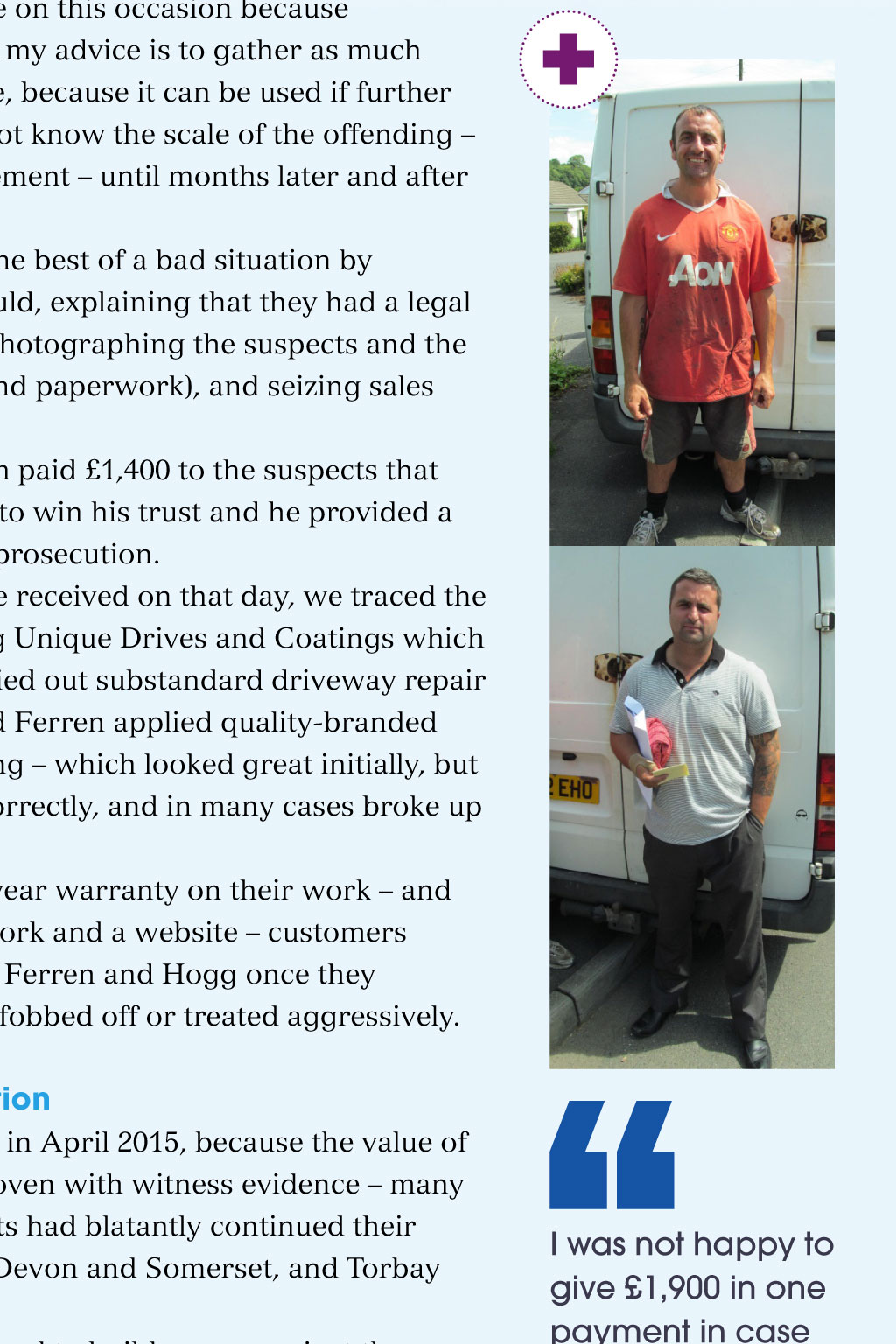

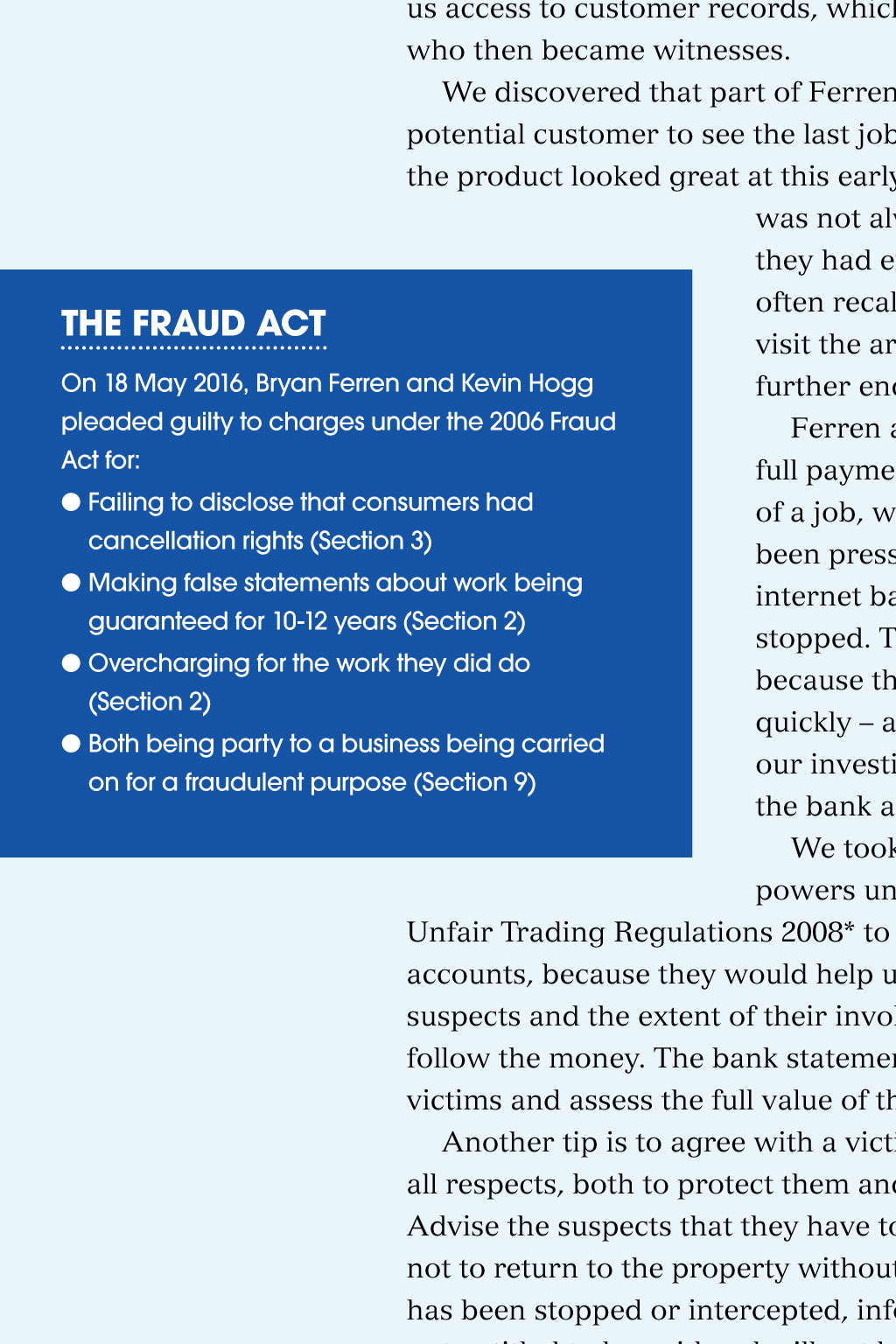

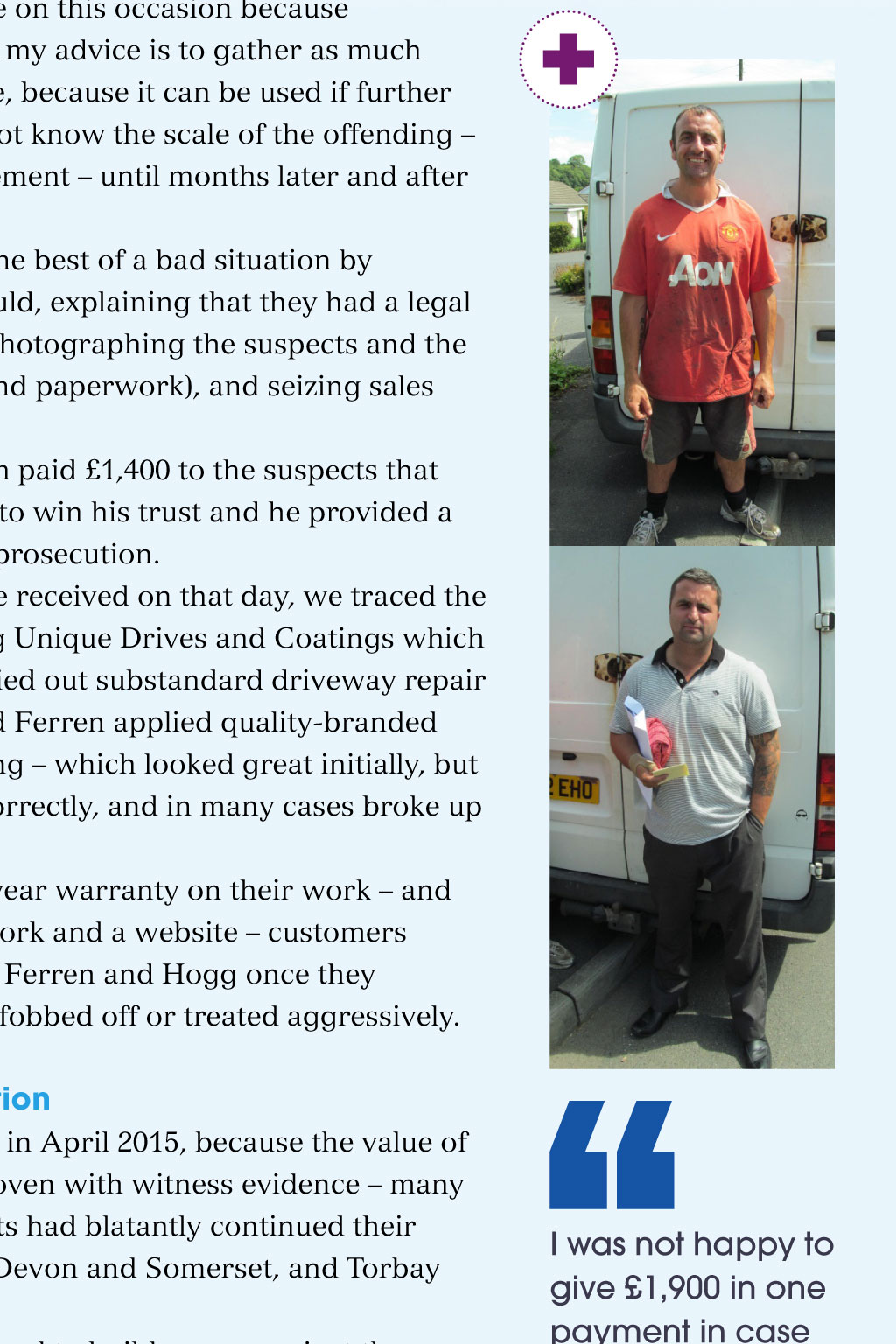

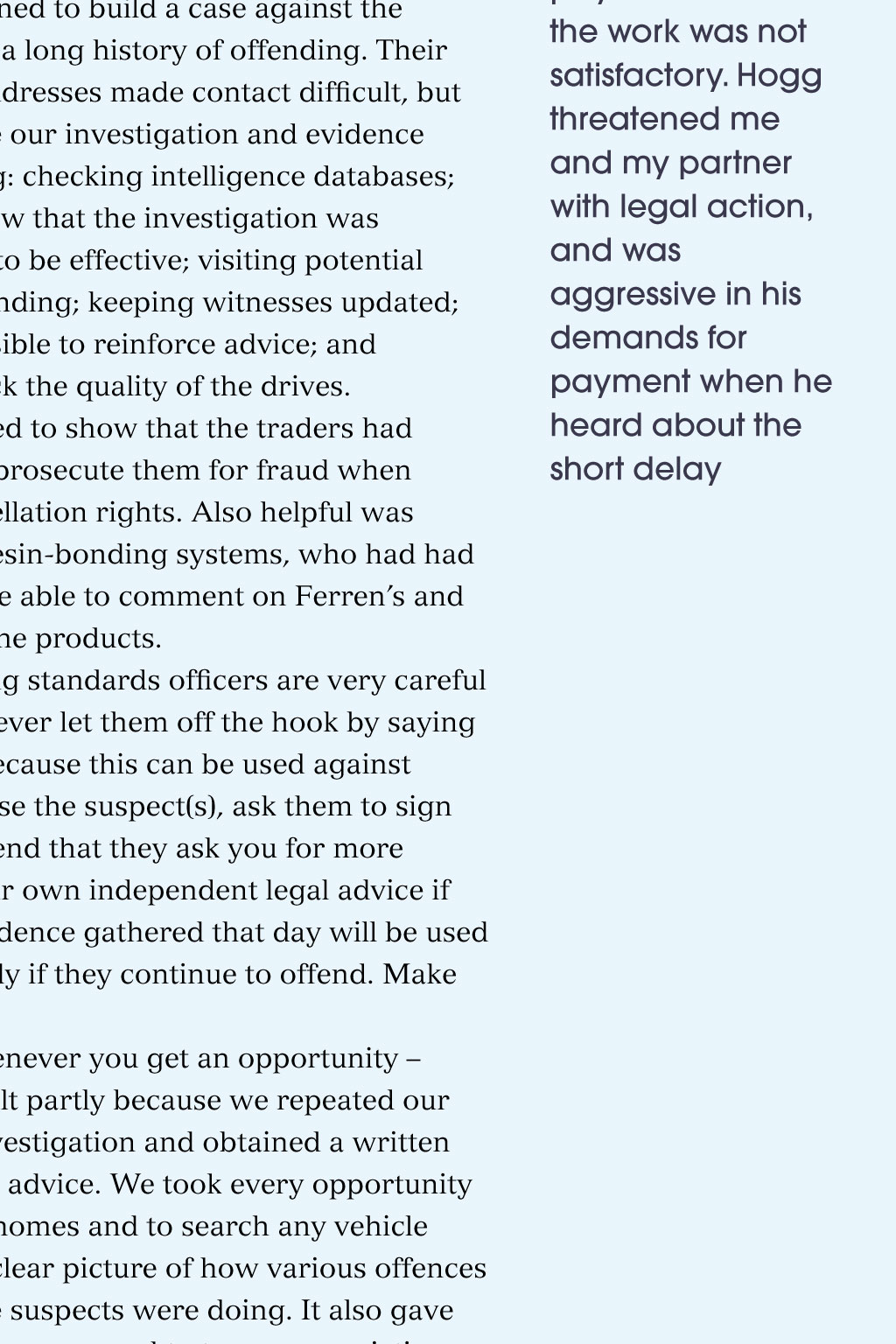

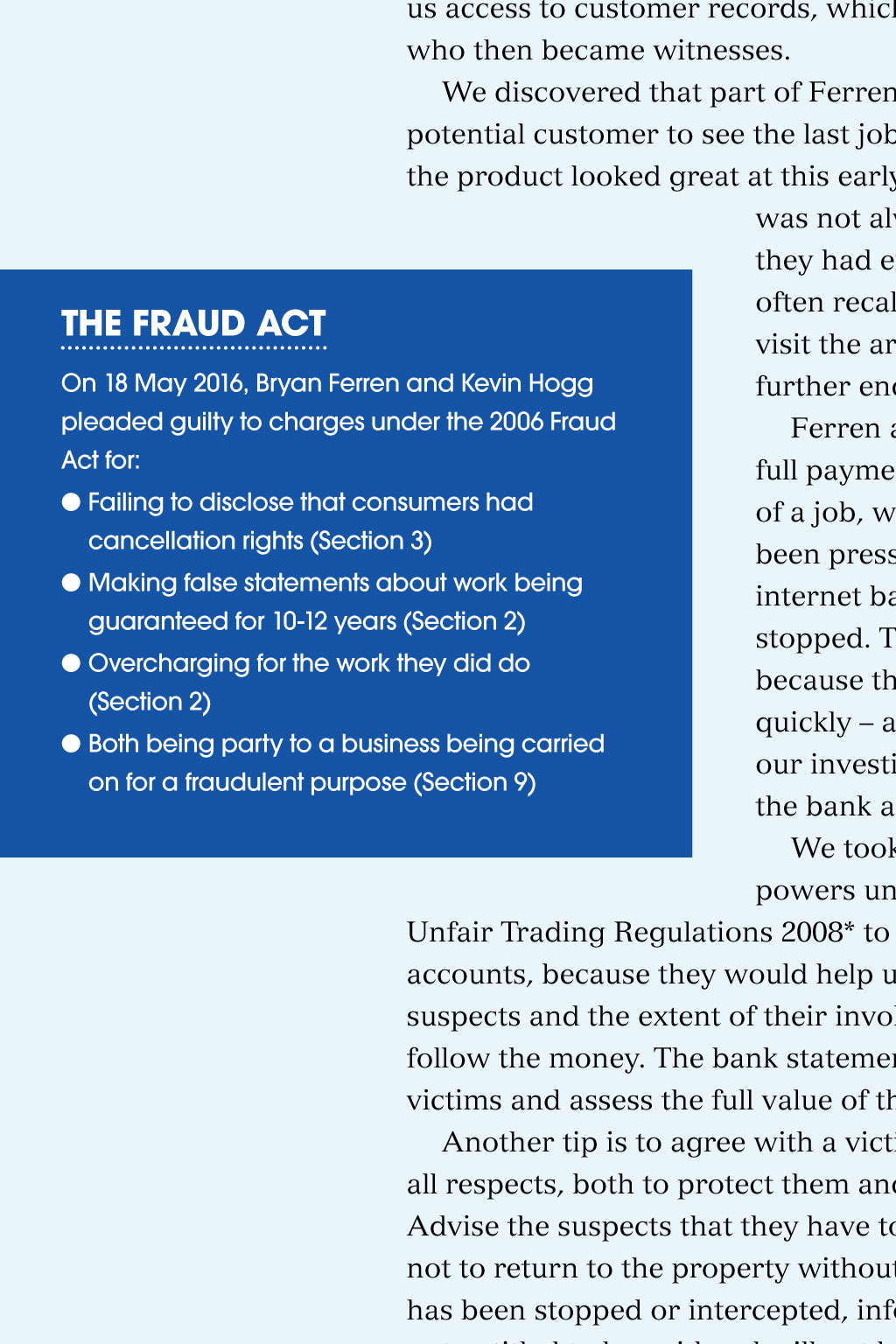

Devon and Somerset Trading Standards Ferran and Hogg prosecution Early provision of advice, followed by painstaking evidence collection, is key to a successful prosecution of fraudsters, as Carl Hitchings explains S cams that target elderly and vulnerable victims are, sadly, not unusual, but when we intercepted two men Bryan Ferran and Kevin Hogg jet washing the roof of an elderly mans home, a web of fraud and deceit opened up before us. There had been a history of alleged offending in south Devon, with various business names and services targeting vulnerable and elderly victims. Bonded resin driveways were the latest scam, but it was during the jet-washing incident that we uncovered some vital information on two rogue traders, which proved the importance of thorough evidence collection. Initial suspicions Jet washing a roof is a complete scam; it is very aggressive treatment that damages the tiles and makes them more porous so we were suspicious. In this case, water from the jet washing entered the property and brought down the bedroom ceiling. Ferren promised to fix the damaged ceiling, but never did, despite being paid in full. In court, this payment was accepted as fraudulent. Initially, the victim in his 90s and the primary carer for his wife, who has dementia did not wish to speak to us because he trusted the suspects. This is something we see frequently; fraudsters win the trust of the victims and then we have to be more charming than the suspects to reach out to people who may be reluctant to accept