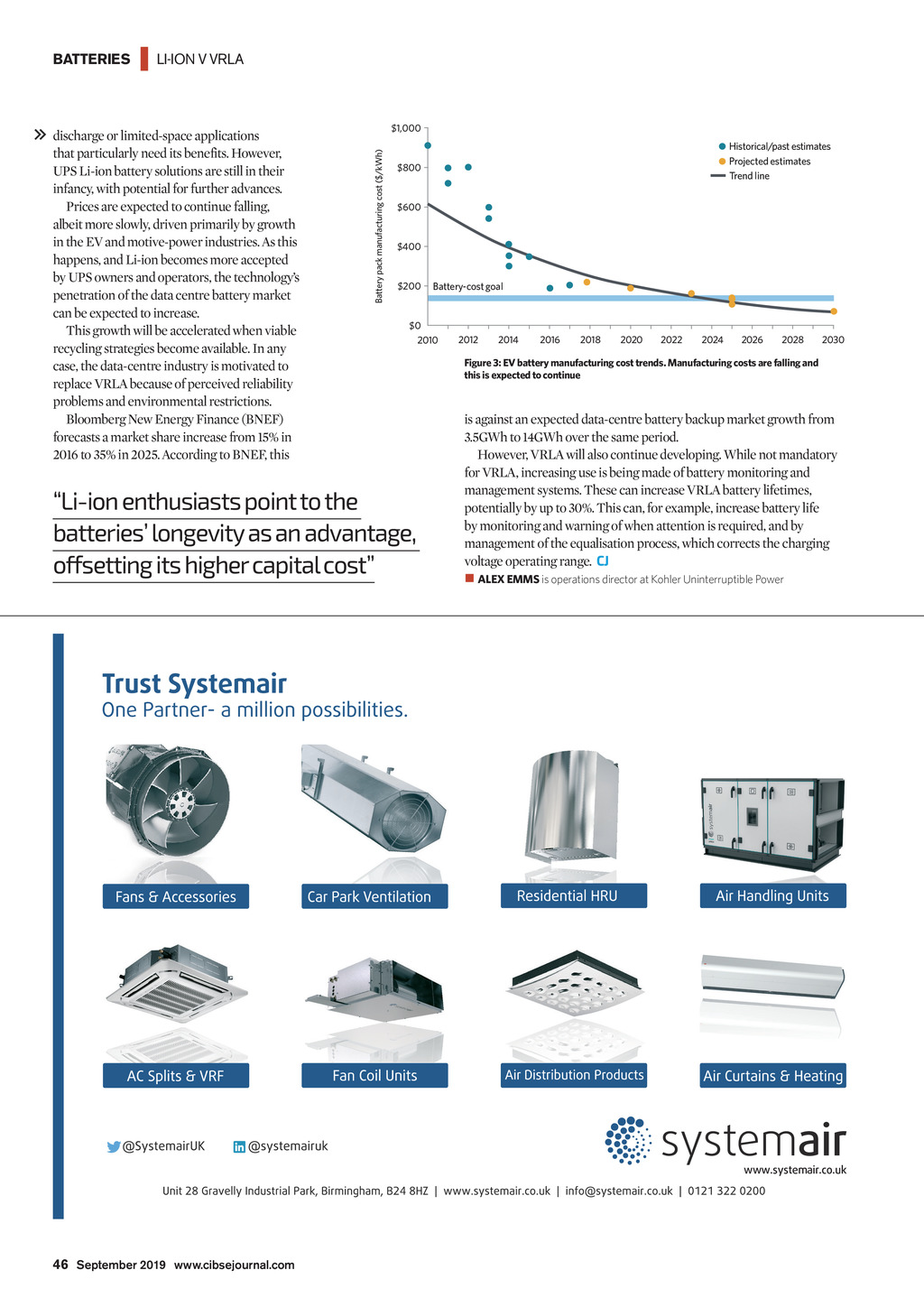

| LI-ION V VRLA discharge or limited-space applications that particularly need its benefits. However, UPS Li-ion battery solutions are still in their infancy, with potential for further advances. Prices are expected to continue falling, albeit more slowly, driven primarily by growth in the EV and motive-power industries. As this happens, and Li-ion becomes more accepted by UPS owners and operators, the technologys penetration of the data centre battery market can be expected to increase. This growth will be accelerated when viable recycling strategies become available. In any case, the data-centre industry is motivated to replace VRLA because of perceived reliability problems and environmental restrictions. Bloomberg New Energy Finance (BNEF) forecasts a market share increase from 15% in 2016 to 35% in 2025. According to BNEF, this $1,000 Battery pack manufacturing cost ($/kWh) BATTERIES Historical/past estimates Projected estimates Trend line $800 $600 $400 $200 Battery-cost goal $0 2010 Li-ion enthusiasts point to the batteries longevity as an advantage, offsetting its higher capital cost 2012 2014 2016 2018 2020 2022 2024 2026 2028 2030 Figure 3: EV battery manufacturing cost trends. Manufacturing costs are falling and this is expected to continue is against an expected data-centre battery backup market growth from 3.5GWh to 14GWh over the same period. However, VRLA will also continue developing. While not mandatory for VRLA, increasing use is being made of battery monitoring and management systems. These can increase VRLA battery lifetimes, potentially by up to 30%. This can, for example, increase battery life by monitoring and warning of when attention is required, and by management of the equalisation process, which corrects the charging voltage operating range. CJ ALEX EMMS is operations director at Kohler Uninterruptible Power www.systemair.co.uk 46 September 2019 www.cibsejournal.com CIBSE Sep19 pp44-46 Battery.indd 46 23/08/2019 16:27