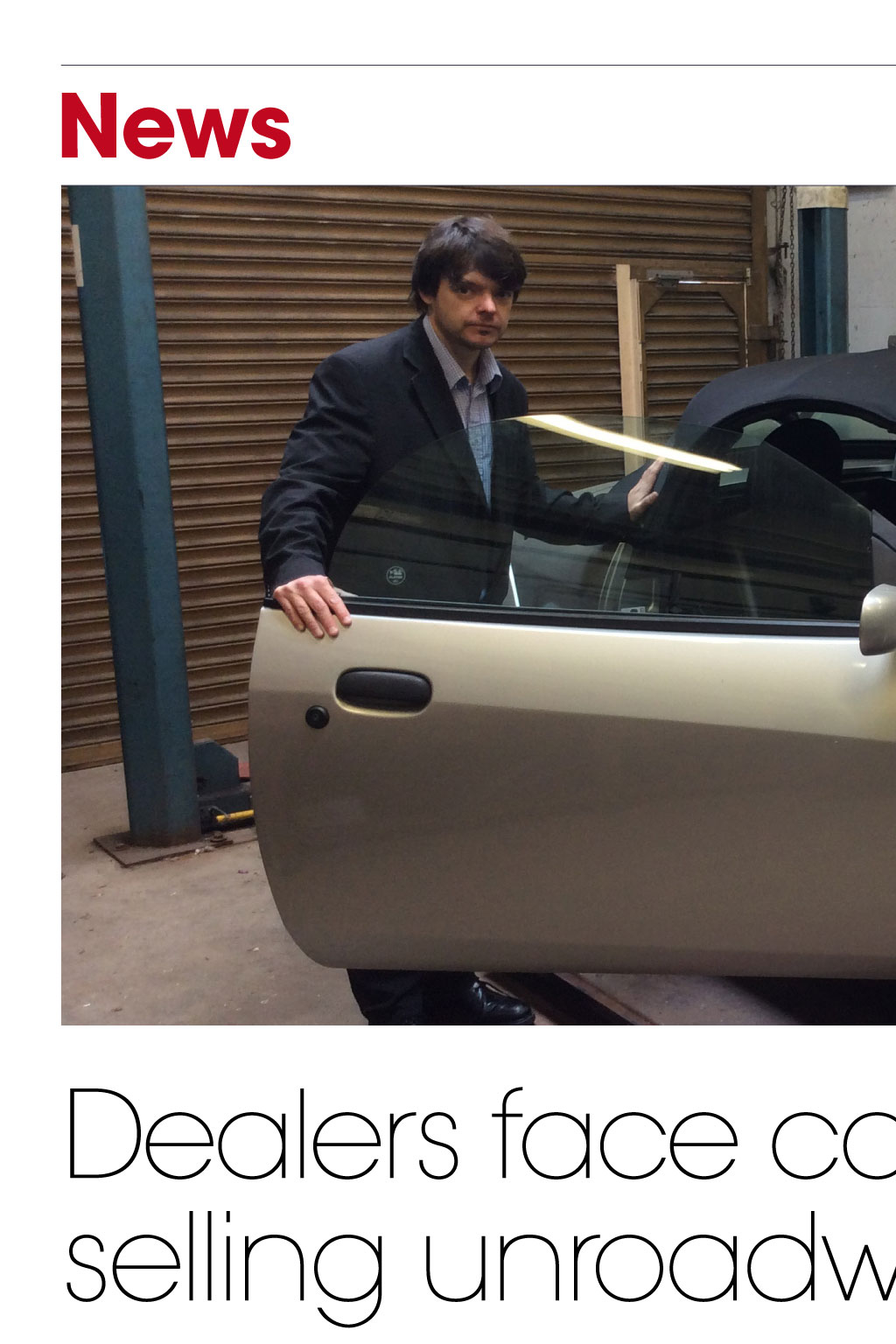

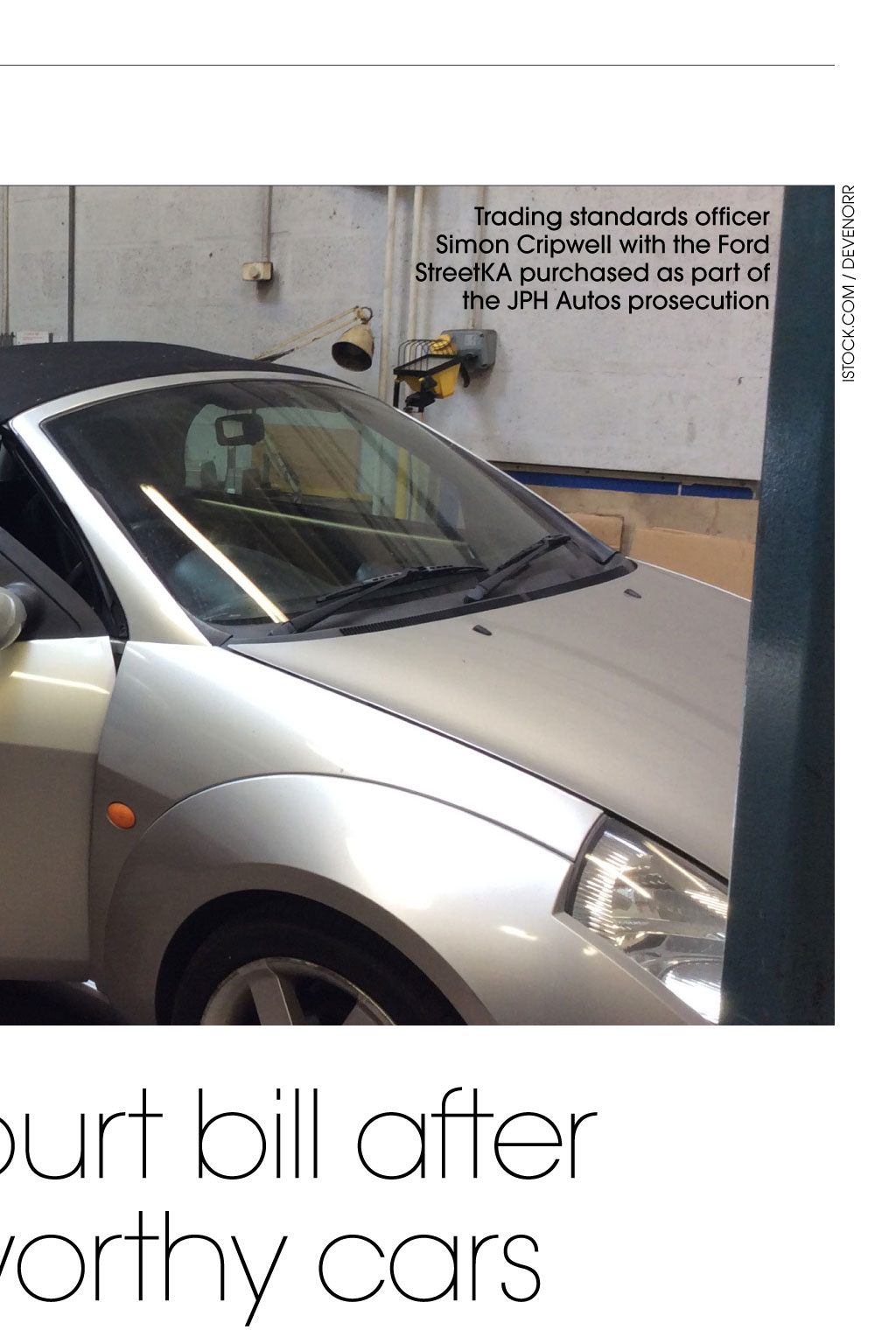

Trading standards officer Simon Cripwell with the Ford StreetKA purchased as part of the JPH Autos prosecution iSToCk.Com / DEVENorr News Dealers face court bill after selling unroadworthy cars Two car dealers have been prosecuted for selling unroadworthy vehicles. Warwickshire Trading Standards launched investigations into Wootton Wawens John Paul Hunt, trading as JPH Autos, and Anstybased StevenAlan Ring, trading as Impact Autos, after receiving a raft of complaints from people who had bought cars that were advertised as being in good condition. Undercover officers bought a Ford StreetKA they had seen on the JPH Autos website, and a Fiat Stilo that had been advertised by Impact Autos in AutoTrader magazine. They then asked an expert vehicle examiner to check the condition of the cars. He found a number of issues that made both vehicles unroadworthy, including: heavy corrosion to the chassis; badly corroded coil springs; a deteriorating exhaust system; rear brakes in poor condition; corroded suspension; and under- or over-inflated tyres. Many of these faults would have attracted a failure notice in an MOT test and suggested to the vehicle examiner that the cars had not been serviced or if they had then very poorly. Ring had also attempted to deny his customers their statutory consumer rights by stating that vehicles priced at under 1,000 were sold as seen. At Nuneaton Magistrates Court on 25 July, Ring admitted all the charges put to him under the Consumer Protection from Unfair Trading Regulations 2008, the Road Traffic Act 1988, and the General Product Safety Regulations 2005. In sentencing Ring, the chair expressed how concerned the court was about the issues they had heard from the prosecutor. He said that Ring had placed people at risk and there was no evidence to support his claim that he had either taken notice of trading standards guidance, given only three weeks prior to the date of the offences, or had actually taken measures to improve his practices since. He told him that, had it not been for his previous good character, a custodial sentence could have been very likely. He was fined 1,120, and ordered to pay legal costs of 1,428 and a victim surcharge of 112. At an earlier hearing at Nuneaton Magistrates Court on 4 July, Hunt, of Solihull, admitted all the charges put to him under the Consumer Protection from Unfair Trading Regulations 2008, the Companies Act 2006, and the Road Traffic Act 1988. He was fined 120, with a 30 victim surcharge, and was ordered to pay costs of 300. Tax phone-scam warning People across the UK are being warned about aggressive phone scammers who claim to be from the tax office. CPR Call Blocker, makers of a UK call-blocking device, is urging people to hang up if someone claiming to be from the tax office telephones, or leaves a message claiming they must call back or risk legal action. It follows reports of a similar con in Australia, where scammers were claiming to be from the Australian Tax Office (ATO). The scam reported to CPR Call Blocker involves an automated message telling the recipient that they owe tax and face legal action. They are then prompted to press a number to speak to someone, to make a payment on their unpaid bill or face a lawsuit. Some calls have even told people to get in touch with a solicitor, as they are warned they could face serious legal problems if they dont pay the outstanding tax immediately. Bryony Hipkin, of CPR Call Blocker, said: What we often see with phone scams is that they can quickly spread across the globe, as scammers see what is working well in other places. After the large sums of money that have been lost in Australia to the recent ATO scam, it isnt surprising to hear from our customers that a similar scam is now doing the rounds over here. So its sensible for people all across the UK to be on their guard. Cold-calling ban on pensions announced iSToCk.Com / pASTorSCoTT CTSI, Citizens Advice and the Money Advice Service have all welcomed government plans to ban cold calling including emails and texts in relation to pensions. The Department for Work and Pensions published its response to a consultation on the matter last month (August), which considered a package of measures designed to tackle three different areas of pensions scams including a ban on cold calling. Recent research by Citizens Advice found that as many as 10.9 million people received unsolicited calls, emails and texts about their pensions in 2016 alone, while research by the Money Advice Service suggests there could be as many as eight scam calls every second the equivalent of 250 million calls per year. The Information Commissioners Office (ICO) will now act as the enforcement agency for the ban on cold calling. The ICO currently regulates firms making unsolicited direct-marketing calls and has a number of enforcement powers that it can use to tackle firms in breach of the rules, including issuing monetary penalties of up to 500,000. CTSI chief executive Leon Livermore welcomed the news. He said: Scammers were quick to pick up on an opportunity when the new pension freedoms came in, and this is a welcome move on the part of the DWP to close down such opportunism. Jackie Spencer, pensions expert at the Money Advice Service, said the move would give people peace of mind, while Gillian Guy, chief executive of Citizens Advice, said: Introducing an outright ban on pension cold calls will help protect peoples life savings. Pension scams can rob people of tens of thousands of pounds, ruin their retirement plans, and threaten their financial security in the long term. It is hoped that a cold-calling ban will cut off a key source of pension scams from fraudsters, while simplifying the anti-fraud message to the general public that they will never be cold called about their pension. According to the consultation response, the government intends to work on the final and complex details of the ban on cold calling in relation to pensions during the course of this year, then bring forward legislation to deliver the ban