they have been conned. Often this is not the only scam the victims have been subjected to, which can make it difficult for them to accept that they have been conned again. Indeed, in this case, we later found out the victim had been the subject of a 342,000 investment scam in 2010. Arresting suspects on site is a great way to capture evidence of their identity, and of controlling them with bail procedures, with a view to interview and a prompt and efficient investigation. If arrest cannot be achieved as was the case on this occasion because police resources were so stretched my advice is to gather as much evidence and intelligence as possible, because it can be used if further offendingcomes to light. You may not know the scale of the offending or the extent of the suspects involvement until months later and after further enquiries. On this particular day, we made the best of a bad situation by protecting the victims as best we could, explaining that they had a legal right not to pay, fully advising and photographing the suspects and the contents of their vehicles (signage and paperwork), and seizing sales leads and records. Despite our best efforts, the victim paid 1,400 to thesuspects that day. Subsequently, we worked hard to win his trust and he provided a witness statement in support of the prosecution. From paperwork and evidence we received on that day, we traced the men to various businesses, including Unique Drives and Coatings which over a 13-month period had carried out substandard driveway repair and surfacing. Hogg (top image) and Ferren applied quality-branded materials to drives with resin bonding which looked great initially, but the product was not mixed or laid correctly, and in many cases broke up very quickly. Despite the pair offering a 10-12 year warranty on their work and having professional-looking paperwork and a website customers found it difficult to get in touch with Ferren and Hogg once they reported problems, and were either fobbed off or treated aggressively. Ensuring a successful prosecution The decision to prosecute was made in April 2015, because the value of the offending was high 72,875 proven with witness evidence many victims were elderly, and the suspects had blatantly continued their activities, despite clear advice from Devon and Somerset, and Torbay Council trading standards officers. Our investigative work was designed to build a case against the suspects because we knew they had a long history of offending. Their use of a variety of businesses and addresses made contact difficult, but we used different methods to ensure our investigation and evidence were as robust as possible, including: checking intelligence databases; letting colleagues and witnesses know that the investigation was active and we needed their support to be effective; visiting potential witnesses to gather evidence of offending; keeping witnesses updated; intercepting suspects wherever possible to reinforce advice; and employing an expert witness to check the quality of the drives. Our early intervention work helped to show that the traders had the degree of knowledge needed to prosecute them for fraud when they did not offer the required cancellation rights. Also helpful was evidence from the suppliers of the resin-bonding systems, who had had complaints from customers and were able to comment on Ferrens and Hoggs lack of training in applying the products. We would recommend that trading standards officers are very