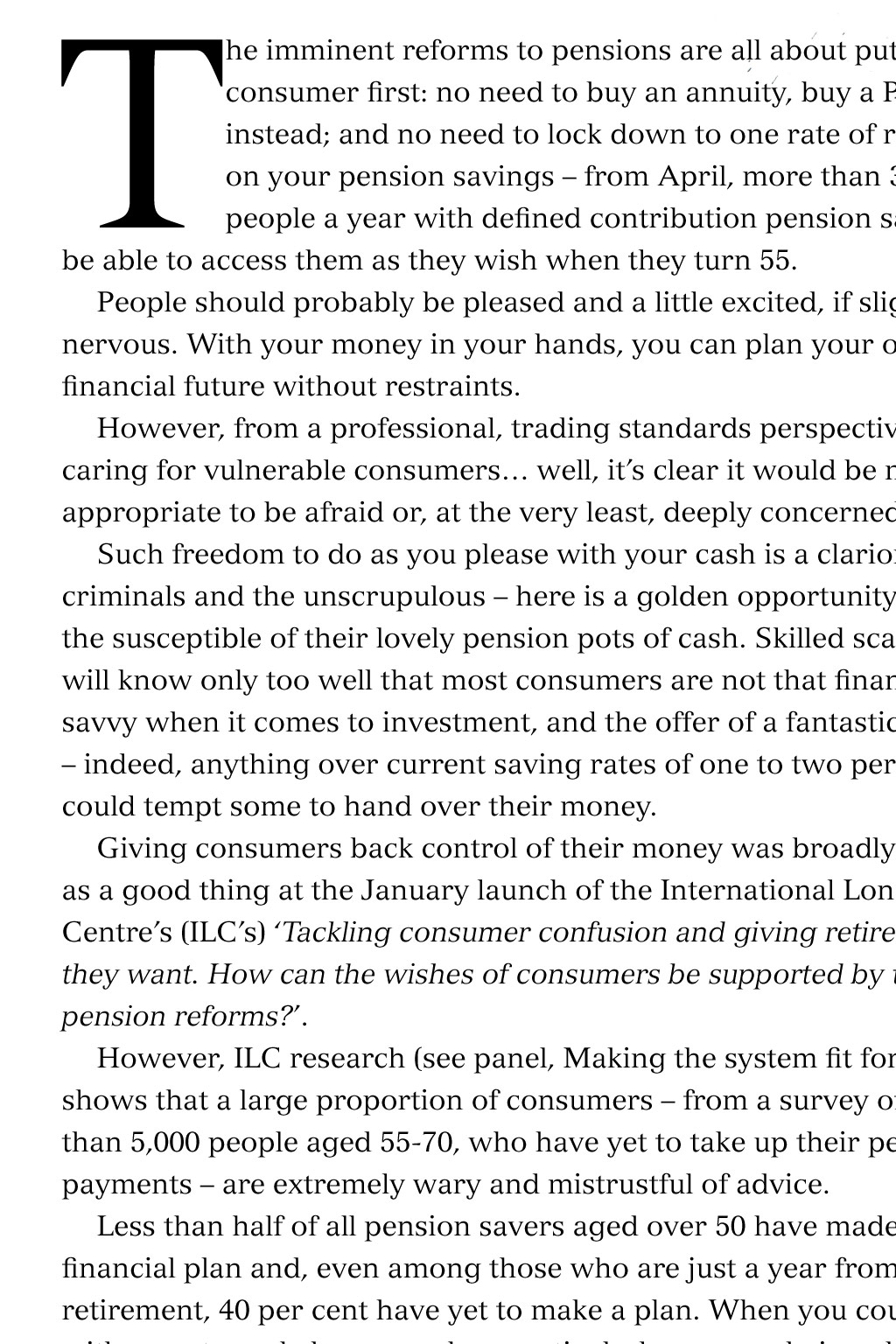

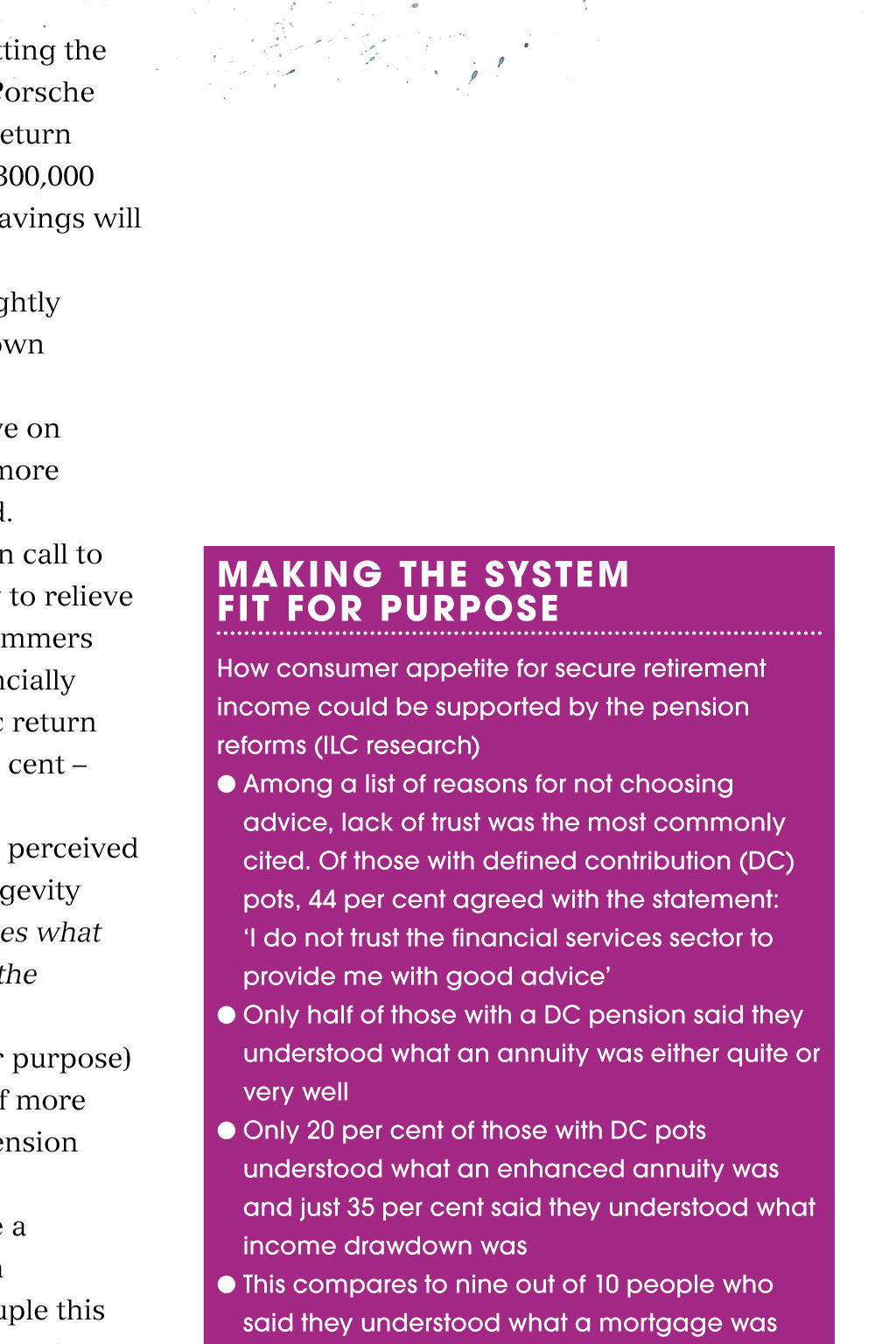

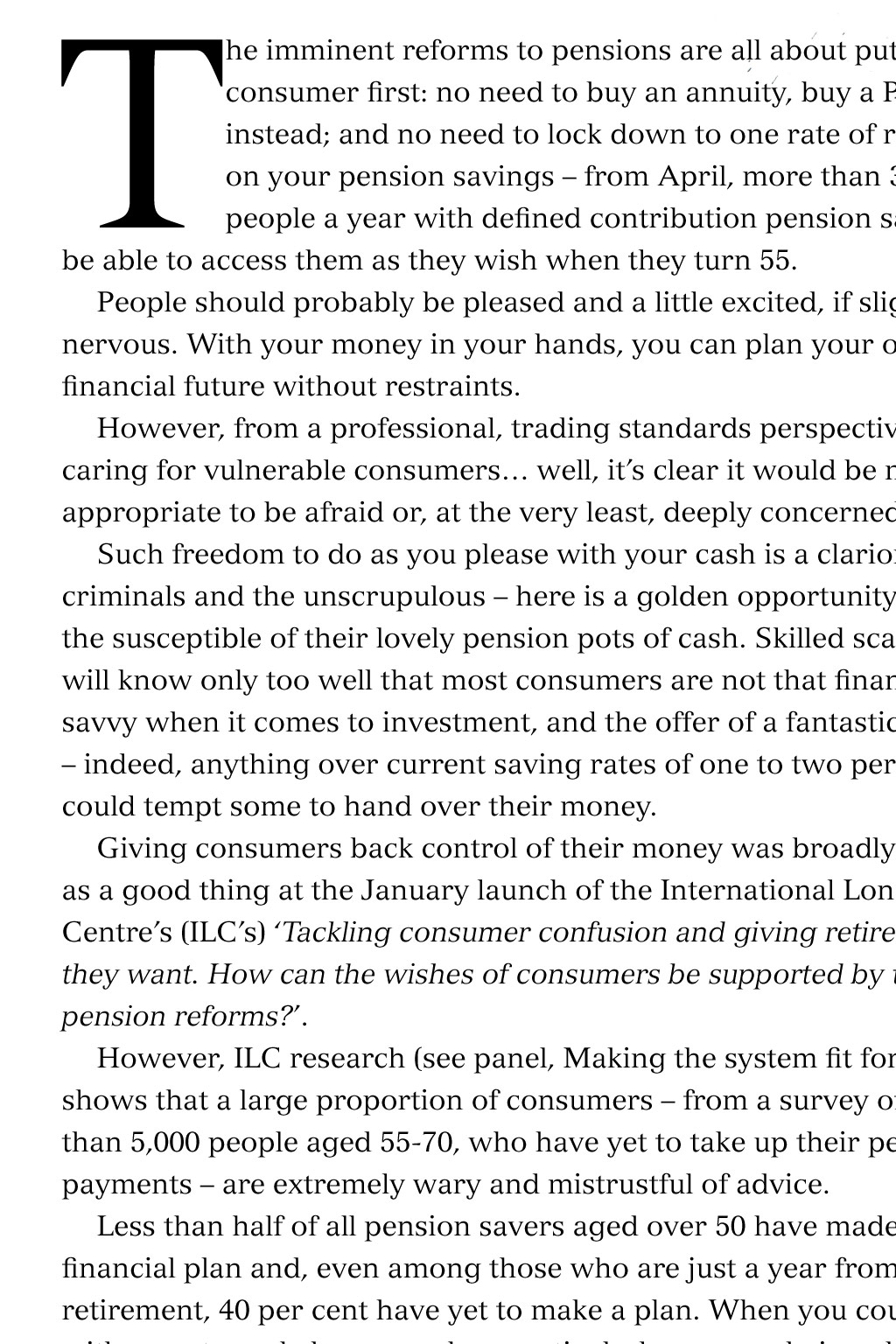

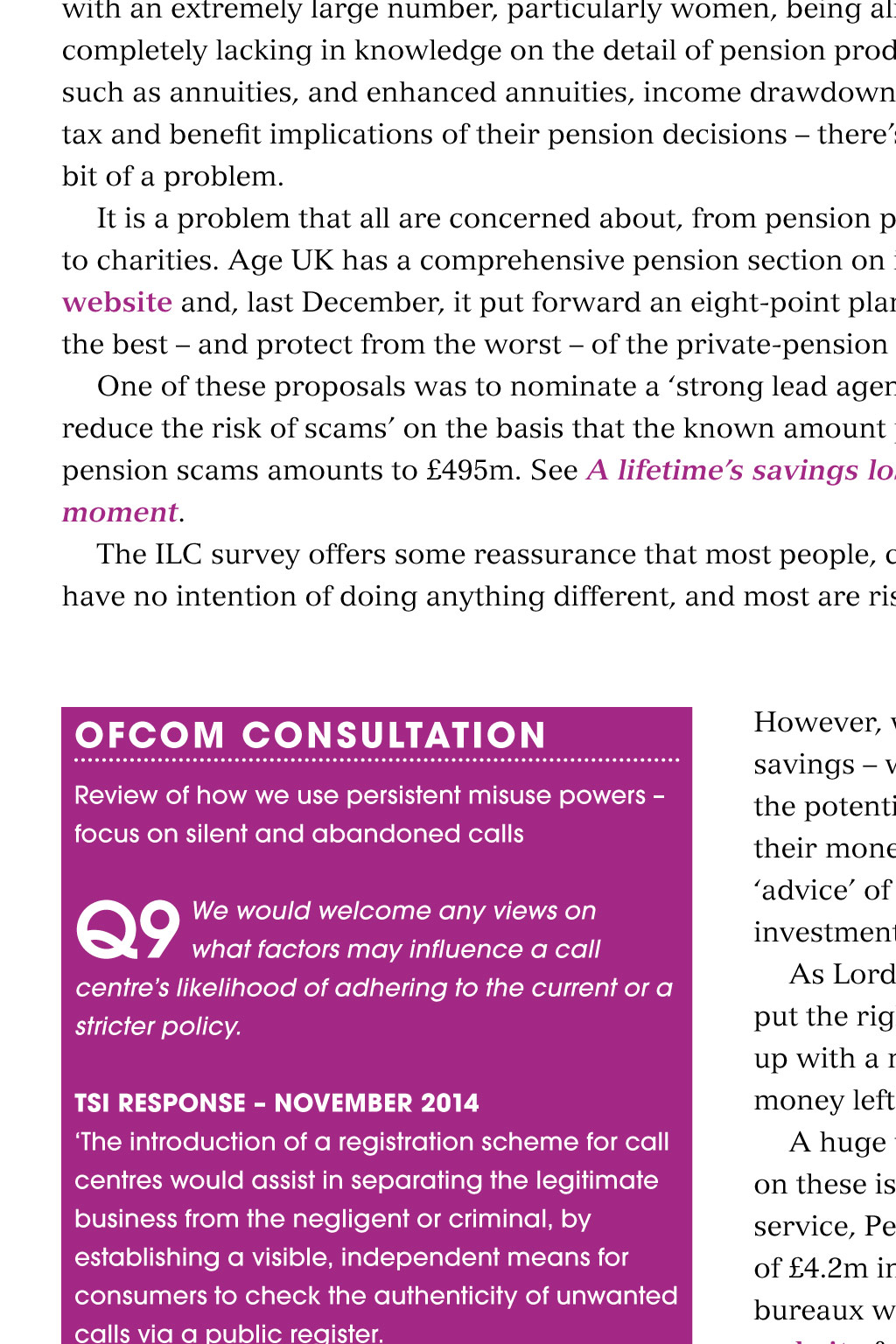

Pensions In this feature pension reforms regulation scams From April, reforms to private pensions will enable holders to create a basket of options and products to suit their needs, instead of taking an annuity. Should we be worried, asks Suzanne Kuyser Be very afraid... or at least deeply concerned T he imminent reforms to pensions are all about putting the consumer first: no need to buy an annuity, buy a Porsche instead; and no need to lock down to one rate of return on your pension savings from April, more than 300,000 people a year with defined contribution pension savings will be able to access them as they wish when they turn 55. People should probably be pleased and a little excited, if slightly nervous. With your money in your hands, you can plan your own financial future without restraints. However, from a professional, trading standards perspective on caring for vulnerable consumers well, its clear it would be more appropriate to be afraid or, at the very least, deeply concerned. Such freedom to do as you please with your cash is a clarion call to criminals and the unscrupulous here is a golden opportunity to relieve the susceptible of their lovely pension pots of cash. Skilled scammers will know only too well that most consumers are not that financially savvy when it comes to investment, and the offer of a fantastic return indeed, anything over current saving rates of one to two per cent could tempt some to hand over their money. Giving consumers back control of their money was broadly perceived as a good thing at the January launch of the International Longevity Centres (ILCs) Tackling consumer confusion and giving retirees what they want. How can the wishes of