the main price they will pay for the product or service they intend to purchase. Additionally, where a surcharge is made for a type of product or service or for a method of payment where charges are unusual and are likely to come as a surprise to the consumer then special attention should be drawn to those charges. Consumers are entitled to seek redress if they are asked to pay a surcharge that is more than that allowed by the Regulations. Further information and guidance in relation to payment surcharges can be found on the Business Companion website.