careful about how they advise a suspect never let them off the hook by saying you arent taking any legal action, because this can be used against you in the future. Better to fully advise the suspect(s), ask them to sign paperwork to confirm this, recommend that they ask you for more advice if they wish and to seek their own independent legal advice if necessary and be clear that the evidence gathered that day will be used against them in due course, especially if they continue to offend. Make this very clear. Always reinforce your advice whenever you get an opportunity inthis case, we got a successful result partly because we repeated our advice to the suspects during the investigation and obtained a written record acknowledging receipt of the advice. We took every opportunity to intercept the suspects at victims homes and to search any vehicle being used by them. This gave us a clear picture of how various offences were being carried out and what the suspects were doing. It also gave us access to customer records, which were used to trace more victims, who then became witnesses. We discovered that part of Ferrens sales patter was to take a potential customer to see the last job before it had failed. Naturally, the product looked great at this early stage and the previous customer was not always there to share any problems they had encountered. However, victims often recalled the driveways, so we could tHE FraUD aCt visitthe area, spot the faults and make On 18 May 2016, Bryan Ferren and Kevin Hogg furtherenquiries. pleaded guilty to charges under the 2006 Fraud Ferren and Hogg insisted on immediate Act for: full payment by bank transfer on completion Failing to disclose that consumers had of a job, which meant