consumers be supported by the pension reforms?. However, ILC research (see panel, Making the system fit for purpose) shows that a large proportion of consumers from a survey of more than 5,000 people aged 55-70, who have yet to take up their pension payments are extremely wary and mistrustful of advice. Less than half of all pension savers aged over 50 have made a financial planand, even among those who are just a year from retirement, 40 percent have yet to make a plan. When you couple this with an extremely large number, particularly women, being almost completely lacking in knowledge on the detail of pension products such as annuities, and enhanced annuities, income drawdown, and the tax andbenefit implications of their pension decisions theres clearly a bit of a problem. It is a problem that all are concerned about, from pension providers to charities. Age UK has a comprehensive pension section on its website and, last December, it put forward an eight-point plan to make the best and protect from the worst of the private-pension reforms. One of these proposals was to nominate a strong lead agency to reduce the risk of scams on the basis that the known amount paid into pension scams amounts to 495m. See A lifetimes savings lost in a moment. The ILC survey offers some reassurance that most people, currently, have no intention of doing anything different, and most are risk averse. oFcoM consULtation Review of how we use persistent misuse powers focus on silent and abandoned calls Q9 We would welcome any views on what factors may influence a call centres likelihood of adhering to the current or a stricter policy. tsi resPonse noVeMBer 2014 The introduction of a registration scheme for call centres would assist in separating the legitimate business from the negligent or criminal, by establishing a visible, independent means for consumers