when parliamentary time allows. Rogue tree surgeons jailed for five years Two rogue tree surgeons, who were the subject of a BBC Watchdog sting, have been jailed after targeting elderly women for substantial amounts of money. James Cunningham, of Gateshead, and Essex-based Peter Varey distributed leaflets in Bromley advertising tree-care and gardening services. The flyers showed false addresses and phone numbers. The conmen used sophisticated methods to dupe the victims into parting with large amounts of money, deliberately setting out to hide their true identities and targeting vulnerable people who lived alone. The offences took place between June and September 2015. The four cases all involved elderly women, who were given quotes for gardening jobs that rose substantially once the work had been completed. Some of the victims were taken to their banks to withdraw cash to pay the men. In two cases, bank staff became suspicious and contacted trading standards. A full trading standards investigation was conducted, and the BBC Watchdog programme carried out a sting operation on Varey and Cunningham. At the request of trading standards, police arrested both men, who were later identified by the victims as being involved in the offences. A third suspect was also identified, but he remains at large. Kate Lymer, executive councillor for public protection and safety at the London Borough of Bromley, said: These commuting rogue traders were ruthlessly cynical and have deliberately set out to take as much money as they could from their victims. Despite their distance from our borough, this prosecution should serve as a warning to other potential offenders that they are never beyond the law. At Croydon Crown Court, the men admitted fraud by false representation. Cunningham was sentenced to two years imprisonment, suspended for two years as his wife had recently died and he has dependants. He was ordered to attend a Think First programme and 30 days rehabilitation activity. He was warned he would go straight to prison if these were breached. Varey was sent to prison for three years. Both were ordered to repay their victims. Slaughterhouses in England to install CCTV All slaughterhouses in England will have to install CCTV, as part of government plans to enforce laws against animal cruelty. The rules are being phased in over the next year, and will allow Food Standards Agency vets to see footage of all areas where livestock are held. Slaughterhouses found to be failing welfare standards could face a criminal investigation or lose staff licences. The government is also updating its statutory animal-welfare codes to reflect advancements in technology and in veterinary medicine. Environment Secretary Michael Gove said: We have some of the highest animal-welfare standards in the world, and the actions I am setting out will reinforce our status as a global leader. As we prepare to leave the European Union, these measures provide a further demonstration to consumers around the world that our food is produced to the very highest standards.