once the button had cancellation rights (Section 3) been pressed at a local bank branch or via Making false statements about work being internet banking the payment could not be guaranteed for 10-12 years (Section 2) stopped. The suspects used bank transfer Overcharging for the work they did do because they knew their product would fail (Section 2) quickly and it did! However, the benefit to Both being party to a business being carried our investigation was that victims often had on for a fraudulent purpose (Section 9) the bank account number and sort code. We took the view that we could use our powers under the Consumer Protection From Unfair Trading Regulations 2008* to request bank statements for these accounts, because they would help us to establish the identity of the suspects and the extent of their involvement. Our advice is always to follow the money.The bank statements also helped us to identify more victims and assess the full value of the offending. Another tip is to agree with a victim that you can act for them in all respects, both to protect them and to control your investigation. Advise the suspects that they have to deal with you from now on, and not to return to the property without agreeing it with you. If a payment has been stopped or intercepted, inform the suspects that they are not entitled to be paid and will not be paid. If you are not sure about this, remember that you can buy time to check the legal situation with colleagues delaying a payment is merely an inconvenience and not an offence, and any legitimate trader should accept this until your enquiries are complete. Prosecution counsel Shaun Brunton advised us to roll up our charges as a joint enterprise between Ferren and Hogg because they were the most active in the scam. This clever strategy condensed a large number of offences into a clear and simple picture of fraud, which greatly assisted the court. In court, Ferren and Hogg were each sentenced to two years in jail for fraudulent trading (Section 9, Fraud Act 2006) and a further 12 months, to run concurrently, for three other Fraud Act offences (see box). Their sentences show that the courts can take this sort of offenceseriously, even outside of the organised crime groups that are often involved. I was not happy to give 1,900 in one payment in case the work was not satisfactory. Hogg threatened me and my partner with legal action, and was aggressive in his demands for payment when he heard about the short delay Footnote *From May 2015, the legal powers in the Consumer Protection from Unfair Trading Regulations 2008 and other specified fair trading legislation were replaced by new powers in schedule 5 of the Consumer Rights Act 2015. These new powers are more flexible because they are not limited to inspection powers that is, they do not require an officer being present at a premises to use them and more clearly define powers to request data at arms length, such as by letter, email orfax. Credits Carl Hitchings is a trading standards officer To share this page, in the toolbar click on You might also like A family affair September 2016 at Devon and Somerset Trading Standards. Images: ticus / Marina Lohrbach / Shutterstock tHE rogUES Mo Bryan Ferren and Kevin Hogg targeted the elderly and vulnerable, often cold-calling at homes. Initially, Ferren was very friendly, charming and persuasive, and the prices quoted were not unreasonable, presuming the work was done correctly. Many were convinced