to check the authenticity of unwanted calls via a public register. Having received an unsolicited call, a member of the public would be able to check with which company the number was registered, and then telephone the company to check that it had indeed made the call. Registration would be a simple regulatory tool, so that call centres not adhering to a code of conduct could be removed. A penalty could be associated with falsely claiming registration. Such a register of call centres may be set up in a TPS-type database, listing authenticated businesses rather than consumers. MaKinG tHe sYsteM Fit For PUrPos e How consumer appetite for secure retirement income could be supported by the pension reforms (ILC research) G Among a list of reasons for not choosing advice, lack of trust was the most commonly cited. Of those with defined contribution (DC) pots, 44 per cent agreed with the statement: I do not trust the financial services sector to provide me with good advice G Only half of those with a DC pension said they understood what an annuity was either quite or very well G Only 20 per cent of those with DC pots understood what an enhanced annuity was and just 35 per cent said they understood what income drawdown was G This compares to nine out of 10 people who said they understood what a mortgage was G Women were consistently less financially aware than men on all measures and are, therefore, most at risk of confusion from the new pension freedoms However, with the freedom to do what you will with your pension savings which, for your average consumer, is around 20,000 comes the potential for consumers to end up not with Porsches, but: seeing their money scooped up by creditors; or poorly invested after the advice of unregulated financial advisors; or robbed by get-rich-quick investment schemes that are no more than a South Sea bubble. As Lord Hutton, one of the panellists at the launch, said, if we dont put the right quality of regulated advisers in place, we are going to end up with a nation of pensioners saying: We were duped, and have no money left to see us through. A huge task lies ahead for Citizens Advice in educating the public on these issues. It will be running the face-to-face provision for a new service, Pension Wise, which has been funded by an industrial levy of 4.2m in the first year, and will be available in a number of local bureauxwith specially trained staff. There is also a Pension Wise website funded by the Treasury, andatelephone service run by the Pension Advisory Service. Everyone trips over the implications of giving advice or guidance, and it is more accurate, in this instance, to say they will only provide information on the options. After that, those who are planning where they will store or invest their pension monies or how and when they will draw on it should turn to a financial adviser for the planning and management stage. This could prove a hard pill to swallow for those who distrust financial advisers; with costs ranging from 50 to 250 an hour, paying for advice could be seen as throwing away hard-earned gains, and changing this perception is going to take some consistent PR. However, since 2012, independent financial advisers can no longer take commission from suppliers of investments or pensions, so consumers should feel confident of receiving independent advice. There is some good news in terms of consumer protection. The Financial Conduct Authority (FCA) is seeking to make it a criminal offence to falsify a claim to be a financial adviser. In addition, in line with a suggestion from Age UKs eight-point plan to put in further protection, the FCA has written an open letter to pension providers. It outlines its intention to make rules