even those who were initially sceptical, such as this 61-year-old prison officer from south Devon: I was in the garden when my wife informed me there was a man asking if we wanted our drive covered. My initial response was Are they cowboys?, at which a head popped round my shed and told me: We definitely are not!. This person I now know to be Bryan Ferren. I gave Ferren 5,430 cash, and he gave me a receipt and a guarantee for 12 years. This document looked genuine, with names, addresses, telephone numbers (landline and mobile) and an email address. I felt my fears had been for nothing. Ferren would phone legitimate suppliers of raw materials and hand the phone to the victims to make the payment by credit or debit card, so the goods were owned by the victim, not the suspects. Ferren would often overestimate the quantities needed to create a free resource for him to use on other driveway work, despite the goods being owned by the victims which amounts to theft. This practice should have been a warning to the victims, because it is unusual and suggests the business is not solvent. The stone and resin suppliers should also have questioned this unusual practice, but they did not. After a few weeks, people started to see the faults appear in the work. Ferren and Hogg then became difficult to contact, or made empty promises. Some customers were treated aggressively and, even when repairs were carried out, these did not solve the problems. I am very disappointed that I spent 3,400 on the job and two holes have appeared, said one victim, a 64-year-old retired builder from Plymouth. I am finding it impossible to contact Hogg to get him to rectify the work. I feel that the 10-year guarantee stated on the receipt is worthless.