before April 2015 that privatepension providers must advise consumers, who are seeking to withdraw their funds, of all their options before releasing the cash. Our concern must lie with those who do not seek out and read, or listen to, the information available on pensions. They are potentially twice as vulnerable not knowing their options or taking professional advice on their pension pot and, for the first time, having access to what, for many, will be the largest capital fund they have every held. Is trading standards alone in defending the pension-pot vulnerable? Yes and no. Everyone involved appears to be awake to the risk and it was agged up as a possible new growth area of complaints for the Financial Ombudsman Service, at a consumer-panel, horizon-scanning meeting in February. The Pension Regulator also looks after work-based pensions, while the Pension Ombudsman Service deals with complaints and disputes over personal pensions. In addition, the FCA does seem determined to be a force to be reckoned with when it comes to going after those who falsely advertise themselves as qualified financial advisers, and it provides pension information on its website. Charities are determined to inform and warn as best they can, but it will be down to trading standards to be alert to yet another area in which the vulnerable are alone and threatened by those with no care for the rules. This urgent concern surely adds weight to TSIs argument for a registration scheme for call centres, which could create one more barrier to the determined cold-call pension-pot scammer being successful (see panel, Ofcom consultation) P ens ion ProDUcts GLos sarY Credits Published Suzanne Kuyser is editor-in-chief of Tuesday 24 February, 2015 TS Today and service director (communications and policy) Images: Will McPhail To share this page, click on in the toolbar